Highlights

- Saunders commenced FY22 with a contract of AU$10 million for infrastructure projects.

- Crowley’s defence contract worth AU$165 million is the largest in the company’s history.

- During the March 2022 quarter, SND secured AU$17 million in infrastructure projects in the NSW region.

With the end of FY22, the reporting period will commence shortly for ASX-listed companies. Australia-based engineering & construction company Saunders International Limited (ASX:SND) had one of the busiest years in recent times. The company secured high-value projects catering to the defence and civil sectors during the reported period.

Moreover, the company gained a preferred contractor status in several projects and applied for number of tenders.

These projects are expected to underpin the company’s revenue and earnings in FY22 through FY23. The company has provided revenue guidance of AU$115-130 million with EBIT guidance in the range of 6.5-7.5% for FY22.

Commencing the year with contracts worth AU$10 million

Saunders commenced FY22 with a bang. The company won contracts in the New South Wales region for AU$10 million.

One of the projects from a local government authority was for the design and construction of a 3-span concrete bridge in the Hunter Region. Another contract focused on a major bridge replacement project, entailing the manufacturing of 77 Super-T precast concrete beams. The third contract was awarded by a private contractor to build precast concrete rail supports and components.

These projects contributed to Sanders’ revenue stream from Q1 to Q4 of the financial year ended 30 June 2022.

AU$165 million defence contract – largest in SND history

Saunders secured a design and build contract worth AU$165 million for 11 fuel tanks from Crowley.

Under the contract from the US Defence Logistics Agency to Crowley, the company will also provide engineering, procurement and construction management (EPCM) solutions.

Expected to generate 400 employment opportunities in construction, the project will be the largest storage facility for fuels in the Northern Territory region.

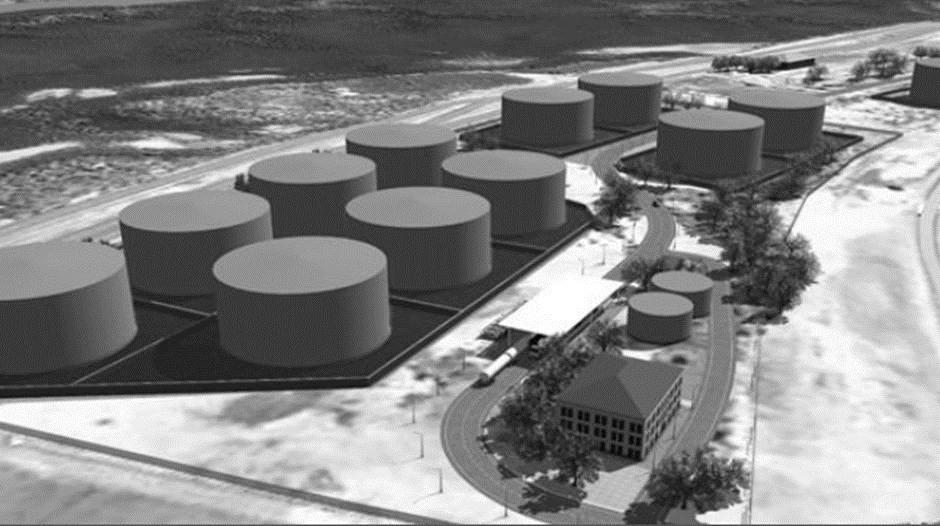

Conceptual design of the fuel tank farm (Image source: Company Presentation)

Infra project contracts worth AU$17 million

In March 2022, Saunders announced new contracts for infrastructure projects. The AU$17 million contracts included the following

- Construction of a 4-span, 45m bridge, including approach road construction in the Port Macquarie region.

- Design and construction of a 52m-long bridge in the Narrabri region.

- Manufacturing and delivery of 166 Super-T bridge girders for four bridges for the Sydney Gateway Project.

These projects will generate revenue and earnings from Q3 of FY22 through FY23.

These contracts highlight the company’s strategy to tap federal and state government infrastructure projects. Moreover, the developments demonstrate the company’s abilities to execute projects in the infrastructure and defence sectors while maintaining strong relationships with key customers.

SND shares traded at AU$1.02 on 15 July 2022.