Highlights

- Calima has a current average daily production of ~4,100 boe/d.

- The Gemini #8 and #9 wells drilled in the Brooks area are undergoing clean-up operations.

- The Pisces #5 well is set for completion and fracture stimulation.

- Previously announced dividend is expected in the form of capital distribution.

- The company is working on the December quarter drilling program.

ASX-listed oil & gas company Calima Energy Limited (ASX:CE1|OTCQB:CLMEF) is going full steam ahead across its Canadian project portfolio to boost its current daily production of ~4,100 boe/d.

Calima’s recently drilled assets in the Brooks area – the Gemini #8 and Gemini #9 wells – have joined the production stream. The wells are undergoing a clean-up operation, which is expected to take 30 days.

Triggered by the update, CE1 shares jumped by 10% to trade at AU$0.165 apiece on the ASX during the early hours of trading on 11 July 2022.

Other two wells – Pisces #4 & #5 – have also been drilled and are currently awaiting a fracking operation. The wells will undergo fracture simulation to bring them to production. Calima owns a 50% working interest in Pisces #5, which was spudded in early July 2022. The well has been drilled to a total depth (TD) of 1,420m with horizontal section drilled into the pay zone.

Calima has also updated on the Leo #4 well, which was drilled in January this year in the Thorsby area. A tie-in operation is underway on the well, and production testing is expected to commence soon.

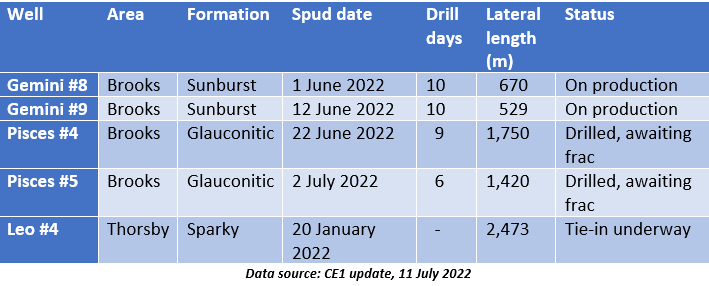

Drilling summary

Commenting on the developments, Mr Jordan Kevol, CEO and President of CE1, said, “Gemini #8 and #9 are now on production and cleaning up adding to revenue. Pisces #4 and #5 are now ready for fracture stimulations to be completed and are expected to be on production and adding to August revenue. We expect to be able to test Leo #4 in the next 2 weeks. All up the Company is very happy with the progress of this quarters activities and we are now working on the December quarter drilling program.”

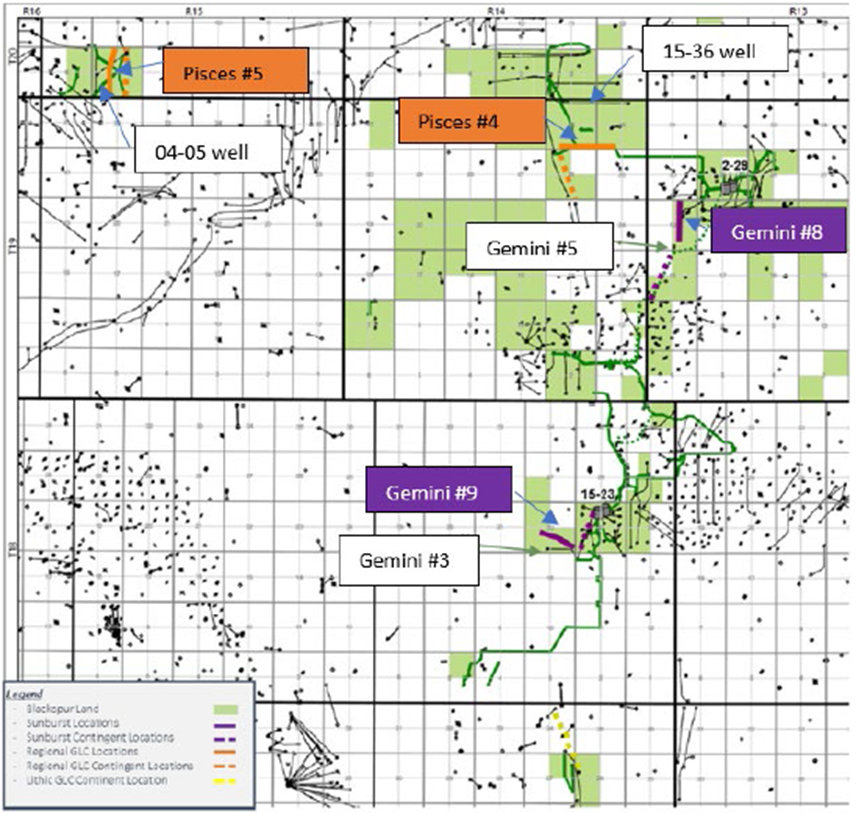

Image source: CE1 update, 4 July 2022

Calima to kick off dividend payments

In May, Calima unveiled its plans to commence a dividend program for its shareholders. The company intends to pay AU$2.5 million as dividends under the program starting in the second half of 2022.

CE1 has determined that the dividend will be paid in the form of capital distribution, which requires shareholder approval. Meanwhile, the company is in the process of preparing a Notice of Meeting.