Summary

- Propel Funeral Partners, a small-cap stock from All Ordinaries index, has been under the spotlight driven by impressive results during FY2020.

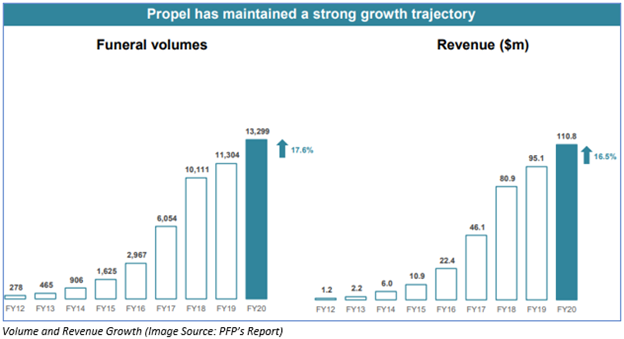

- Propel reported a 17.6% increase in funeral volume and a 16.5% growth in revenue. The Company declared a fully franked dividend of 10 cents during the financial year.

- PFP has recently executed a conditional sale deal to acquire the business, assets, and freehold property of Mid West Funerals in Geraldton in Western Australia.

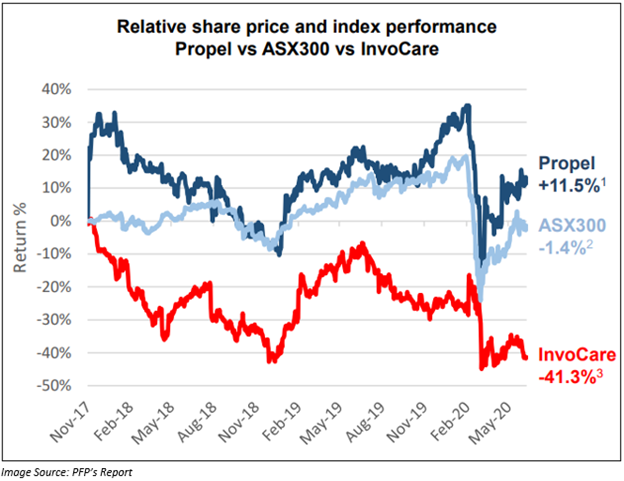

- The Company highlighted that since the IPO, its share price performance has been better than ASX300 and its peer InvoCare Limited as at 30 June 2020.

ASX All Ordinaries index listed Company, Propel Funeral Partners Limited (ASX:PFP) is the second largest provider of death care services in Australian and New Zealand. The Company owns funeral homes, cemeteries, crematoria, and related assets which are located in places like Queensland, New South Wales, Victoria, Tasmania, South Australia, Western Australia, and New Zealand.

Propel Funeral Partners belongs to an industry which provides essential service to individuals and families experiencing or preparing for death and bereavement. The Company generates its revenue via funeral operations, cemeteries and memorial gardens and other sources like revenue from coroner’s contracts and cremations performed for other funeral directors.

In FY2020, there was an increase in the funeral volume by 17.6% to 13,299 funerals as compared to the previous corresponding. The Company surpassed its FY2020 Revenue and Operating EBITDA guidance.

PFP share price, by the end of the day’s trade, settled flat on ASX at A$2.830. PFP has a market cap of A$279.42 million and around 98.74 million outstanding shares.

Let us look at FY2020 results:

- The revenue of the Company stood at A$110.8 million, up 16.5% as compared to FY2019.

- Funeral volume increased 17.6%, and average revenue per funeral was A$5,672.

- Operating EBITDA improved by 36.4% to reach A$32.4 million.

- Operating NPAT grew 6.5% to A$14.2 million.

- By the end of FY2020 on 30 June 2020, the cash and cash equivalent with the Company was A$53.9 million.

- Total dividend declared by Propel Funeral Partners for the full year was 10 cents (fully franked).

