On August 21, 2020, S&P/ASX200 ended the session in red as there was a fall of 0.14% to 6111.2 while All Ordinaries fell by only 0.02% to 6270.7. We would now have a look at the performance of some individual stocks.

On August 21, 2020, the stock price of Nearmap Ltd (ASX: NEA) rose by 10.246% on an intraday basis to A$2.690 per share. Also, the share price of The Star Entertainment Group Limited (ASX: SGR) rose 7.143% to A$3.150 per share.

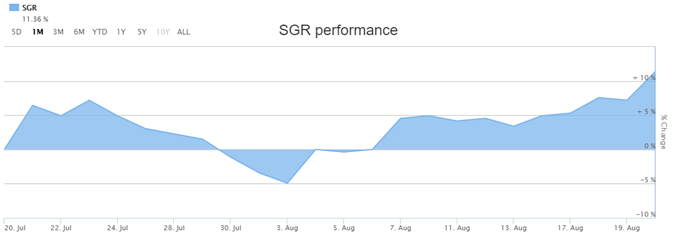

The following image shows how the stock price of SGR has performed in the span of past one month:

Stock Performance (Source: ASX)

Let us now have a look at the performance of New Zealand market. On August 21, 2020, S&P/NZX50 closed in green as there was an increase of 1.49% to 11,836 while S&P/NZX20 increased 1.50% to 7,901. Also, S&P/NZX10 rose by 1.51% to 12,457.

Recently, we have written some information on Redbubble Limited (ASX:RBL) and investors can click here to view the content.

SUN Released FY 2020 Results

Suncorp Group Limited (ASX:SUN) came forward and released FY 2020 financial results. It was mentioned that the company is well capitalised with excess CET1 of $823 Mn adjusting for the final dividend, and the businesses are holding CET1 within their target operating ranges. It was stated that the company has recently confirmed new leadership team structure and would continue to embed recent changes to the operating model in order to further reduce the duplication, clarify accountabilities as well as enable greater efficiency along with innovation.

The stock price of SUN ended the session in green as there was a rise of 11.047% on an intraday basis to A$9.650 per share.

WEB Ended the Session Green

Recently, Webjet Limited (ASX:WEB) made an announcement about its financial results for FY 2020. The company stated that after its record result for 1H FY 2020, which was driven by performance of WebBeds business, its 2H FY 2020 was impacted by coronavirus pandemic that caused a significant fall in the booking activity in all Group businesses. The company stated that it is entering FY 2021 in a robust capital position, providing financial as well as strategic flexibility. Notably, proforma cash on hand stood at $320 Mn and pro forma liquidity at $420 Mn.

On August 21, 2020, the stock price of WEB rose by 11.801% on an intraday basis to A$3.600 per share.