Highlights

- Lithium Australia achieved significant milestones during the March quarter, advancing to create a circular battery economy.

- LIT’s subsidiary VSPC appointed Lycopodiumto provide engineering services to advance the DFS for its LFP production plant.

- Envirostream posted revenue of AU$560,000 during the March quarter.

- The Company completed pre-commissioning of the autoclave for the LieNA® pilot plant.

- LIT reported a strong financial position at the end of the reported period.

Lithium Australia NL (ASX:LIT) is actively pursuing exciting opportunities to achieve its goal of ensuring an ethical supply of energy metals to the battery industry. The Company is committed to creating a circular battery economy to increase sustainability and resource security.

LIT recently released its March quarter report, shedding light on significant activities and advanced initiatives for the period ended 31 March 2022.

The Company reported a cash reserve of AU$8.0 million at March end with no debt. Moreover, LIT held investments worth AU$9.8 million in Australian- and Canadian-listed

Shares.

VSPC advances DFS for LFP production unit

During the reported period, LIT’s fully owned subsidiary VSPC engaged Lycopodium Minerals Pty Ltd to provide consulting engineering services to advance the Definitive Feasibility Study (DFS) for its planned lithium ferro phosphate (LFP) manufacturing unit.

Also read: Lithium Australia (ASX:LIT) ropes in Lycopodium to drive DFS for LFP manufacturing facility

VSPC, which operates an R&D facility, specialises in the research and production of high-purity battery materials. The Company is focused on the production of LFP and LMFP (lithium manganese ferro phosphate) cathode powders.

VSPC plans to set up a pre-qualification pilot plant close to its R&D facility in Brisbane, while the commercial LFP plant will be located in North America. As there is no commercial LFP plant operational in the US currently, VSPC expects this opportunity to provide a first-mover advantage.

Additionally, VSPC filed for an international patent for ‘Production of iron (II) oxalate’ during the reported period. Also, it received a Deed of Letter of Patent for the ‘Method for producing fine-grained particles’ from the European Patent Office.

Related read: Lithium Australia welcomes VSPC’s move to join R&D for next-gen lithium batteries

LIT now owns 100% of Envirostream

Subsequent to the March quarter, LIT increased its stake to 100% in Envirostream.

Envirostream registered a 20% quarter-on-quarter jump in revenue to AU$560,000 during the March quarter. The subsidiary also commissioned its newly permitted site at Laverton, which can increase the processing volume of spent batteries.

Envirostream received results from field trials for recycled battery material micronutrients during the reported period. The results confirmed that the uptake of manganese from its products was similar to those for commercial blends and compounds at similar dose rates.

Envirostream continues to engage with fertiliser manufacturers and suppliers to progress the commercialisation of its micronutrient products.

Read more: Lithium Australia (ASX:LIT) consolidates stake to 100% in Envirostream

Pre-commissioning work completed on LieNA®

During the March quarter, LIT, along with ANSTO, completed the assembly of the final component required for the construction and commissioning of the LieNA® pilot plant. LieNA® has the potential to expand current hard-rock lithium resources as it can refine low-grade spodumene to produce high-purity lithium chemicals.

LIT also received a patent from IP Australia for ‘Caustic conversion process’, which has been named LieNA® Generation 2.

Related read: How is Lithium Australia (ASX:LIT) making a strong mark in battery space?

Data source: LIT update, 29 April 2022,

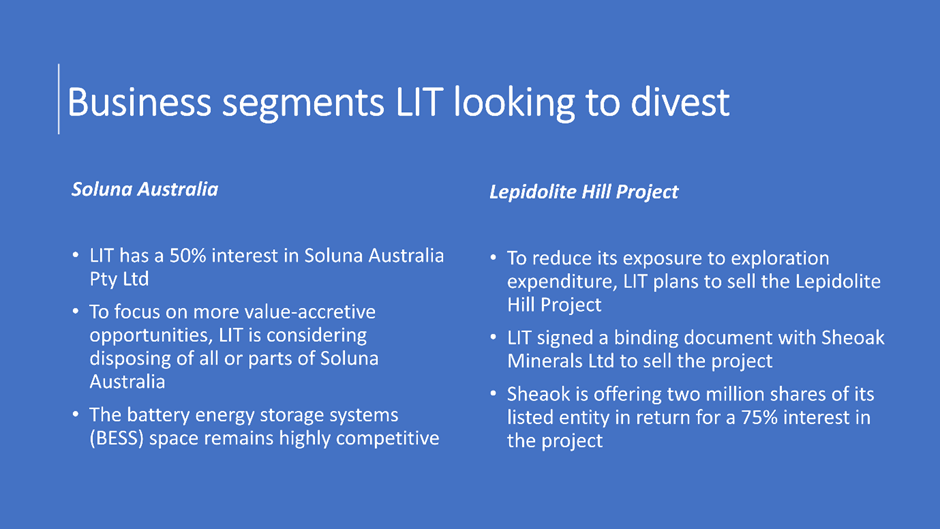

Note: The Lepidolite Hill transaction remains subject to certain conditions precedent including ASX approvals

LIT shares were trading at AU$0.102 midday on 29 April 2022.