Summary

- In the present times, market uncertainty still prevails. Most indices are trading in the red zone.

- WiseTech, which was the best performing stock on 19 August 2020, reported a growth of 23% in revenue.

- Domino's Pizza was amongst the top 5 best performers. It noted EBIT growth of +3.6% to A$228.7 million.

- ANZ reported an unaudited statutory profit of A$1,327 million and an unaudited cash profit from continuing operations of $1,498 million.

The market continues to remain uncertain in the present times. The S&P/ASX 200 which closed in the green zone on 19 August 2020. At AEST 12:51 PM on 20 August 2020 is down by 1.07% and is positioned at 6,101.3. Most of the indices are trading in the red zone. A significant drop of over 2.5% was seen in sectors like Health Care and Energy.

In this article, we have considered two such players who were the amongst the top five performers on ASX on 19 August and another one stock which performed well on ASX, driven by their latest result announcement.

WiseTech Global Limited (ASX:WTC)

WiseTech Global Limited, the provider of software solutions to the logistics industry worldwide, was the best performer on ASX on 19 August 2020 where the shares by the market closure zoomed up by nearly 34% and settled at A$27.87. At AEST 12:50 on 20 August 2020, WTC shares are trading at A$27.92, up 0.179% from the last close. The significant growth in the share price was due to the solid results posted by the company on the day. WTC has a market cap of A$6.74 billion and 323.75 million outstanding shares.

FY2020 Results:

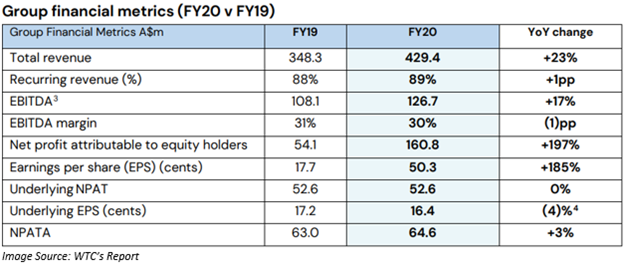

- Revenue went up by 23% and EBITDA by 17%. The results were as per the guidance.

- Despite the challenges faced by the company during the COVID-19 pandemic, the company delivered robust revenue growth.

- CargoWise revenue increased by 20% to A$263 million. The growth reflects the strength of the core CargoWise platform.

- Revenue attributable to acquired businesses grew 29% to A$166.4 million.

- EBITDA margin strong at 30%. It demonstrates the continued revenue growth and 2H 2020.

- Underlying NPAT remained flat at A$52.6 million despite a 66% rise in depreciation and amortisation.

- NPATA increased by 3% at A$64.6 million.

- Balance sheet, cash flow and liquidity got strengthened with a growth of 16% in operating cash flow.

- The cash held by the company as at 30 June 2020 was A$223.7 million with undrawn debt facility of A$190 million.

- The company declared a final ordinary dividend of 1.60 cents per share which is payable on 02 October 2020.

Strategic Update:

- For entire FY2020, the company continued to increase its penetration of the global logistics and supply chain market.

- WTC completed five strategic acquisitions across North America, South Korea, Poland and Switzerland.

- Since the FY2016, the company has invested nearly A$440 million in product innovation. Ongoing product development and innovation being the topmost priority, during FY2020, the company added over 1,100 product upgrades and enhancements to the CargoWise platform. It also invested in technology development in fields of global customs, rates management, border compliance, transport management solutions as well as landside logistics.

Outlook and Guidance:

Based on the condition that the market situation does not change significantly, the company expects its FY2021 revenue growth between 9% to 19% and EBITDA growth of 22% to 42%.

Domino's Pizza Enterprises Limited (ASX:DMP)

Food retailer operating pizza chain, Domino's Pizza Enterprises Limited was amongst the top five players who performed well on ASX and had a contribution in influencing S&P/ASX 200 index. On 19 August 2020, the shares of Domino's Pizza soared up by 8.885% and settled at A$83.700. The highest price attained by the company on the day was A$85.200, which is the 52-week high price now. However at AEST 12:49 PM on 20 August 2020, DMP shares are trading at A$85.65, up 2.33% from the last close. DMP shares have delivered a growth of ~ 34% in the previous six months.

The growth in the share price of DMP was after the release of the FY2020 results.

- Network sales during the period increased by +12.8% to A$3.27 billion.

- Online sales grew +21.4% to A$2.36 billion.

- EBIT improved by +3.6% to A$228.7 million.

- Free Cash flow improved +90.7% to A$161.9 million.

- International EBITDA for the period was A$186.7 million while ANZ EBITDA was A$116.3 million.

In Japan, the company delivered a record performance across multiple metrics. It was successful in attracting new customers. The order frequency also increased from this region. Sales increased by +25.9% to ¥59.2 billion and EBITDA +29.9% to ¥7.5 billion.

In Europe, the short-term closure in France and support for franchisees resulted in reduced EBITDA of -1.5% to €50.6 million. Network sales grew +5.1% to €749.1 million. The sales growth in Europe was Supported majorly by Germany.

In ANZ, the increased safety and franchisee investments shielded the network, however, reduced EBITDA by -5.8% to A$129.4 million. The sales growth in the region boosted towards the end of the second half of FY2020.

Australia And New Zealand Banking Group Limited (ASX:ANZ)

Through Australia And New Zealand Banking Group, Limited was not amongst the top five market movers on 19 August 2020, but it’s shares zoomed up on ASX by 3.376% and settled at A$18.680. However, at AEST 12:46 PM on 20 August 2020, ANZ shares are trading at A$18.41, down 1.445% from the last close.

ANZ shares have delivered a negative return of 32.20%. IN the last three months, the shares delivered a decent performance of 19.43%. ANZ has a market cap of A$51.25 billion and around 2.84 billion outstanding shares.

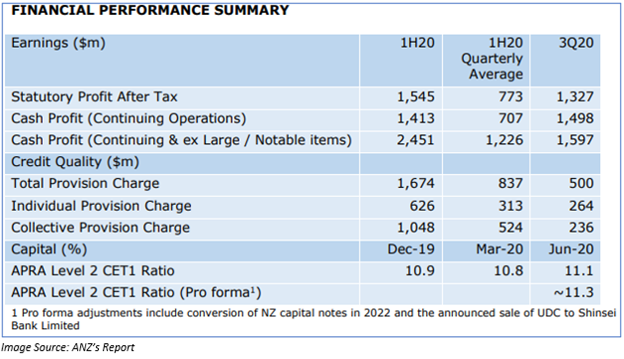

On 19 August 2020, ANZ released its Q3 FY2020 trading update. The company reported an unaudited statutory profit of A$1,327 million and an unaudited cash profit from continuing operations of $1,498 million.

Commenting on the trading update for Q3 FY2020, ANZ Chief Executive Shayne Elliott stated that the performance of the company in such difficult times reflects the strength of the company’s portfolio. The company was able to balance the need to support customers as well as its staff during the global pandemic.

Amid COVID-19 pandemic, the company grew its home loans in Australia well above the rest of the market.

The company also noted strong deposit growth which shows that ANZs customers are taking wise methodology in shoring up their finances.

Because of the strong customer flows and underlying volatility, ANZ’s markets business improved by 60% on the first half quarterly average. On the other hand, a reduction in risk-weighted assets from the International business provided a capital benefit to the Group.

The company also took steps towards the simplification of the business. It announced the sale of UDC in New Zealand to Shinsei Bank and also agreed to sell its off-site ATM fleet in Australia to Armaguard.

Did You Know: ANZ issues dividend despite challenges | ASX Market Update