Highlights

- IOUpay is tapping the fast growth and adoption trends in digital payment solutions across the SEA region.

- The company has been focusing on product innovations while also advancing various strategic partnerships for growth and expansion.

- The recent growth drivers include the Pine Labs agreement, KA$Hplus Card, Shariah Compliance certification and a strategic investment in IDSB.

Shares of IOUpay Limited (ASX:IOU) skyrocketed by over 24.6% to AU$0.081 on 21 July 2022 after the release of an update on the company’s business strategy. The shares were trading at AU$0.094 midday on 22 July 2022.

IOU continues to strengthen its reputation as a leading fintech services provider in South East Asia (SEA). The company is driven by its focus on capitalising on the rapid growth and adoption trends in digital payment solutions.

During the last two quarters, the fintech player reported a positive adjusted net operating cash flow of over AU$1.0 million. Moreover, the company reported record monthly transaction volumes in Q1FY22 for its mobile banking division and invested in upgraded infrastructure in Q2FY22 to accommodate further growth.

The income margin for its flagship BNPL offering myIOU stood at 7.01% for FYTD at 31 March 2022.

How big is the Malaysian BNPL opportunity for IOUpay?

According to independent research firms, Malaysia’s BNPL active user base is expected to grow at a CAGR of 24.6% from 600,000 in 2021 to 4 million by 2028. Moreover, the Malaysian BNPL GMV of US$287 million in 2021 is predicted to double to US$601 million in 2022.

With 45% of Malaysia's population currently serviced by banks, IOU is targeting the top two-thirds of this banked population.

The current market share of IOU is 4% by volume with a medium-term target of 10%.

The company looks to adopt a measured approach to growth while ensuring its product offering delivers on financial objectives before upscaling portfolio volumes.

SEA market opportunity and growth drivers

In the bigger picture, IOU is eyeing the broader SEA market, which has a population of 679 million across 10 countries. Moreover, the region now has 440 million internet users, of which around 80% are digital consumers who have made at least one purchase online.

The SEA region represented an internet economy of US$170 billion in 2021, which is now expected to reach US$300 billion by 2025.

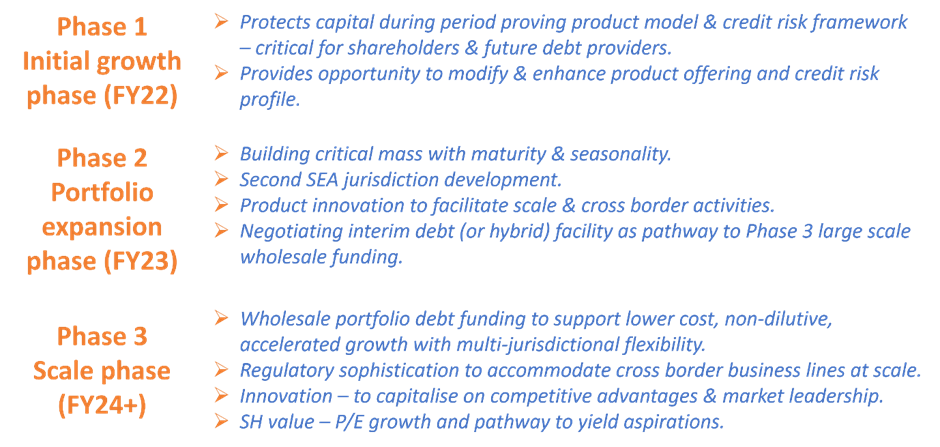

Amid the significant opportunity, IOU’s path to profitability comprises three phases, including the following:

Data Source: IOU Announcement 21/07/2022

Product innovations driving growth for IOU

IOU has also been focusing on product innovation to drive growth and scale, including the following key developments:

- Launch of myIOU 2.0, which has enhancements in design, functionality & security.

- KA$Hplus, a ground-breaking prepaid VISA card that allows BNPL purchases anytime- anywhere.

- myIOU Islamic, a Shariah-compliance certification that facilitates access to new markets in Malaysia and SEA.

Image Source: IOU Announcement 21/07/2022

Pine Labs deal and KA$Hplus Card

IOU inked a Master Partner Services Agreement with Pine Labs, a leading merchant commerce platform across India and SEA.

The agreement enables Pine Labs to refer and acquire merchants to onboard the myIOU BNPL service offering. This indicates substantial growth potential in Malaysia and SEA while positioning IOU for territory expansion as Pine Labs expands its footprint.

Besides this, the KA$Hplus card offers a merchant base to all VISA-approved merchants. The KA$Hplus & myIOU co-branded VISA prepaid card will be integrated into the myIOU BNPL platform and offers features like prepaid loading, top-up & debit-card-style usage with recharge via bank & e-wallet transfers.

Source: IOU Presentation 21/07/2022

In stage 1, the cards will be rolled out to existing IDSB and selected myIOU customers, while stage 2 includes integrating myIOU KA$Hplus card into the myIOU BNPL platform to offer customers more flexible shopping and payment alternatives.

This is a real game changer for IOU as, once integrated, the myIOU KA$Hplus card will allow myIOU customers to purchase goods and services at any merchant accepting Visa and then choose to convert that purchase into a myIOU BNPL transaction seamlessly via their mobile device using the myIOU app.

Shariah compliance and IDSB investment

IOU has been awarded Certification of Shariah Compliance, which is required to access Islamic financing and BNPL opportunities within industry best practice for Shariah principles. Through this pivotal development, IOU looks to launch myIOU Islamic to target the large Islamic populations of Malaysia and other SEA jurisdictions.

In addition to this, IOU’s strategic investment in IDSB indicates compelling investment fundamentals. IOU believes that the deal offers substantial upside potential from additional banks with big portfolios of civil servant customers and also delivers a unique competitive advantage over traditional institutional lenders through its AG-Code licence which ensures lower credit risk and therefore more competitive pricing than its competitors.

IDSB currently services approximately 50,000 civil servant customers through its partnerships with two of Malaysia’s leading banks. With approximately 1.5 million civil servants in Malaysia, IOU believes there is an immediate growth opportunity to capture an increased share of that market.

Strategically, the investment also opens up various commercial partnership opportunities that position IOU for diversified growth along the consumer finance value chain.

By working closely with IDSB and focusing on each company’s competitive strengths, IOU is seeking to develop a broader base of consumer finance offerings with recurring revenue streams.

In essence, backed by significant drivers, IOUpay is focusing on consistent performance and diversified growth to deliver sustainable shareholder value.