The Australian energy sector, which is facing the higher LNG exports effect, is now shifting towards the alternative renewable energy sources amid cost-effectiveness and environmental responsibility.

In the status quo, the Australian supermarket mammoth-Coles entered into a long-term power purchase agreement (or PPA) from three solar farms, which would provide 10 per cent of the companyâs national electricity usage.

Coles entered into a 10-year agreement with global renewable power generation company- Metka EGN, to purchase over 70 per cent of the electricity generated by three solar plants of Metka EGN, which the global renewable energy giant would build outside the regional centres of Junee, Corowa, and Wagga Wagga.

In its media release, Coles mentioned that the new solar plants able to power 39,000 homes which would be constructed in regional New South Wales.

Coles mentioned that the three solar power plants would supply over 220Gwh or gigawatt-hours of electricity into the national electricity grid, which in turn, would take down the greenhouse gas emission.

As per the company, electricity generation of 220 gigawatt-hours from the traditional non-renewable sources would emit over 180,000 tonnes of greenhouse gas emissions a year, which is equivalent to the annual emission from 83,000 cars.

The current Chief Executive Officer of Coles- Steven Cain mentioned that the use of more considerable renewable energy was a significant part of the Colesâ commitment to becoming the most sustainable supermarket.

Coles is on the path to take down its greenhouse emission as the company plans to sustain and success for another century. Coles, which has been a cornerstone of Australia retail for over 100 years, is ensuring sustainability by utilising the clean energy.

The company has invested over $40 million in the last two financial year in energy efficiency measures, which in turn, has enabled the company to reduce its greenhouse emission by 4 per cent from last financial year and over 30 per cent since 2009.

The energy efficiency measures adopted by the company include the installation of LED lights across all its store network along with the installation of solar panels on 30 stores.

Coles Chief Property and Export Officer- Thinus Keeve, who was the first Australian retailer to favour the buying of renewable energy believes that such power purchase agreements are necessary to promote the renewable generation capacity in Australia, as this would provide the developers with confidence over the need to invest.

Apart from supporting the large-scale renewable power generation projects, Coles is also working alongside the property partner to gear up the on-site generation of renewable power at stores and across distribution centres.

Coles further plans to install solar panels above 38 stores additional in the present financial year

Molycop Heads for Renewable Energy:

Coles announcement came right after the announcement from Molycop- a manufacturer for mining and rail companies.

Molycop announced the signing of a long-term PPA with an energy retailer- Flow Power on 19 August 2019. The contract signed by the company is valid till 31 December 2030 and is backed by the offtake from Bomen Solar Farm and the Sapphire Wind Farm in New South Wales.

As per the company, the Bomen Solar Farm is presently being constructed and expected to be fully operational in Q2 CY2020, while Sapphire Farm is operational since November 2018.

Under the agreement, Molycop expects an offtake of 100,000 megawatt-hours per year of renewable energy, which in turn, would cover over half of its electricity consumption in the New South Wales.

Latest in the Resource Sector:

While renewable energy took a staggering leap in Australia, the resources players presented reports over the development and financial year progress.

St Barbara Limited (ASX: SBM)

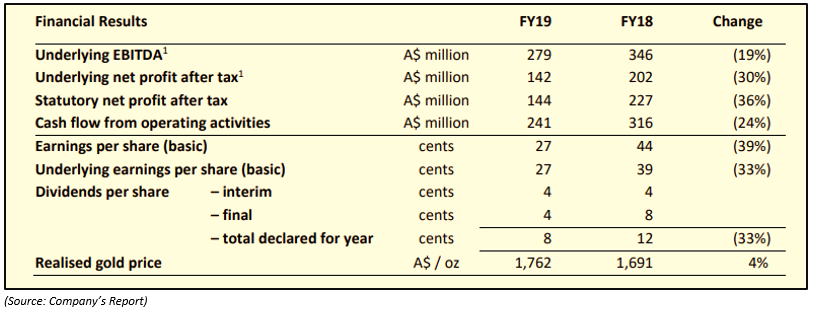

SBM reported a statutory net profit after tax of $144 million for the financial year 2019 ended 30 June, which was over 36 per cent down as compared to the 2018 statutory net profit after tax of $227 million.

