Highlights

The Australian share market opened lower on Thursday.

The ASX 200 index fell 9 points, or 0.13% to 7,118.70 at the open.

The index has gained 0.67% in the past five days.

The Australian share market opened lower on Thursday following a poor closing on Wall Street. The US Federal Reserve’s monetary policy minutes from the July meeting revealed that the interest rates would continue to be hiked until consumer prices ease.

The ASX 200 index fell 9 points, or 0.13% to 7,118.70 at the open. The index gained 0.67% in the past five days but has declined 4.38% on a year-to-date (YTD) basis.

The ASX All Ordinaries index was down 0.205% at 7,366, while the A-VIX fell 3.725% to 13.413 at the open. On Wednesday, the benchmark index closed 0.3% higher at 7,127.7 points. The benchmark index was trading at 7,102.50, down 25.20 points or 0.35% in the first 10 minutes of the trade.

On Wall Street, the S&P 500 dipped 0.7%, the Dow Jones declined 0.5%, and the NASDAQ ended 1.25% lower. In Europe, the CAC dipped 1%, the Stoxx 50 fell 1.3%, the FTSE slipped 0.3%, and the DAX ended 2% lower.

Market action

On Wednesday, the US Treasury yields surged, with the benchmark 10-year notes rising to 2.9041%. On the other hand, the US dollar index declined to 106.39. However, it later rebounded to 106.55.

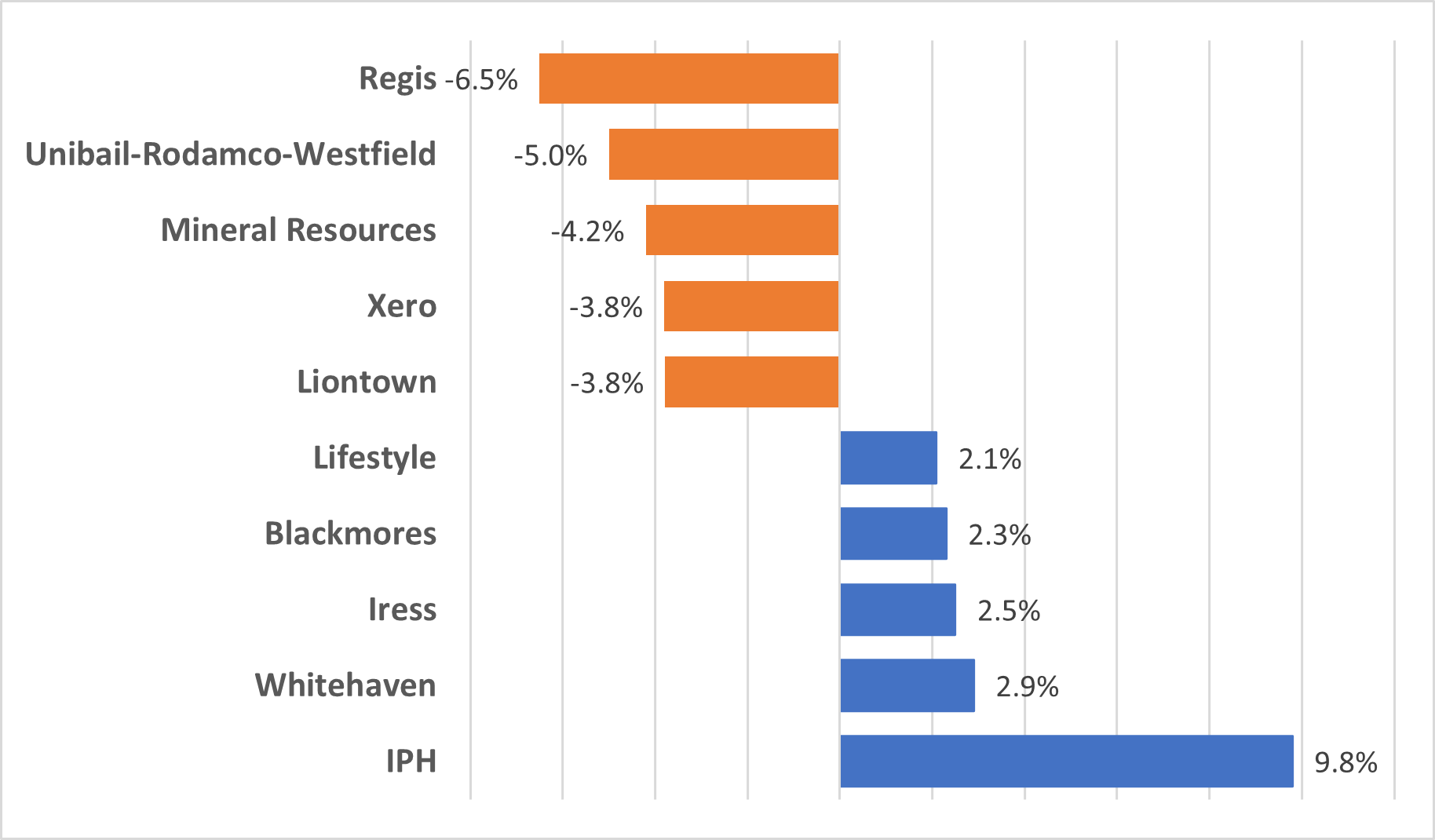

Data Source: ASX (as of 18 August 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

Regis was the top loser, while IPH was the top gainer.

Meanwhile, on the ASX, barring energy and healthcare, all other sectors were trading in the red in the early trade.

Newsmakers

- Transurban announced a total revenue of AU$3.4 billion for FY22, compared to AU$2.88 billion in FY21.

- Codan’s underlying net profit rose 3% to a record AU$1005 million.

- Sezzle’s underlying merchant sales for July rose 9.5% (M-O-M).

- Orora’s net profit rose 36% and revenue was up 15.6% in 2022.

- NRW Holdings’ full-year net profit rose 79.4% to AU$97.4 million.

- Evolution Mining’s statutory net profit stood at AU$323.3 million for the year ending 30 June 2022.

- Nuix reported a net loss of AU$22.8 million and a fall in revenue of 13.5% to AU$152.3 million in FY22.