ASX-listed advanced gold explorer, Alice Queen Limited (ASX:AQX) recently released its quarterly activities report for the three months ended 30 September 2019, throwing light on the quarter that was eventful and dynamic.

Flagship Project â Horn Island, Queensland

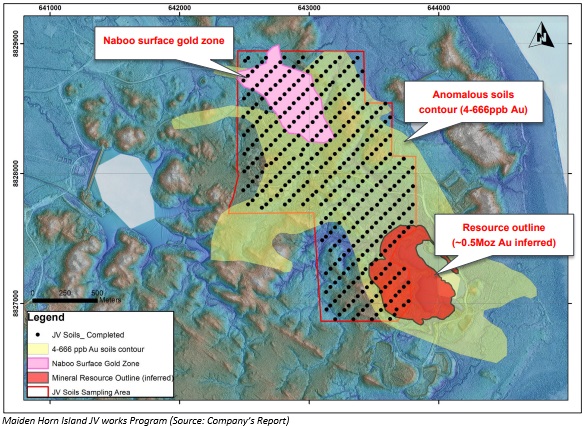

Horn Island is the flagship gold project of the company, for which it executed a joint venture with established gold miner St Barbara Limited (ASX: SBM) to prioritise drill target generation for large-scale Intrusion Related Gold Systems (IRGS).

During the September quarter, the company, as part of the JV, started a maiden works program at the project. A soils infill program was carried out, aimed towards collating additional data for further metal zonation studies.

The survey

- Coincided with a complex structural framework that was similar to the Horn Island pit deposit observed in the airborne geophysical program completed in October 2018;

- Targeted the ~2km NW surface strike extension from the current Horn Island gold resource to the Naboo prospect;

- The soils survey grid includes 100 metres spaced NE orientated lines with sample intervals at 50 metres.

Results from the soil sampling program, in addition to induced polarisation or IP survey, which is the second planned works program, will deliver the work that the partners need to generate potential exploration drill targets (IRGS).

Read More Alice Queen Completes Soils and Rock Chip Program at Horn Island under EIJVA with St Barbara

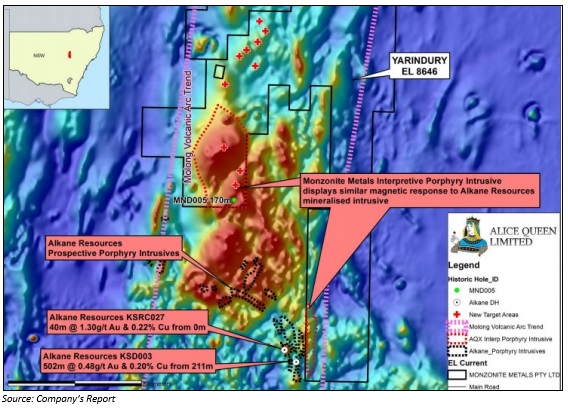

Yarindury Gold-Copper Project in NSW

Alice Queen, in the month of August 2019, announced that it is preparing for performing drilling activities at highly prospective copper/gold porphyry targets at its New South Wales (NSW) project, Yarindury.

During the quarter, the company unveiled enhanced prospectivity of Yarindury, after Alkane Resources announced to have discovered significant porphyry Au-Cu mineralisation at its Boda project. Alkane Resourcesâ discovery hole, KSDD003 (502 metres at 0.48 gram per tonne gold and 0.20% copper from 211 metres), lies within 700 metres of the boundary of Alice Queenâs Yarindury project.

- On the basis of magnetic data, the Cadia-age rocks (highly prospective) intersected at Kaiser-Boda extend at surface that is adjacent into the AQX NSW project, Yarindury, in a thin strip potentially i) 700 metres wide (west to east) and ii) over five kilometres long (south to north);

- There are chances that significant mineralisation will extend eastwards into EL8646 Yarindury, if Kaiser-Boda confirms to be a Cadia-scale porphyry field, as a result, AQX plans to perform surface mapping and sampling at this adjacently located area, targeted towards generating drilling targets in the near-term;

- Meanwhile, the tenements extended over magnetic high features, and exploration activities performed by Alkane have highlighted that these features might be monzonite intrusions driving porphyry copper-gold mineralisation, consequently, the prospectivity of all of Alice Queen's North Molong Belt project has been enhanced.

Under its maiden drill program at Yarindury, the company plans to test some of the magnetic highs, which are under younger cover and never been drilled.

More on this company update can be read here.

Corporate Activities

During the September quarter, the company secured $2.4 million through three capital raising activities from institutional and sophisticated investors.

- In July 2019, AQX raised $400,000 before costs in a placement, at an issue price of $0.012 per share. The placement included around 33.33 million new fully paid ordinary shares and 16.67 million free-attaching options, with the funds directed towards meeting the companyâs working capital needs.

- In August 2019, the company secured $516,000 before costs in a placement, at an issue price of $0.012 per share. The placement included 43 million ordinary shares and 21.5 million free-attaching options and the funds were raised to support initial drilling program at Yarindury and working capital requirements.

- In September 2019, Alice Queen raised $1.5 million (before costs) in a premium-priced placement, at an issue price of $0.03 per share. A total of 50 million ordinary shares were issued to Datt Capital, which is known name in the resources sector. Proceeds were raised to aid funding for upcoming drilling in New South Wales and other working capital requirements.

As at 30 September 2019, the companyâs cash balance stood at AUD 1.862 million. There were cash outflows of AUD 779,000 from operating activities and cash inflows of AUD 2.578 million from financing activities. During the next quarter ending 31 December 2019, the company is expecting cash outflows of AUD 862,000.

Stock Performance

The market cap of Alice Queen Limited stands at ~AUD 31.92 million, while the number of outstanding shares is 798.04 million. On 4 November 2019, the AQX stock closed the dayâs trading at AUD 0.037. Over the last three months and six months, AQX has delivered an outstanding return of 263.64 per cent and 150 per cent, respectively, while on a year to date basis, the stock has delivered a 122.22 per cent return.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.