Summary

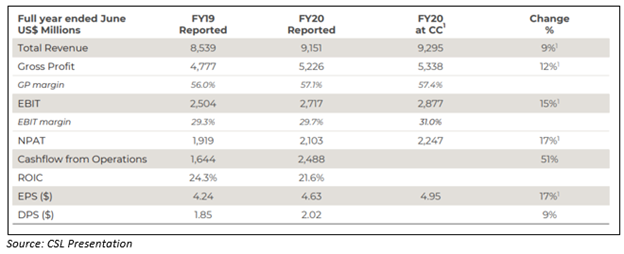

- CSL Limited reported an NPAT of ~US$2,103 million for FY20, up 17% on a constant currency basis. The total full-year dividend rose to US$2.02 per share.

- CSL’s FY21 NPAT is expected to be in the range US$2,100-US$2,265 million at constant currency, signifying a growth of up to 8% over FY20.

- Medical Developments International (MVP) to take control of European Union Markets with the agreement to enter a contract with Mundipharma.

- MVP appointed Mr Stefaan Schatteman as a Head of its European business.

Some ASX healthcare players have witnessed a substantial rise in share price in current times, despite the market instabilities that have taken place during the chaos caused by SARS-CoV-2. COVID-19 crisis has bankrupted many businesses but has created opportunities for the healthcare sector.

In the current reporting season, many ASX-listed healthcare companies are posting strong financial results dodging COVID-19 pandemic and adding value to the ASX healthcare sector index. On 19 August 2020, S&P/ASX 200 Health Care Sector rose by 3.98% to 45,373.3 points while the benchmark index S&P/ASX 200 increased by 0.72% to 6,167.6 points.

Let us discuss two ASX-listed healthcare companies which are having a good day with a significant upward movement in share price after some significant announcements- CSL, MVP.

CSL Limited Reported NPAT of US$2.1 billion Despite COVID-19

Melbourne-headquartered biotech behemoth CSL Limited (ASX:CSL) is into the development and delivery of innovative biotherapies as well as influenza vaccines to save lives and support patients experiencing life-threatening diseases.

CSL Limited operates in- CSL Behring, CSL Plasma and Seqirus businesses.

On 19 August 2020, CSL Limited revealed its results for the fiscal year 2020 (ended 30 June 2020), it has been a big year for CSL amid the COVID-19 pandemic.

Highlights from the financial front-

- Net profit after tax (NPAT) reported at US$2,103 million for FY20, up 10%, or 17% on a constant currency basis.

- CSL’s total revenue for the period rose by 9% at constant currency.

- Earnings per share during FY20 reported at US$4.63, up 17% at constant currency.

- CSL Limited stated that no material revenue impact resulting from the COVID-19 pandemic was observed. However, the situation is fluid, and some elements are not predictable.

- The Company announced a final dividend of US$1.07 per share; total full-year dividend rose to US$2.02 per share, up 9%.

- The balance sheet of the Company remains strong, with net assets of ~US$6.52 billion.

CSL’s Chief Executive Officer and Managing Director Mr Paul Perreault stated-

Highlights from the operational front-

- Clinical trials suspended in FY20, as a COVID-19 precaution, have recommenced now-

- CSL112 trial (cardiovascular disease) Phase 3 clinical study recruited more than 9500 patients.

- Phase 3 clinical study of HIZENTRA® for dermatomyositis commenced.

- Phase 3 HAE study of HAEGARDA® in Japan initiated.

- Garadacimab (Anti-FXIIa) in HAE Phase 2 clinical trial complete.

- Phase 3 study of CSL964 for preventing GvHD with AAT is actively recruiting.

- US FDA approves AUDENZTM adjuvanted cell-based influenza pandemic vaccine.

- Acquisition of license rights for EtranaDez, Haemophilia B gene therapy program.

- Acquisition of Vitaeris Inc. and Clazakizumab, commencement of AMR (transplant rejection) study.

COVID-19 Update

COVID-19 pandemic has presented challenges to employees of CSL, its supply chains and plasma collection, which is an essential raw material used in the production of many therapies of CSL. However, demand for CSL’s therapies during COVID-19 remains strong, particularly for immunoglobulins and influenza vaccines.

It is noteworthy to mention that the governments across the world recognise that the capabilities the Company offers to the communities it serves are essential.

RELATED: How is the Global Biotech Player CSL Limited Responding to COVID-19?

Outlook for FY21

- CSL stated that demand for its plasma, recombinant and vaccine products continues to be resilient.

- The Company’s NPAT for FY21 is expected to be in the range of ~US$2,100-US$2,265 million at constant currency, signifying growth over FY20 of up to 8%.

- Seqirus is anticipated to continue to perform well and deliver another solid profitable year.

Stock Information- On 19 August 2020, CSL share price ended at A$312.050, zooming up by 6.396%. The market capitalisation of the Company stood at ~A$133.17 billion.

Medical Developments International to take control of European Union Markets

ASX-listed healthcare company Medical Developments International Limited (ASX:MVP) provides emergency medical solutions to improve patient outcomes. MVP is engaged in the production of a fast-acting pain reliever- Penthrox® that is used in hospitals and emergency departments for trauma & emergency across Australia. Earlier, the Company had signed agreements on its pain reliever-Penthrox.

On 19 August 2020, Medical Developments International disclosed that the Company had reached an agreement to enter into a contract with the Mundipharma network in Europe to regain the distribution rights for its pain relief drug, Penthrox® in all twenty-seven member states across the European Union.

The strategy of Medical Developments International is to have a hybrid model selling direct in a few nations and using distributors in others. Medical Developments International would be capable of buyback rights in the European Union due to a substantial reorganisation of Mundipharma’s Europe business. The two parties had entered a deal in 2019 for distribution rights in Australia.

As a result, MVP will be able to buyback the EU rights for €3 million payable in staged instalments for the period of transition along with a 5% royalty on sales capped at a maximum of €5 million commencing from 1 September 2020 when the Company starts booking sales revenue.

MVP Chairman, David Williams stated-

So far, the focus of MVP has been on clinical trials along with expanding its regulatory approvals. This deal with Mundipharma will now add to its focus, driving commercialisation and product innovation in the European Union.

Moreover, this deal provides more control on pace to market, pricing, margins, in-market presence, and a direct interface with the health care specialists.

Both the companies (MVP and Mundipharma) are working on an organised six-month transition period starting from 1 September 2020, and Mundipharma shall provide all logistics, sales/marketing as well as regulatory services on behalf of MVP.

Appointment of Mr Stefaan Schatteman as Head of European business-

In the latest news, Medical Developments stated that it had already set up a European office and appointed Mr Stefaan Schatteman as Head of its European business effective immediately. Mr Schatteman will lead MVP’s direct push into the 27 member states in the European Union and Switzerland.

Stock Information- On 19 August 2020, the share price of MVP stood at A$6.620, climbing by 5.92%, with a market capitalisation A$410.15 million.