The cash flow from operating activities also witnessed a decline of over 23 per cent in FY2019 to stand at $241 million against previous year cash flow from operating activities of $316 million.

The underlying NPAT also declined by almost 30 per cent to stand at $142 million in FY2019 as compared to $202 million in FY2018.

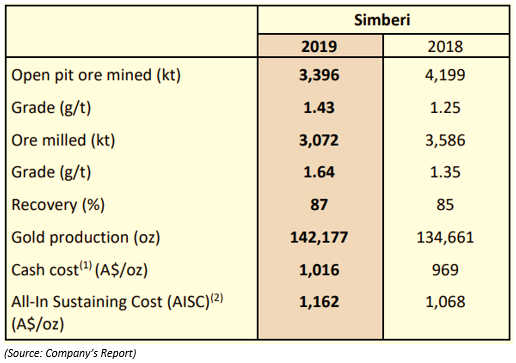

Despite recognising 4 per cent higher gold prices in FY2019 of A$1,762 per ounce, and record production of 142,177 ounces from Simberi mine, the financials of the company witnessed massive declines.

Dividend:

The company distributed an interim dividend of 4 cents in the first half of the year 2019 and declared another 4 cents per share dividend for the second half of the year 2019, which took the total dividend of the financial year 2019 to 8 cents per share, unchanged as compared to FY2018.

Production Scenario:

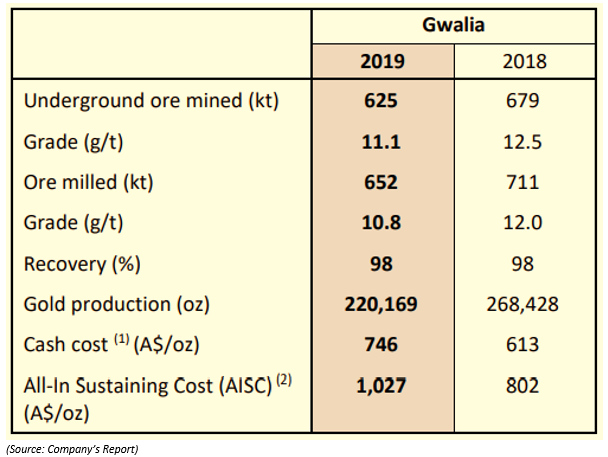

The production from the Gwalia operations declined by almost 18 per cent to stand at 220,169 ounces in FY2019. The fall in production could be accounted for lower grade quality and fall in the number of underground mined ores.

The Simberi operations of the company witnessed a record production amid higher grades and improved recovery rate despite fall in the numbers of open-pit mined ore.

Upgraded Ore Reserves:

As on 30 June 2019, the total Ore Reserves of the company stood at 4.1 million ounces, up by 0.2 million ounces; while the Mineral Resources stood at 9.6 million ounces, up by 0.4 million ounces.

Post the acquisition of Atlantic Gold, the total Ore Reserves of the company now stands at 5.9 million ounces of contained gold; while the Mineral Resources are 12.0 million ounces of contained gold.

The shares of the company last traded at A$3.270 (22 August 2019).

Iluka Resources Limited (ASX: ILU)

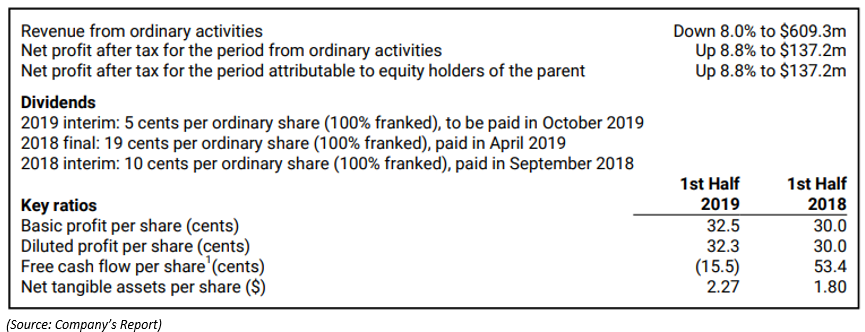

ILU presented its interim report of the financial year 2019 for the half-year ended on 30 June 2019. ILU Net Profit After Tax (or NPAT) stood at $137.2 million; while the underlying EBITDA for the group stood at $273.9 million.

