Many ASX-listed companies recently started with their new financial year. Some of them recently came up with their expectations regarding FY2020. Letâs take a look at these stocks and their guidance.

Stocks in Discussion

Amcorâs EPS up by 15%

Packaging solutions provider, Amcor Plc (ASX: AMC) recently revealed the results for the quarter ended 30 September 2019 wherein it reported adjusted net income of USD 218 million and adjusted EPS of 13.4 US cents, both up by 14.9% on pcp, in constant currency terms.

The company declared quarterly dividend of 11.5 US cents per share. The companyâs net sales increased by USD 878.3 million, or 38.8%, to USD 3,140.7 million, as compared to pcp.

Amcorâs CEO Mr. Ron Delia commented that the company is making strong progress against its priorities to:

- Maximize the benefits from the Bemis acquisition

- Deliver organic growth in the underlying business

- Capitalize on the increasing need to develop packaging that best protects the environment

Amcor believes that it is well positioned to continue generating strong returns for shareholders and has reaffirmed its FY2020 expectations for adjusted EPS growth of 5% to 10% in constant currency terms.

In the past six months, Amcorâs stock price declined by 11.96% as on 7 November 2019. At market close on 8 November 2019, AMC stock was trading at a price of $14.500, up by 1.045% intraday, with a market close on $23.25 billion.

James Hardie Industries PLC (ASX: JHX)

World leader in the manufacture of fiber cement siding and backerboard, James Hardie recently announced the results for the second quarter of FY2020 and half year ended 30 September 2019.

JHXâs Q2 FY20 and H1 FY20 Highlights

- Group Adjusted net operating profit of USD 98.6 million for the quarter and USD 188.8 million for the half year, an increase of 22% and 17%, respectively, as compared to pcp.

- Group Adjusted EBIT of USD 134.2 million for the quarter and USD 258.6 million for the half year, an increase of 26% and 21%, respectively, compared to pcp

- Group net sales of USD 660.1 million for the quarter and USD 1,316.9 million for the half year, an increase of 2%, compared to pcp;

- During Q2 FY20, North America Fiber Cement Segment volume increased by 5% and 4% for the half year, compared to pcp;

- North America Fiber Cement Segment EBIT margin of 27.1% for the quarter and 26.1% for the half year;

- Asia Pacific Fiber Cement Segment EBIT margin of 24.0% for the quarter and 23.5% for the half year;

- Europe Building Products Segment Adjusted EBIT margin1 of 9.9% for the quarter and 10.3% for the half year.

The companyâs management is pleased with the second quarter performance, delivering net sales and EBIT growth in local currency in all three regions: North America, Asia Pacific and Europe, reflects Amcor team's continued good execution of the companyâs global strategic plan.

For FY20, the company expects modest growth in the US housing market with North America Fiber Cement segment EBIT margin to be between 25% and 27%.

In Australia, the company expects its addressable underlying market to experience high single digit percent contraction in FY20 compared to last year and it also expects volume from its Australian business to continue to grow above the market.

