Summary

- IOUpay Limited has secured a Malaysian Money Lending Licence, required to comply with various legislations governing BNPL services.

- The Licence has been obtained through the acquisition of Sibu Kurnia Marine Sdn Bhd, an authorised moneylending entity.

- IOU looks forward to expediting its plans to tap the significant market opportunities across the BNPL and digital space.

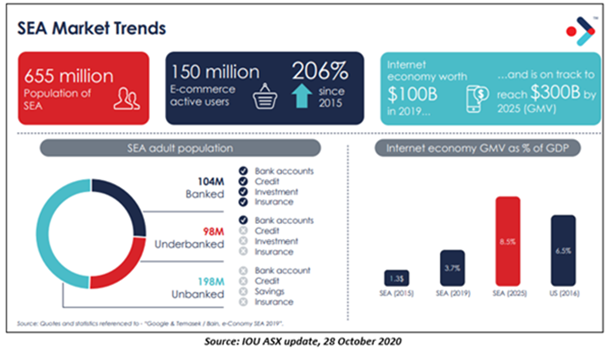

Fintech player IOUpay Limited (ASX:IOU) has achieved a key milestone, moving further towards its goal of becoming one of the leading digital transaction processors in the booming cashless economies of Southeast Asia.

In line with the booming market opportunities in the Southeast Asian region, the Company has been bagging agreements and entering partnerships to boost its offerings.

INTERESTING READ: IOUpay Limited (ASX:IOU) eyes dominance in SEA Digital Payment Market

IOU Secures Malaysian Money Lending Licence

Latest in the string of developments is the acquisition of a Malaysian Money Lending Licence, which would enable the Company to offer its Buy-Now-Pay-Later (BNPL) service offerings to merchants as well as consumers in Malaysia.

The Licence declares the compliance of IOU’s BNPL offering with Money Lending Act 1951 (MA1951 Licence) and Financial Services Act 2013 of Malaysia.

The Company has secured the MA1951 Licence through the acquisition of 100% of the ordinary shares in MA1951 Licence-holder Sibu Kurnia Marine Sdn Bhd (SKM) in exchange for $1,375,000.

IMPORTANT READ: IOUpay (ASX:IOU) in Catbird Seat to Cash In on Digital Payments Boom

For the process, IOU consulted with two autonomous valuation experts and gathered formal valuation reports. These reports included various valuation methodologies as well as other qualitative and quantitative analyses. All these were undertaken by the experts with a view to determine an equity valuation of SKM.

Thus, this information laid the foundation of the investment valuation and concluded the equity value of SKM on a controlling and non-marketable interest during the negotiation.

INTERESTING READ: Get Acquainted with High-Calibre Leadership Team at IOUpay Limited

IOU Expediting Activities To Remain Ahead Of Schedule

Pleasingly, both the reports delivered values beyond the final agreed consideration, and the conclusion of this acquisition marks a notable milestone in the Company’s plan.

IOUpay has achieved this crucial milestone ahead of schedule. This enables the Company to expedite its plans to tap the significant market opportunities across the digital payments and BNPL space.

DID YOU READ: IOUpay (ASX:IOU) Going Great Guns in Malaysia

Chairman of IOUpay Lee Chin Wee stated:

With the grant of the MA1951 licence, IOU would be able to provide BNPL as well as consumer loan facilities in Malaysia.

IOU intends to finance the acquisition of the authorised moneylending entity, SKM, through its existing cash reserves.

DID YOU READ: IOUpay (ASX:IOU) Weathers COVID-19 Storm With A Slew Of Milestones

IOU share price closed at $0.175 on 19 January 2021 with a market capitalisation of $78.83 million.

.jpg)