Propel Funeral Partners Amid COVID-19:

In late March 2020, the funeral attendee limits were imposed, and social distancing measures were introduced to curb the spread of coronavirus. With the ease in lockdown restrictions from late April 2020, the Company noted a rise in Average Revenue Per Funeral during May 2020 and June 2020. In the fourth quarter of FY2020, the flu cases in Australia were over 95% below the prior 5-year average. There was only a single case of Flu death in Australia but 106 death cases due to COVID-19 in Australia and New Zealand. Propel Funeral Partner’s funeral volumes cycled a robust PCP and were nearly 350 less than pre-COVID-19 anticipations.

DO READ: How the COVID-19 Pandemic has Shaped-up Future of Funeral Stocks, A Lens on PFP and IVC

Propel Funeral Partner’s COVID-19 Response:

Amid the COVID-19 environment, Propel Funeral focused on people safety, essential service continuity and financial resilience.

- People safety: Propel during these challenging times took the below measures to ensure people safety.

- Ensured there is an ample supply of PPE.

- Terminated a few services such as catering.

- Working from home where possible.

- Made changes to the seating arrangements. It also increased time and cleaning between services.

- Took steps to communicate government guidelines and directives to staff and mourners.

- Examining impacts on teams, trading, and suppliers, with the health and safety of staff and client families in front of mind.

- Essential service continuity

- Propel took steps to ensure that staff could cross state/territory borders and gain access to ‘hot spot’ areas

- Made more remote arrangements (via phone and online) and with some family members (when in person)

- Increased streaming services and provided an option of delayed memorial service.

- Ensured that government guidelines and directives followed by staff as well as the mourners

- Regular conversation with key stakeholders.

- Financial resilience

- Wisely, increasing cash at bank.

- Postponing non-essential capital expenses.

- Controlling operating costs by adjusting staffing mix and for the time being, reducing staff costs, whilst maintaining headcount. Initiatives are taken as 100% fee waivers from Directors and the Manager in April and May 2020.

PFP’s Performance Summary Since IPO:

Since Propel Funeral Partners made its ASX debut on 23 November 2017, the Company noted that by 30 June 2020, its share price improved by +11.5% while the ASX 300 index was down by 1.4%. On the other hand, its peer, InvoCare Limited (ASX:IVC), delivered a negative return of 41.3% in the same time frame.

The above graph shows that the PFP share price surpassed the ASX 300 index during this period.

Also, Propel Funeral Partners has provided a fully franked dividends totalling 21.9 cps, a total shareholder return of ~23%, and total shareholder value accretion of ~ A$61 million.

Acquisitions During FY2020:

Propel remained consistent with its Investment Strategy in FY2020. It acquired the total issued share capital of Gregson & Weight Pty Ltd, three substantial freehold properties along with a portion of empty land on the Sunshine Coast in Queensland. It also acquired the business, assets plus a few freehold properties linked to Grahams Funeral Services Limited in the North Island of New Zealand. PFP also purchased three freehold properties. Out of these three properties, two were tenanted by Propel earlier.

After the completion of FY2020, the Company has executed a conditional sale deal to acquire the business, assets as well as freehold property of Mid West Funerals in Geraldton in Western Australia. The value of the property is nearly A$1.1 million. Mid West Funerals is capable of performing around 120 funerals and generates around A$0.7 million of revenue, per annum. The Company expects this acquisition to complete by 31 December 2020.

Outlook:

In July 2020, the Company witnessed continuous resilience in operating earnings. The average revenue per funeral continued to improve, with growth over the PCP within the PFP’s target range of 2%-4%.

The expected growth drivers in FY2021 and beyond is the growing and ageing population, the strong funding position followed by the acquisitions signed & completed to date and other possible future acquisitions in a fragmented industry.

FY2021 outlook also depends on COVID-19 related disruptions and uncertainties, which are expected to continue.

Compared to its peer, InvoCare Limited, Propel Funeral Partners’ performance has been better. The impressive results, coupled with the Company’s upcoming acquisition and a positive outlook, gives a sense of confidence to the market participants.