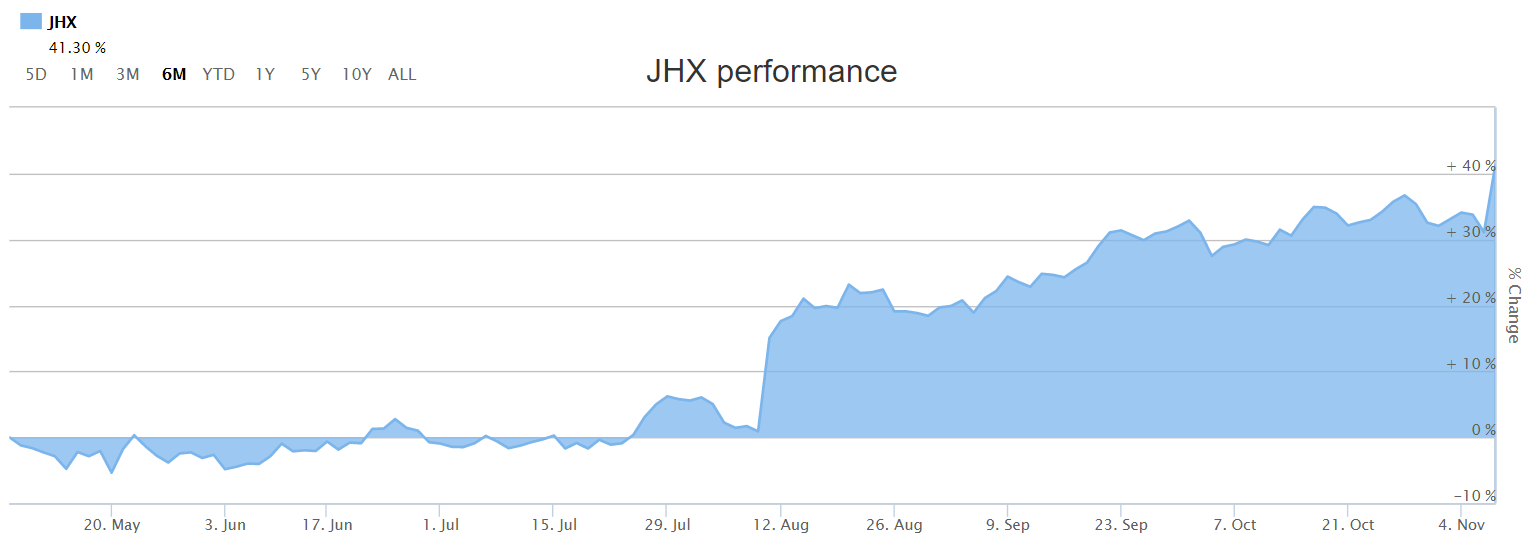

Notably, in the last six months, JHX stock increased by 41.30% as on 7 November 2019. At market close on 8 October 2019, JHX stock was trading at a price of $27.660, up by 3.907% intraday, with a market cap of $11.91 billion. The stock is trading very near to its 52 weeks high price $27.790.

JHX Six-months Price chart

Boral Limited (ASX: BLD)

Australiaâs leading construction and building supplier Boral Limited recently held its 2019 AGM wherein all resolutions were passed.

In the first quarter of FY2020 (quarter ended 30 September 2019), Boral Australia witnessed lower earnings due to the softer housing market nationally and delays in infrastructure projects. Further, the company experienced 8 per cent lower concrete volume as compared to last year, and broadly flat asphalt volumes.

BLDâs Q1 FY20 Update

- First quarter earnings from Boral North America were slightly lower than the prior year;

- In USG Boral, first quarter earnings were slightly lower than last year;

- In the Fly Ash business, earnings from site services were lower in the first quarter due to the completion of a major Synmat construction project, ahead of starting potential new work at other utility sites;

- The company signed a memorandum of understanding regarding a significant project which will increase our future fly ash volumes.

At the AGM, the company reaffirm its FY2020 outlook guidance provided in August, as per which, it expects Boralâs NPAT to be around 5 to 15% lower in FY2020 relative to FY2019, reflecting lower earnings and higher depreciation charges.

For the full-year FY2020, the company expects Property earnings to be in between $55 and $65 million and expect Boralâs EBITDA in the first half of the year to be around 5 per cent lower than the prior year.

BLD Outlook:

- In Boral Australia, the company expect several major projects to ramp up in the second half, including Queens Wharf and Westgate Tunnel projects.;

- In Boral North America both volume growth and price increases are expected to contribute to second half earnings growth

- In USG Boral, the company expect a broadly balanced first half and second half of underlying earning.

Boral CEO & Managing Director commented:

âPositioning our business for the long-term, delivering financial returns that exceed the cost of capital, and securing a safety culture that delivers Zero Harm, are my most important prioritiesâ

At market close on 8 November 2019, BLD stock was trading at a price of $4.980, down by 0.599% intraday, with a market cap of around $5.87 billion. In the past one year, BLD stock provided a negative return of 10.54% as on 7 November 2019. The stock is trading at a PE multiple of 21.590x with an annual dividend yield of 5.29%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

Â