Sales:

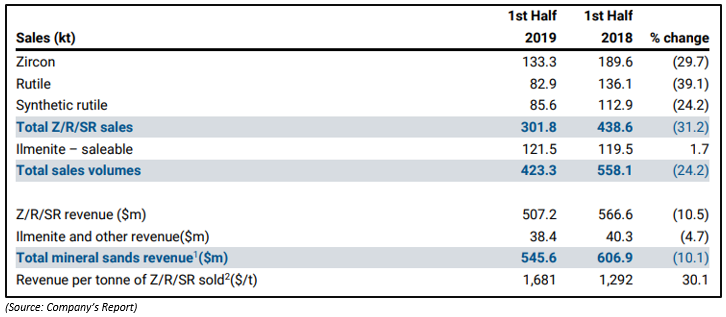

The company sales declined across all the major products, which in turn, exerted pressure on the revenues as well.

The zircon sales of the company stood at 133.3k tonnes in 1H FY2019, down by 29.7 per cent against the previous corresponding period (or pcp) zircon sales of 189.6k tonnes.

Likewise, the rutile sales reduced by 39.1 per cent to stand at 82.9k tonnes in 1H FY2019, and the synthetic sales declined by 24.2 per cent to stand at 85.6k tonnes.

The decline in sales exerted pressure on the mineral sandsâ revenue, which stood at $545.6 million in 1H FY2019, down by 10.1 per cent as compared to the mineral sandsâ revenue of $606.9 million in 1H FY2018.

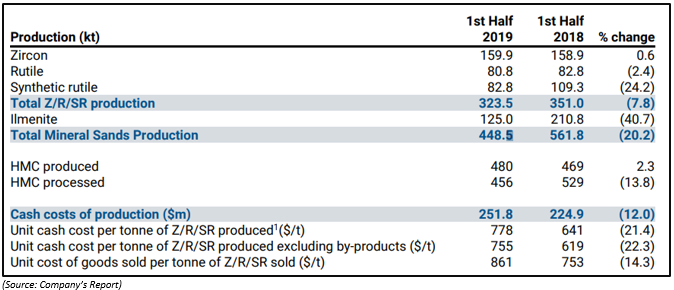

Production:

Along with a decline in sales, ILU witnessed a decline in majority of mineral sands production as well.

Dividend and Key Ratios:

ILU declared a fully franked dividend of 5 cents per share in 1H FY2019, which was 50 per cent lower than the interim dividend of 10 cents a share paid by the company in 1H FY2018.

The shares of the company last traded at A$7.530 (22 August 2019).

Mineral Resources Limited (ASX: MIN)

MIN entered into a binding head of agreement over the purchase of assets that comprise the Parker Range Project in the Yilgarn region. The company entered into a contract with a wholly-owned subsidiary of ASX-listed Cazaly Resources- Cazaly Iron Pty Ltd.

The heads of agreement remain subject to the completion of 21 days due diligence period by MRL, and upon completion, MRL would pay Cazaly Iron Pty Ltd A$20 million.

The shares of the company last traded at A$13.360 (22 August 2019).

New Hope Corporation Limited (ASX: NHC)

NHC in a recent update mentioned that previously the company and its subsidiaries received a declaration, which stated that the company was not bounded by a Deed of Cross Guarantee.

The company received the declaration after the proceedings brought against Wiggins Island Coal Export Terminal Pty Ltd (or WICET) and others in the New South Wales Supreme Court.

However, on 20 August 2019, WICET filed an appeal with the Court of Appeal in NSW against the Supreme Court verdict.

In the notification to the public, NHC mentioned that the company would provide further updates related to the appeal in due course.

The shares of the company last traded at A$2.190 (22 August 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.