Highlights

- The ASX 200 benchmark index closed up today (August 17), gaining 0.31% to end at 7,127.70 points.

- Over the last five days, the index has gained 1.93%, but is down 4.26% on a year to date basis.

- Seven out of 11 ASX sectors ended the day in green zone.

Australian share market closed on a positive note today (August 17) with the benchmark S&P/ASX 200 gaining 0.31% to end at 7,127.70 points.

Market declines of up to 22.5 points were caused by poorly received trading announcements from CSL and Santos in early trading.

The biggest drag ultimately was Commonwealth Bank, which saw a 1.81% decline as its shares traded without the right to the subsequent dividend.

Key pointers from ASX close today

- The ASX 200 benchmark index closed up today, gaining 0.31% to end at 7,127.70 points.

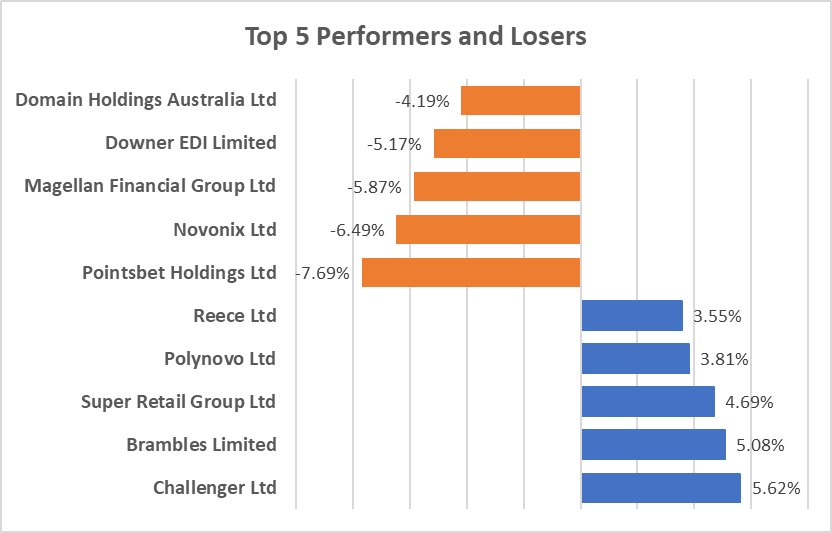

- Top performing stocks were Challenger Limited (ASX:CGF) and Brambles Limited (ASX:BXB), up 5.63% and 5.08% respectively.

- Bottom performing stocks in this index were Pointsbet Holdings Limited (ASX:PBH) and Novonix Limited (ASX:NVX), ending 7.69% and 6.49% lower respectively.

- Over the last five days, the index has gained 1.93%, but is down 4.26% for the last year to date.

- Seven out of 11 ASX sectors ended the day in green zone.

- Consumer Staples was the best performing sector today, gaining 1.79%. The sector has gained 3.48% in last five trading days.

- Healthcare was the worst performing sector today, down 1.03%.

- Volatility indicator A-VIX index was down 1.30% at 4.42 PM AEST.

- The All-ordinaries Index gained 0.26%.

Newsmakers

Parabellum Resources (ASX:PBL): Parabellum has implemented a trading halt before raising a capital. The amount the company hopes to raise, and its intended use of the funds are unknown to the market.

Alicanto Minerals (ASX:AQI): Rob Sennitt has been appointed managing director (MD) of Alicanto Minerals (AQI), effective on September 1.

Mr Sennett’s appointment is likely to strengthen the company’s rapid expansion strategy at its Sala project in Sweden.

Meanwhile Alicanto shares closed trading at AU$0.058 per share, up 9.43% on ASX.

Image Source: © 2022 Kalkine Media ®

Data Source- ASX website

Bond Yields

Australia’s 10-year Bond Yield stands at 3.23% as of 5.09 PM AEST.

In global markets

On Tuesday (16 August), US stocks ended the trading day with a mixed result, helped by advances in retail firms following the announcement of their quarterly reports. The strong earnings results suggested that despite the highest inflation in decades, Americans are still maintaining significant spending.

The S&P 500 rose 0.19% to 4,305.20, while the Dow Jones was up 0.71% to 34,152.01. The NASDAQ Composite lost 0.19% to 13,102.55, and the small-cap Russell 2000 fell 0.04% to 2,020.53.

In Asia, the Asia Dow was up 0.16%, the Hang Seng in Hong Kong gained 0.56%, while Nikkei in Japan and Shanghai Composite in China, picked up by 1.23% and 0.45% respectively at 5.14 PM AEST.

In Commodities markets

Crude Oil WTI was spotted trading at US$87.07/bbl while Brent Oil was at US$93.14/bbl at 5.15 PM AEST.

Gold was at US$1775.94 an ounce, copper was at US$3.629/Lbs and iron ore was at US$108.50/T at 5.16 PM AEST.