Highlights

- Renegade Resources has significant exposure to copper and gold projects in Queensland.

- The company’s aims to remain flexible to explore new opportunities whenever available.

- RNX is currently engaged in the exploration of the North Isa Project and has rights to own a 75% interest in the project.

An Australian based minerals exploration and development company Renegade Exploration Limited (ASX:RNX) is making significant progress at its North Isa Project in Queensland. Renegade had signed an option agreement with Burke Copper in December 2021 to acquire up to a 75% stake in the project.

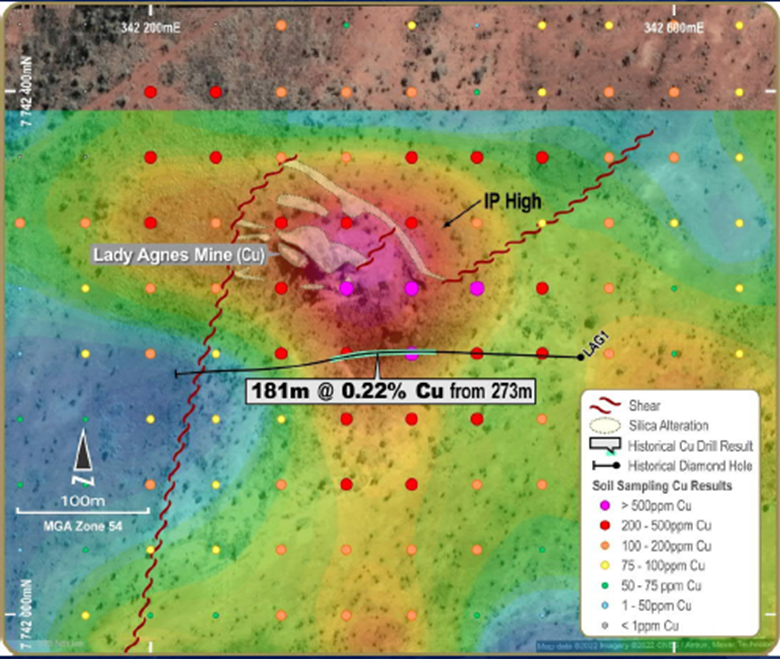

Renegade recently completed an RC drilling program over Lady Agnes, one of the North Isa Project prospects, to test the extent of copper oxidation and the historically induced polarisation (IP) anomaly on the prospect. A total of 1,234m of drilling was completed over the prospect to test the oxide and sulphide target zones.

Lady Agnes target (Image source: Company update)

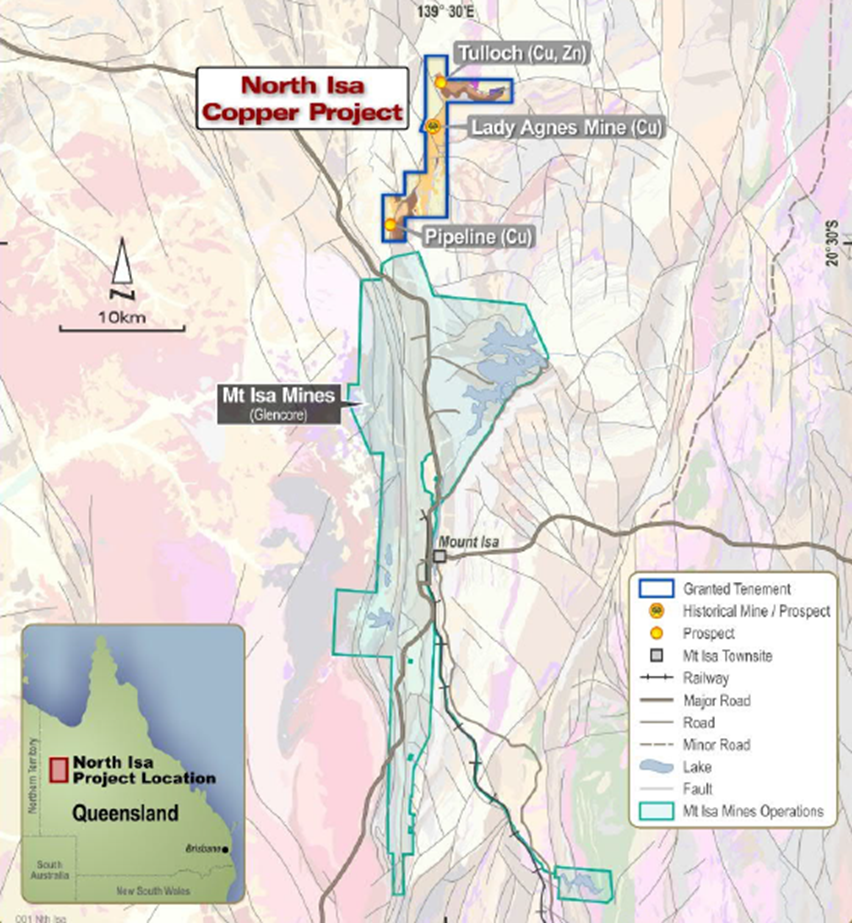

The North Isa Project is in a copper-rich zone. Post signing the JV with Burke Copper Pty Ltd Renegade has conducted extensive field operations to delineate copper targets for a subsequent exploration program.

Tulloch and Pipeline are two other prospects that are part of RNX’s exploration activities over the North Isa Project. In this piece, we will try to evaluate factors that are acting in favour of the company.

1. Copper and gold exposure

Renegade believes that a favourable market exists for copper and gold. Strong demand from the EV sector and increased electrification efforts are expected to keep copper demand high. Also, there has been no significant resource discovery in copper exploration in recent times.

Gold, on the other hand, is considered a safe investment destination and hedge against economic uncertainty and inflation. Renegade has good exposure to these two metals.

2. Strategic divestments

Renegade divested its Yandal East Gold Project to Strickland Metals (ASX:STK). The deal fetched considerable cash proceeds along with 40 million shares of STK. Renegade will also receive 0.5% smelter royalty for any commodity mined from the project.

Similarly, the company has maintained exposure to base metals through 1% smelter royalty from the sale of the Yukon Base Metal Project, apart from the cash consideration of AU$1.65 million.

The cash component from the sales will be used to deploy in new projects.

3. Agile Strategy

Renegade strives to deliver long-term shareholder value through acquisition, discovery and development of mineral deposits. The Company has grown itself into a lean and flexible organisation to quickly respond to new opportunities. The Company’s short-term goal includes the discovery of additional resources through exploration while creating new opportunities.

4. Tier-1 mining jurisdiction

The company operates two exploration projects in Queensland region. Queensland is one Australia’s prominent mining jurisdictions that houses several major mining projects.

Renegade has exposure to the Mt Isa Project and has the rights to acquire up to 75% interest in the project. The project is operated in JV with Burke Copper. In the Carpentaria JV Project, RNX works in a JV with Glencore’s subsidiary Mt Isa Mines Ltd in which it owns 23% interest.

Location map of North Isa Project (Image source: Company update)

5. Experienced Board and Management

RNX’s Board and management have extensive experience in the global resource industry. The combined commercial and technical knowledge of the Board is driving the company on the high growth path.

Bottom line: Favorable tailwinds

The demand for copper is expected to remain moderate in the long-term as it is one of the commodities that is vital for economic growth. Renegade is focused to play an important role in the copper supply chain in the coming times.