Summary

- The market remained volatile during this week. WTC and IEL shares became the top gainers while VEA and TWE shares were the top losers.

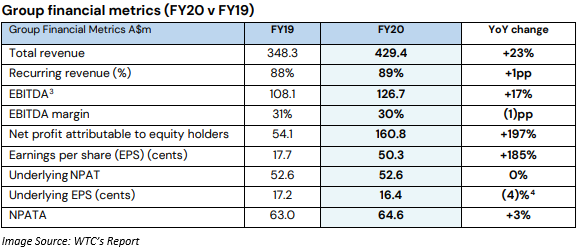

- WiseTech Global reported a 23% growth in revenue and 17% in EBITDA.

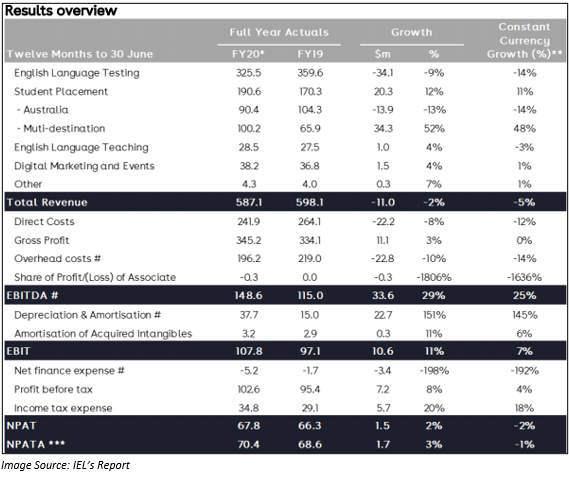

- IDP Education noted 11% growth in EBIT and NPATA by 3% in FY2020 results.

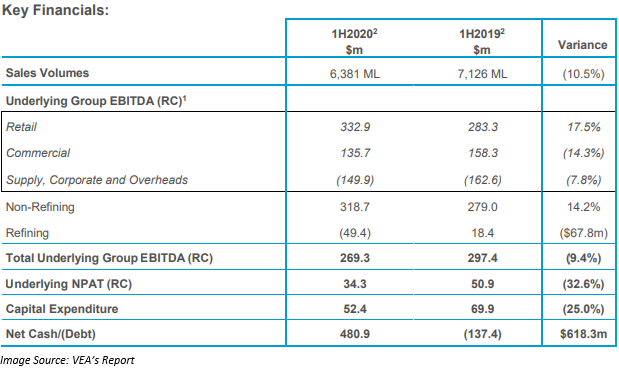

- Viva Energy Group’s sales revenue got impacted due to restrictions imposed by both State and Federal Governments to manage the containment of COVID-19.

- Treasury Wine’s net sales revenue declined 6% to A$2,649.5 million challenging conditions in the US wine market plus the COVID-19 pandemic, which played a key role in driving the performance.

The unceasing uncertainty in the market spilled over the week ended 21 August 2020. During this time frame, the benchmark index, S&P/ASX 200 remained broadly in line, moving from 6076.38 on 17 August 2020 to 6111.18 on 21 August 2020 (up by a marginal 0.005%).

The common reasons which influenced the index performance were the rising cases of COVID-19 in Australia, the results of various companies and update related to any recent development supported the performance of the S&P/ASX 200 index during the week.

DO READ: Victoria’s second wave of COVID-19 is pulling down jobs and consumer spending

In this article, we would be looking at two best and two worst-performing stocks during this week and find the reason which influenced the respective share prices during this week.

WiseTech Global Limited (ASX:WTC)

WiseTech Global Limited, the provider of software solutions to the logistics industry, noted a massive growth of 43.22% in the last five days. The shares by the end of the day’s trade on zoomed up by 1.602% and settled at A$27.900. WiseTech was the best performer on 19 August 2020, where the shares surged up by 33.93% on the day. The shares were influenced by the robust performance delivered by the Company amid COVID-19 pandemic. Let’s take a look at the financial performance of the Company during this period.

- Revenue during the period increased by 23% and EBITDA by 17%.

- The revenue from its CargoWise platform improved 20% to A$263.0 million.

- Revenue attributable to acquired businesses grew 29% to A$166.4 million.

