Summary

- ASX 200 listed company, carsales share price has given positive return of 93.21% between hitting 23 March low of $10.47 to a high of $20.23 on 19 August, inching towards its 52-week high price of $20.290.

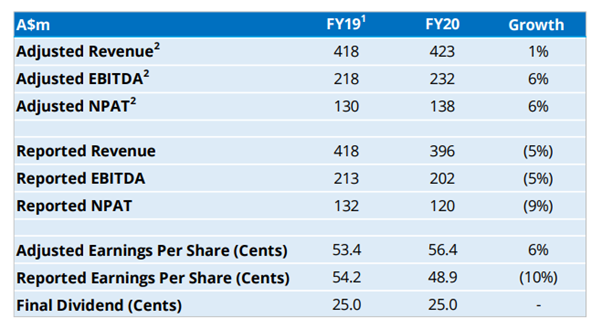

- The Group posted robust FY20 results for period ended 30 June, with adjusted revenue up by 1% to $418 million and adjusted net profit after tax (NPAT), up by 6% to $130 million

- The used car market has been very strong; while revenue from car dealers rose, but the same from private dealers fell 5% YOY due to negative impact of coronavirus restrictions.

- carsales business is well diversified in Australia, and its international business now represents 19% of total look-through EBITDA.

- CAR’s business is well funded with low gearing, strong liquidity, and strong cash generation.

Australia based carsales.com Limited (ASX:CAR) has an online automobile, bike and marine related businesses. Together with its subsidiary companies, it contains more than 600 personnel in Australia. It creates technology and advertisement solutions that propel its enterprise worldwide, including the Asia Pacific region and has interests in China, South Korea, Malaysia, Indonesia, Thailand, and Mexico.

The ASX 200 stock, carsales share price has soared 93.21%, between a low point of $10.47 on 23 March to a high point of $20.23 on 19 August, inching towards its 52-week high price of $20.290.

On 19 August, the Group delivered strong results for FY20 for the period ended 30 June, reflecting the resilient business model and the growth potential of its international markets. The solid results came at the back of earnings growth across domestic and international portfolios, and an excellent performance from Encar in South Korea (with 20% growth in EBITDA and 17% rise in revenue).

ALSO READ: What's Latest in the Australian Automotive Industry?

Key highlights from FY20 report includes of the following:

- Marginal growth in the Group’s adjusted revenue of 1% to $423 million, given COVID-19 impact in H2 period

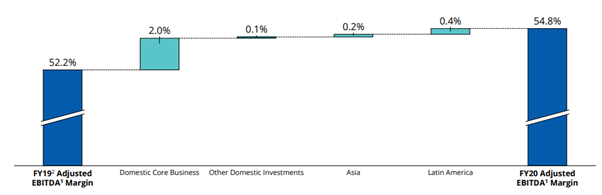

- Group Adjusted EBITDA rose 6% to $232 million, with Group EBITDA margins increasing by 55% indicating good operating leverage and strong cost control in both domestic and international businesses

- Group Adjusted NPAT grew 6% to $138 million

- Reported revenue and reported EBIDTA fell 5% each to $396 million and $202 million, respectively, while reported NPAT declined 9% to $120 million due to COVID-19 dealer support package worth $28 million

- Strong cash flow with reported EBITDA to operating cash flow conversion of 107% was posted, and a final dividend of 25 cents per share was declared to be paid by 7 October 2020

Source: CAR FY20 media release report, ASX

carsales Australia business and current trading scenario

carsales reported strong traffic growth of 8% and good adjusted revenue growth of 10% demonstrating healthy demand for used cars, good depth growth and yield improvements. While revenue from car dealers increased, but revenue from private sellers plunged down, falling 5% year-on-year. Private dealers’ revenue was up by 7% in H1 period reflecting growth in core private business, instant offer, and tyre sales, while there was a drop of 17% in H2 showing the negative impact of COVID-19.

Revenue in data, research and services was flat on pcp, but rose by 5%, barring the effect of a deliberate exit from some low margin, non-core products and contracts. New car advertising market remains challenging. Media results showed new car sales down by 20% in H2.

In the last 2 months of the financial year, the total on-site inventory declined as a consequence of a substantial decline in sales time and a rise in the number of first-time vehicle buyers and individuals adding an extra car to the household.

The Group also provided below-mentioned trading observations instead of FY21 guidance:

- Lead volumes in Victoria are now being impacted by the metro Melbourne restrictions, and dealer support package was implemented with 100% rebate on all fees until stage 4 restrictions are lifted.

- Private listing volumes recovered to pre-COVID-19 levels in July, and lower volumes in tyresales are anticipated in FY21

- New car activity has been improving since June and July, with some recovery in media revenue run rate against pcp, which could be impacted by Stage 4 restrictions.

carsales International business and present trading observations

carsales reported international look-through revenue rise of 13% and EBIDTA increase of 20%, measured in AUD terms despite the COVID-19 impact in H2.

A look-through methodology is for equity-accounted associates and consolidated subsidiaries and involves adding the total revenue or EBITDA for the period of ownership within the reporting period multiplied by the percentage ownership across the period.

South Korea produced an excellent result with revenue and EBIDTA expansion of 16% and 18%, respectively. Though the country was affected by COVID-19, economic activity had been significantly less affected than many other first world countries, and carsales owned Encar website in the country was also not substantially affected.

Similarly, Brazil presented an exceptional performance in the first half, with growth in the second half affected by the onset of COVID-19. In Brazil, webmotors posted a very robust result in the first half of the financial year with underlying local currency sales revenue and EBITDA rising by 29% and 36% compared to H1 FY19.

Mexico, Argentina, and Chile, all gained from using carsales global development network because products launched internationally offer these businesses a strategic edge in their home markets.

Source: CAR FY20 results presentation, ASX

The Group also provided below-mentioned trading observations instead of FY21 guidance:

- Key operating metrics of inventory, listing volumes and traffic are all growing well in South Korea from the beginning of FY21

- In spite of persistent high coronavirus cases, a good bounce-back is observed in traffic, leads and revenue since June in Brazil, as it emerges out of lockdown

- Key metrics in Latin America continue to be affected due to persistent restrictions in Chile, Mexico, and Argentina. The profitability is being well handled through robust cost control measures.

Overall, COVID-19 has continued to create high uncertainty for the Company’s operations. Although lockdowns have now been lifted from most areas, Metro Melbourne and Metropolitan Victoria are now in stage 4, and 3 lockdowns, respectively, while territorial lockdown remains a strong possibility in many jurisdictions.

Good read- Australia’s COVID-19 Battle Continues- Melbourne Lockdown Takes A Toll On Residents