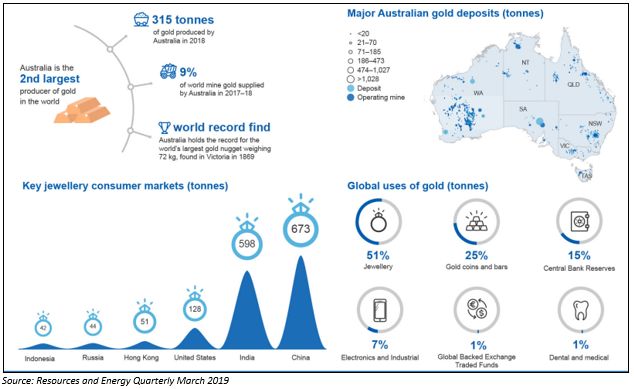

Gold, accounting for approx. three parts per billion of the outer layer of the earth, is considered a safe haven asset, backed by its dual character of a commodity and a monetary asset. Australia is one of the leading gold producers in the globe, with Western Australia holding nearly two-thirds of the countryâs gold resources.

Few Interesting Facts

- Australia has 66 operating gold mines including 14 largest in the world;

- Australia is estimated to have the largest gold reserves, globally;

- Australia accounts for 9,500 tonnes or 17 per cent of the total world estimated gold reserves of 57,000 tonnes;

- In 2018, the country produced 315 tonnes of gold and accounted for 9 per cent of the total mine production;

- In March 2019, the total gold production reached 77 tonnes, up by 6.2 per cent on a yearly basis;

- Moreover, production is expected to peak at 339 tonnes in 2019-20, supported by high exploration expenditure and new mine additions, according to estimates by the Australian Department of Industry, Innovation and Science.

By value, gold is the fifth largest resource exported by Australia. The value of gold exports from the country is projected to reach to a peak level of ~ $22 billion in 2019-20, according to Resources and Energy Quarterly March 2019 report by the Australian Department of Industry, Innovation and Science. Higher prices and export volumes would drive this value.

During the March 2019 quarter, the total gold exploration by Australia reached $220 million, with Western Australia remaining at the centre of gold exploration activity in the country. As gold prices are witnessing a surge across the domestic, as well as the international markets, gold exploration activities are also registering strong growth.

With this backdrop, letâs zoom lens on ASX listed company, Alice Queen Limited (ASX:AQX), which is an advanced gold explorer, focused on gold exploration and mining opportunities across its domestic market.

Projects -

- Flagship Horn Island Gold Project in the Torres Strait in far north Queensland (Ownership - 84.5 per cent);

- Mendooran Copper/Gold Porphyry Project on the Molong Volcanic Arc in central New South Wales (Ownership - 100 per cent);

- Yarindury gold-copper project in NSW (Ownership â 90 per cent);

- Kaiwalagal Project (Ownership - 84.5 per cent) in Torres Strait, Queensland.

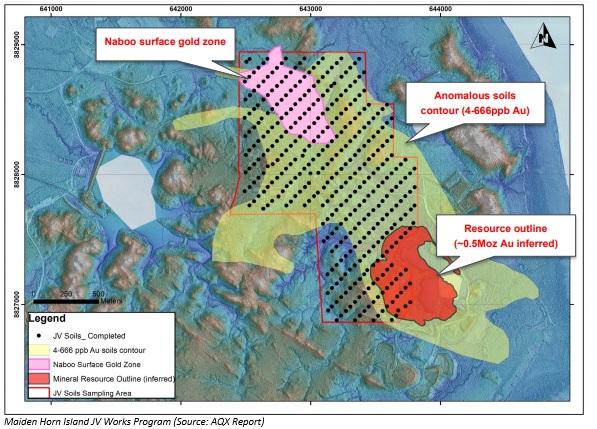

Interesting Facts about Horn Island Gold Project â A Prospective Large-Scale Project

- A brownfields gold project prospective for gold-bearing Carbo-Permian style vein/breccia;

- Comprises Exploration Permit EPM25520 (Horn Island) as well as Exploration Permit EPM25418 (Kaiwalagal), which includes the broader group of islands surrounding Horn Island;

- Gold was first discovered on Horn Island in the late 1800s;

- Alice Queen has built up an Inferred Mineral Resource of 7.9 million tonnes @ 1.9 g/t Au for 492,000 ounces of gold;

- AQX entered into an Earn-In and Joint Venture Agreement with established gold miner St Barbara Limited (ASX:SBM) in June 2019;

- Under the JV, a soil and rock chip geochemical sampling program was recently completed;

- Final assay results from the infill geochemical survey program are pending.

Moreover, the project has an infrastructure advantage, as it is well serviced with an airport, ferry terminal and port, water supply and 4G telecommunications.

Mendooran/Yarindury Projects

The other key project of the company is located in New South Wales, namely Mendooran, which is among the tenements held by AQX on the Molong Volcanic Arc. These tenements are EL8469 (Mendooran); EL8563 (Mendooran North); EL8565 (Mendooran South) and EL8646 (Yarindury), selected for their prospectivity for significant scale porphyry copper/gold deposits and located along strike, of the giant Cadia-Ridgeway mine (50m ounces of gold + 9m tonnes copper).

Yarindury is another highly prospective Cu/Au porphyry project, for which Alice Queen recently announced enhanced prospectivity, following the discovery of significant porphyry Au-Cu mineralisation at the Boda project of Alkane Resources. More on the company announcement can be READ HERE.

Stock Performance

With a market cap of $ 27.93 million and approx. 798.04 million outstanding shares, the AQX stock closed the dayâs trade at $ 0.034 on 11 November 2019. In the last three and six months, the stock delivered an outstanding return of 218.18 per cent and 118.75 per cent, respectively.

Alice Queen has an attractive project portfolio â its flagship project is progressing well with the commencement of a maiden joint venture works program, while preparations for a drilling program at another major project â Yarindury are underway. Moreover, the company achieved some significant milestones over the past financial year (FY19), progressing well towards its target of capitalising on this strong sector now and in the years to come.

More on the companyâs activities during the last quarter can be READ Here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.