Highlights

- Saunders has ended FY22 on a positive note with record revenue and earnings.

- FY22 revenue was up 28% and NPAT went up by 18.2%.

- The company has announced a final dividend of 2 cents per share.

- SND reported an order book of A$192.89 million with tender and pipeline projects valued at around A$1.31 billion at the FY22 end.

Saunders International Limited (ASX:SND) has recorded another year of robust growth. The multi-disciplined engineering and construction company registered a record revenue of A$129.95 million for the year ended 30 June 2022. The company’s revenue grew by 28% year-on-year, while NPAT increased by 18.2% to A$6.5 million.

The results highlight solid financial metrics for SND on the back of larger project activity in FY22, which is expected to continue into the current financial year.

For more details on SND, read here.

Record revenue, increased earnings, and largest contract in SND history

“With the combination of a disciplined approach to risk management at the tender stage and exceptional project execution, the company has continued to improve earnings over the last three years”, said CEO Mark Benson.

He added that strong profits to cash conversion and health of the balance sheet complemented the successful outcomes.

FY22 Performance (Data source: SND update, 25 August 2022)

Saunders attributed its robust FY22 performance to the efficient operational execution of projects and growth opportunities across the market segments in which the company operates.

Despite the impact of weather conditions, floodings across NSW, the COVID-19 pandemic and logistics-related challenges, particularly on the infrastructure services, the company has delivered record growth in revenue and profits.

Furthermore, in FY22 the company secured the largest contract in its history. The Darwin project is on track for timely completion, with all main subcontracts for the tank construction phase now in place. The project is 31% completed, with the balance of plant works packages being issued in the coming months.

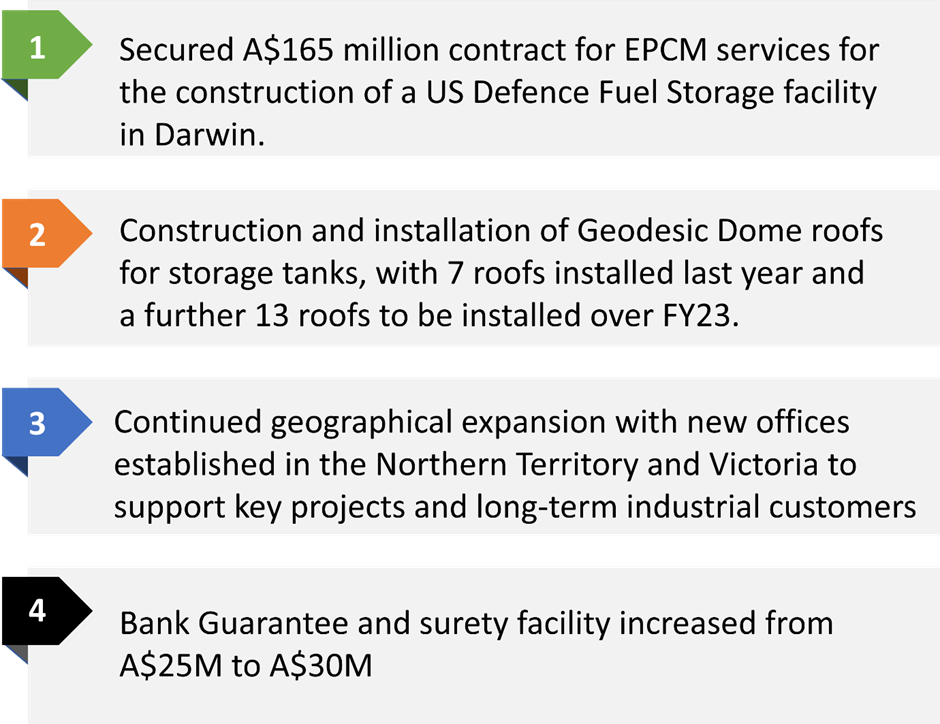

Key highlights in FY22 (Data source: SND update, 25 August 2022

Successful performance paves the way for dividend payout

Following the strong financial results, the Board of SND declared a final dividend of 1.00 cent and a special dividend of 1.00 cent per share, bringing the total dividend for FY22 to 3.00 cents per share, fully franked.

The record date is 13 September 2022, and the payment will be made on 10 October 2022.

Saunders anticipating the next exciting phase of growth

Saunders has entered the new fiscal year with a solid operational foundation and continued focus on its revised strategic initiatives. “The company is in an advantageous position to capitalise on opportunities in all the sectors it serves”, noted Benson.

Work-in-hand at the end of 30 June 2022 is noted at A$192.89 million, 133% up from FY21.

The company reported that the value of live tenders stood at around A$482 million as at

30 June 2022. The pipeline, which is yet to be tendered, is reported to be around A$827 million. These numbers represent both new and current clients, indicating that the company is well-positioned for significant near-term opportunities.

Saunders revised its strategic plan to place emphasis on pursuing initiatives that are specifically designed to promote medium- to long-term growth. This includes strengthening the company’s engagement in the infrastructure, oil & gas, and defence industries, while developing its competencies in the New Energy sector.

To achieve its strategic goals, the company has engaged key project delivery personnel and is continually improving the effectiveness of its systems and processes.

“Our resilient and hard-working teams is the reason Saunders has sustained its growth trajectory in unprecedented times”, said Benson.

SND shares were trading at A$1.085 midday on 29 August 2022.