Summary

- The Newcastle coal price has decreased by 24 per cent (monthly average) since the onset of the year 2020 till now.

- A decline in electricity prices and demand across the continent over lesser daytime cooling needs and installation of rooftop panels are taking a toll on thermal coal prices.

- Moreover, the Asian markets, on which ASX-listed coal mining companies have been beating strong, have witnessed a demand plunge, leading to a downtrend in their share prices on the exchange.

- New Hope Corporation Limited (ASX:NHC) coal production and sales tumble for the quarter ended 31 July 2020.

The energy market across the globe has taken a considerable hit from the economic meltdown on account of COVID-19 outbreak, leading to a drastic fall in energy-related products and commodities such as crude oil and especially thermal coal. This has brought several ASX200 companies under spotlight.

The Newcastle coal price has decreased by 24 per cent (monthly average) since January 2020 with Newcastle coal futures dropping from USD 76.75 a tonne (high in January 2020) to the present low of USD 58.18 (as on 21 August 2020), marking a fall of ~ 24.19 per cent.

Coal prices were under pressure over falling electricity demand across the continent as daytime cooling needs saw a dip in the recent past over relatively cooler weather and installation of rooftop panels.

To Know More, Do Read: NEM Prices Average At Multi-year Low As Demand Dazes And Gas Price Declines in Q12020

Moreover, coal prices were also under pressure due to decline in demand from Japan, Korea, and Taiwan markets during the first half of the year 2020, markets where prominent Australian coal miners Whitehaven Coal Limited (ASX:WHC), New Hope Corporation Limited (ASX:NHC), have been betting strong.

To Know More, Do Read: New Hope Co. and Whitehaven Coal Eye Asian Thermal Coal Market

The decline in coal prices has taken a toll on ASX-listed coal mining companies with many such as WHC, NHC moving in a downtrend.

New Hope Corporation (ASX:NHC)

NHC coal production and sales tumble for the quarter ended 31 July 2020

In the wake of weak Asian markets and weather challenges across Queensland, NHC reported a decline in production and sales.

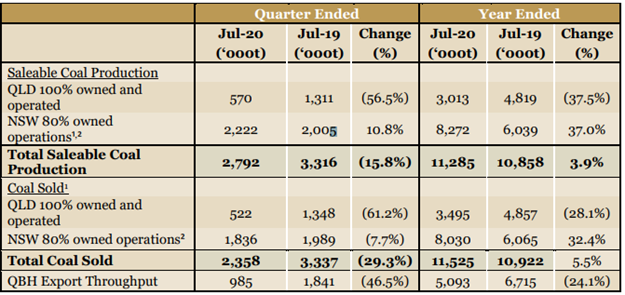

- NHC reported a 37.5 per cent decline in saleable coal production from Queensland for the year ended 31 July 2020 against the previous corresponding period (or pcp) at 3,013k tonnes.

- Likewise, the saleable coal production from Queensland declined 56.5 per cent for the quarter ended 31 July 2020 against pcp.

- The NSW (80 per cent) prospect of the Company performed relatively well with saleable coal production increasing 37.0 per cent on a year-on-year basis at 8,272k tonnes.

- The saleable coal production from the prospect surged by 10.8 per cent on a quarterly basis against pcp at 2,222k tonnes.

The total saleable coal production took a 15.8 per cent hit for the quarter ended 31 July 2020 against pcp at 2,792k tonnes; however, witnessed an increase of 3.9 per cent on y-o-y basis at 11,285k tonnes.

- On the sales counter from QLD, NHC reported a y-o-y decline of 28.1 per cent at 3,495k tonnes (QLD) along with a decline of 61.2 per cent for the quarter ended 31 July 2020 against pcp.

- Likewise, sales plunged by 7.7 per cent for the quarter ended 31 July 2020 against pcp at 1,836k tonnes from NSW. However, on a yearly basis, the coal sales surged by 32.4 per cent at 8,030k tonnes.

The total coal sales took a hit of 29.3 per cent for the quarter ended 31 July 2020 against pcp at 2,358k tonnes; however, increased by 5.5 per cent on a y-o-y basis at 11,525k tonnes.

NHC Performance Snippet (Source: Company’s Report)

Also Read: Coal Prices Bounce Back; Whitehaven Coal Delivers Strong Production In June Quarter

Operational Highlights

NSW Coal Operations (80 per cent owned)

- The 10.8 per cent surge in the coal production at 2.2 million tonnes (80 per cent) was primarily due to the resolved geotechnical issues that hampered production in the third quarter.

- Moreover, on the sales counter, the Company suggested that coal sales were largely hampered by storms and wet weather in Newcastle, which resulted in in-port closures and rail network outages, deferring coal sales from July to August.

- Furthermore, NHC mentioned that at the end of July 2020, the Company had scheduled a major mid-life shutdown of the dragline, which is now planned for 80 days and involves a significant amount of mechanical, electrical, and structural repairs and upgrades to the machine.

QLD Coal Operations

New Acland Mine

- The prospect produced marginally less coal against the previous quarter, and the Company suggested that operations in Centre Pit are coming to an end.

- Also, the Company concluded the clearing and topsoil relocation of the final strip in West Pit during the quarter.

- Furthermore, NHC suggested that the Queensland Government continues to defer its decision on the New Acland Stage 3 project, which is a shovel ready project, citing ongoing legal appeals as the reason for their inaction.

West Moreton Operations

Rehabilitation activities at the prospect continue to be the top agenda at the Jeebropilly and New Oakleigh sites, and during the quarter, re-shaping topsoil placement and pasture seeding have continued along with capping of the most southern area of the tailing storage facility.

Pastoral Operations

On the agricultural business, the Company continued with NSW cattle grazing activities at Bengalla Agriculture Company with the fattening of 150 Acland Pastoral Company (APC) bred cows.

Moreover, NHC undertook various upgrades, including a set of cattle yards, fencing of various paddocks, a lateral irrigator installation and refurbishment of a pivot irrigator.

Exploration and Development

- During the quarter, the Company drilled 10 holes for a total of 2,013m in the Bengalla mining leases and on the Culgowie and Taroom East exploration tenements with drilling at the Bengalla mine focusing on collecting pre-production and geotechnical information prior to mining.

The stock of the Company last traded at $1.285 (as on 24 August 2020, AEST:2:50 PM)), up by 1.18 per cent against its previous close on ASX.