- EBITDA margin healthy at 30%. It shows the Company’s continued revenue growth and cost-saving initiatives during 2H FY2020.

- NPATA increased by 3% at A$64.6 million.

- Cash at 30 June 2020 stood at A$223.7 million. It also has an undrawn debt facility of A$190.0 million.

DO READ: Latest ASX 200 Charts, WTC And DMP Top Performers & ANZ Share Price With A Pinch Of Upbeat Results

IDP Education Limited (ASX:IEL)

Education services provider IDP Education Limited noted a significant growth of 32.02% during this week. IDP Education Limited shares were the best performer on 20 August 2020 with an increase of 28.49% on the day. By the end of the day’s trade on 21 August 2020, the shares slipped by 3.86% and stood at A$18.430. The boost in the share price on 20 August 2020 was driven by the solid FY2020 result posted by the Company.

- EBIT increased by 11% to A$107.8 million.

- Net profit after tax and amortisation improved by 3% as compared to the previous year.

Some key highlights of IEL during the period:

- Accelerated digital strategy delivery which resulted in an industry-leading virtual counselling and event platform.

- IELTS Indicator, which is an online IELTS test to help students progress applications was rolled-out during the period.

- Student placement volumes increased 3% to 51,000, supported by a 28% growth in multi-destination volumes.

- Balance sheet enhanced with A$254 million equity raise along with A$175 million working capital

- Cash balance as at 30 June 2020 stood at A$307 million.

Viva Energy Group Limited (ASX:VEA)

Viva Energy Group Limited is engaged in the manufacture, distribution, and supply of petroleum products to retail and commercial customers was amongst the worst-performing companies list during this week. On 18 August 2020, the shares dropped by 6.09% and was the third-worst performer on ASX. During this week, VEA shares dipped by 2.49%. By the end of the day’s trade on 21 August 2020, VEA shares soared up by 3.226% and stood at A$1.760.

On 17 August 2020, Viva Energy Group posted its financial results for the half-year ended 30 June 2020.

- Sales volume during the period declined by 10.5% as compared to the previous corresponding period. The drop was due to restrictions put in place by both State and Federal Governments to manage the containment of COVID-19. This impacted the demand for fuel.

- Total Underlying Group EBITDA dropped 9.4% to A$269.3 million and Underlying NPAT by 32.6% to A$34.3 million.

- Capital expenditure declined 25% to A$52.4 million.

- Net cash at 30 June 2020 was A$480.9 million.

Treasury Wine Estates Limited (ASX:TWE)

Treasury Wine Estates Limited is an international wine business with a portfolio of luxury, premium and commercial wines was the worst performer on 18 August 2020 with over 14% drop in the share price. During this week, the shares dropped by 19.69%. By the end of the market session on 21 August 2020, the shares improved by 0.916% and stood at A$9.910. The shares are were positioned near its 52-week low price.

On 18 August 2020, Treasury Wine Estates was advised by the Chinese Ministry of Commerce that they have commenced an anti-dumping investigation into Australian wine exports into China. TWE has decided that it would co-operate with any requests received from Chinese or Australian authorities.

Treasury Wine has had a long and respectful relationship with China for a very long period via its team, partners, customers, and consumers. TWE, being the importer of high-quality, premium Australian wine is committed to China as a priority market and would be investing in its Chinese business and its relationships with customers and consumers.

Also, the Company would focus on building premium and luxury brands, investing in the local operating model and team. It would work with partners to improve the wine category and expand its contribution to China.

DO READ: No FY21 guidance from most ASX Companies: 3 Things Investors should look at while going by luck

FY2020 Results:

The results declared by the Company last week on 13 August 2020 were not impressive.

- The net sales revenue declined 6% to A$2,649.5 million. The impact on the sales volume was due to challenging conditions in the US wine market and the pandemic which influenced the performance across all geographies.

- EBITS slipped by 22% to A$533.5 million.

- NPAT declined by 25% to A$315.8 million and EPS by 26% to 43.9 cents per share.

- The balance sheet remained strong and flexible, and investment-grade credit profile maintained, with lease-adjusted net debt to EBITDAS 2.2x, which was 1.8x in FY2019.

- Final dividend for the period was 8 cents.

INTERESTING READ: A Sunny Day for Treasury Wine - Stock zooms over 12% following FY20 results