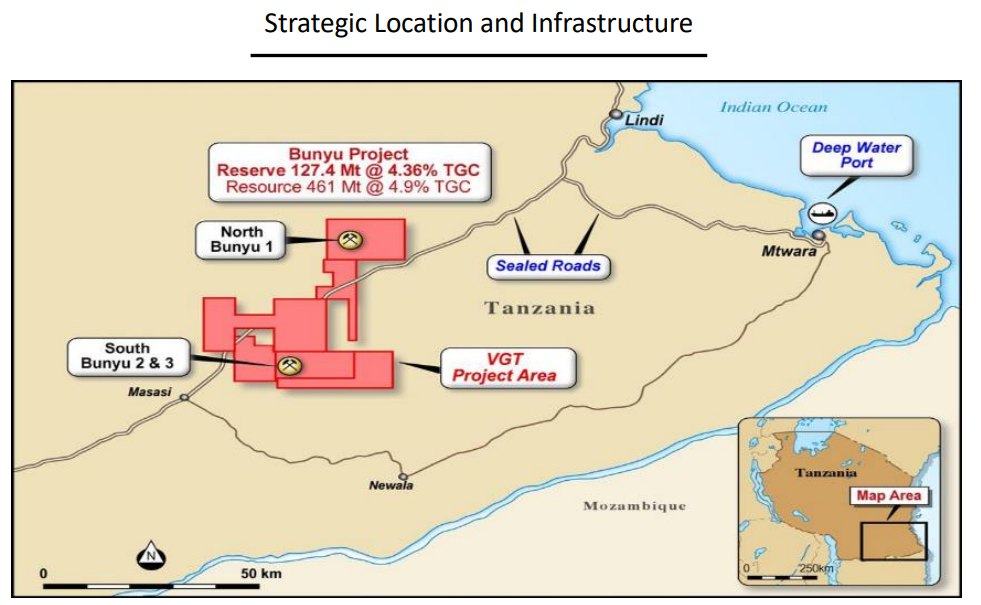

Volt Resources Limited (ASX:VRC), based in Melbourne, Australia, is a graphite exploration and development company. VRC is focused on the two-staged development of its wholly-owned Bunyu Graphite Project located in Tanzania, which enjoys a strategic location close to essential infrastructure such as sealed roads running through the project area and easy access to the deep-water port of Mtwara, that is only 140 km away.

Source: Corporate Presentation

Source: Corporate Presentation

The key environmental and mining licences are in place for both stage 1 and 2 developments. The Pre-Feasibility Study for the project was completed in late 2016, demonstrating the largest JORC graphite resource in Tanzania. In July 2018, the company reported the completion of the Feasibility Study into the Stage 1 of the project, that would target development of a nominal 20,000-25,000 tpa graphite mine and processing facility with planned exports to markets across the US, China, and others. Stage 2 would basically be an expansion of Stage 1 production based on the market demand and response that the company receives for Bunyuâs graphite products.

SPP and Top-up Placement

Recently on 21 August 2019, Volt Resources announced to have closed its oversubscribed underwritten Share Purchase Plan (SPP), announced to the market on 22 July 2019, raising a total of $ 1,299,000. In addition to the SPP, the company also reported to have executed a top-up placement of new shares that raised a further $ 350,000, from sophisticated and professional investors at the same issue price as the SPP, resulting in $ 1,649,000 of total funds raised.

The Lead Manager and Underwriter to the SPP was Patersons Securities, which also led the Placement.

The placement received a strong support and Voltâs Chairman Asimwe Kabunga also invested around $ 100,000 in the SPP. However, the company is yet to receive shareholder approval, to be sought at the next shareholder general meeting, for Mr Kabungaâs participation in the Placement.

The new shares under the SPP and Placement were issued on 23 August 2019, at a 20% discount to the volume weighted average price (VWAP) of shares traded during the five-days prior to the issue date of the New Shares (16 August - 22 August 2019).

The funds raised would assist the company to mitigate its short-term debt and progress with its development funding initiatives that, once implemented, would help in expediting the work planned for Stage 1 of the Bunyu Project. Also, the funds would be directed towards general working capital, for corporate purposes and repayment of the outstanding loan due 14 September 2019 to Yorkville Advisors and Riverfort Global Capital.

June 2019 Quarter Update

On 29 July 2019, Volt Resources reported on its activities undertaken during the three months to 30 June 2019. The company informed that in-country discussions and meetings between Voltâs management team and the Tanzanian Government continued to advance during and after the quarter, with approval process in its final stages, for the planned Tanzanian Note Issue and listing of the Notes on the Dar es Salaam Stock Exchange (DSE).

In addition, Volt Resources also achieved some positive progress regarding a couple of development funding strategies which include providing the company with the options of a private bond investment, a proposed Bond Issue and listing on the Stock Exchange of Mauritius (SEM), for which a draft prospectus is in the final stages of preparation.

The above two initiatives are being pursued to gain access to a larger pool of investors to raise USD 40 million required to accomplish Stage 1 of the Bunyu Project.

In parallel to the above activities, discussions and project due diligence processes continued to be advanced via Exotix Capital with institutions based in North America, Africa and Asia.

The company also continued negotiations with a recognised engineering services company for the role of Project Management Contractor (PMC) and worked on terms and conditions for the final contract. The contract is expected to be signed shortly to coincide with development funding nearing completion.

In May 2019, the companyâs Graphite Tanzania management and CEO Trevor Matthews attended a two-day mining exhibition in Dodoma, the capital of Tanzania. The Ministry for Minerals annual budget speech to the National Assembly was also scheduled for the same day, offering the company an opportunity to introduce its Bunyu Project, elaborate on graphite mining and processing, product markets and ongoing development activities, to the Speaker of the House and members of parliament.

Further in June 2019, Mr Lars Bader provided a funding of USD 1 million (as working capital) to the company through the placement of 20,845,714 shares at 2.1 cents each raising USD 300,000, an 18-month loan facility for USD 700,000 along with 25,536,000 options (Exercise price: $ 0.04, Maturity: 18 months). The funding would expedite the finalisation of approval for the Tanzanian Note Offer and restructuring of the corporate debt.

Mr Kabunga and Mr Hunt, serving as Directors with Volt Resources, also extended some short-term working capital support of $ 100,000, repayable on or before 15 July 2019.

Board Changes â Subsequent to the quarter end, Volt Resources announced on 1 July 2019, the appointment of Mr Giacomo (Jack) Fazio as a Non-Executive Director, succeeding Mr Alwyn Vorster, who suggested that his commitments as Managing Director of BCI Minerals Ltd required his undivided attention.

Mr Fazio joins Volt with an extensive experience acquired from working across the whole life cycle of mining, infrastructure, oil & gas and energy projects from feasibility studies, engineering, procurement, construction, through to production and logistics. He has held senior project management roles with Primero Group Limited, Laing OâRourke and Forge Group Ltd.

Stock Performance: Volt Resources Limitedâs market capitalisation stands at around AUD 20.67 million with approximately 1.48 billion shares outstanding. On 26 August 2019, the VRC stock price settled the dayâs trading at $ 0.012 with ~ 7.74 million shares traded.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.

_06_16_2025_01_53_42_112199.jpg)