Highlights

- 88 Energy has unveiled a maiden resource estimate of 1.03 billion barrels for its Project Icewine East.

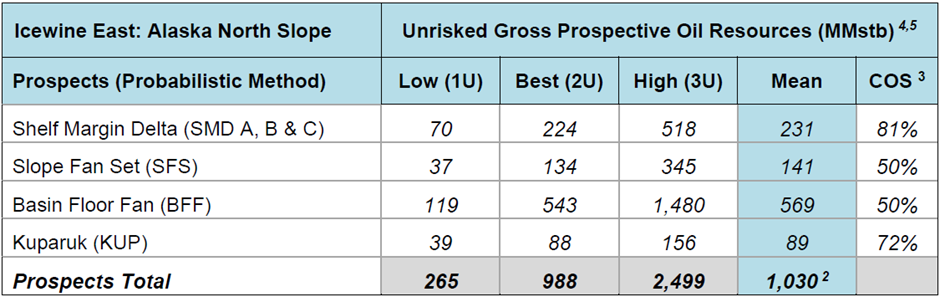

- Significant prospective resources awarded across all mapped play fairways, in particular the Seabee – Lower Basin Floor and Shelf Margin Delta reservoirs.

- 88E plans to drill an exploration well to prove up the resource in 2023.

Alaska-focused oil explorer 88 Energy Limited (ASX:88E) is going from strength to strength at its Project Icewine East, following an independent resource assessment announcement yesterday.

In an upbeat market update, the company announced an enormous 1.03 billion barrels of Gross Mean Prospective Resource of oil, recoverable from multiple reservoirs, for the project.

The maiden Independent Prospective Resource estimate report has been prepared by US-based Lee Keeling and Associates, Inc., an independent expert petroleum and engineering firm. To assess the resource potential of the area, an extensive data review was performed across many geoscience disciplines, including in-depth geophysical and petrophysical analysis to name a few.

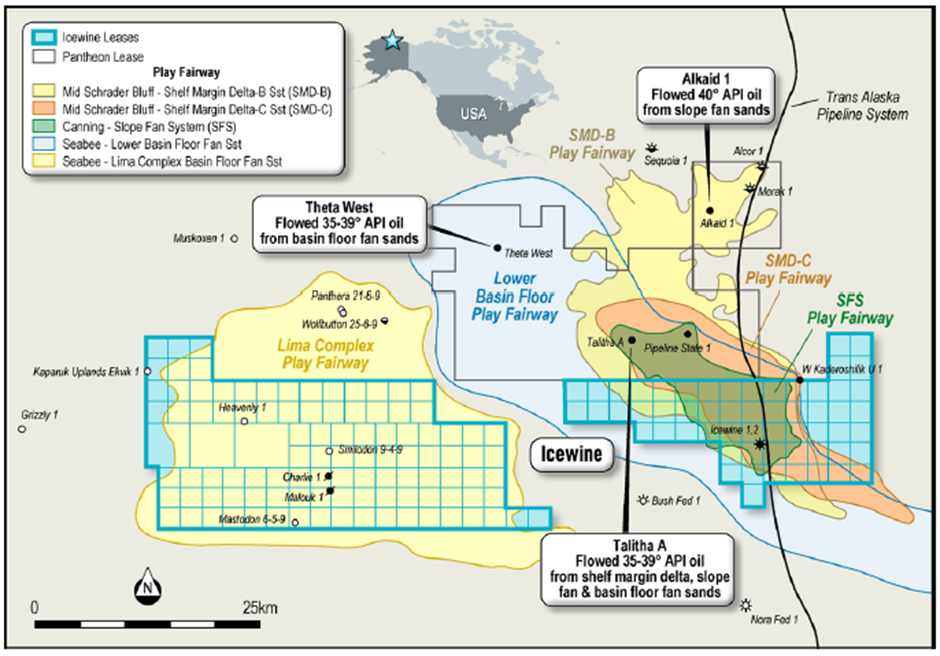

Project map of Icewine (Image source: 88E update, 10 August 2022)

To know more about the Project Icewine East, click here.

88E to unlock significant upside potential of Icewine East acreage

88 Energy was successful in the award of significant prospective resources across all the recently mapped Shelf Margin Delta, Slope Fan System, Basin Floor Fan and Kuparuk play fairways on the acreage. These plays were correlated with the Brookian/Beaufortian reservoirs tested by Pantheon.

The nearby Pantheon wells, Alkaid-1, Talitha-A and Theta West-1, are known to have oil flow of 350 to 400 API gravity, a light and sweet oil (low sulphur).

The well test results from the adjacent Pantheon wells are highly positive according to 88 Energy and significantly boost the prospectivity and chance of success (COS) in its acreage.

Data source: 88E update, 10 August 2022

88 Energy’s Managing Director Mr Ashley Gilbert highlighted that the Icewine East acreage has been considerably de-risked by the recent drilling and flow tests on the Pantheon wells. The data set from the Icewine-1 well and the recently leased Franklin Bluffs 3D data set support the prospectivity of the Icewine East acreage and boost confidence to unlock the potential of the acreage, Gilbert added.

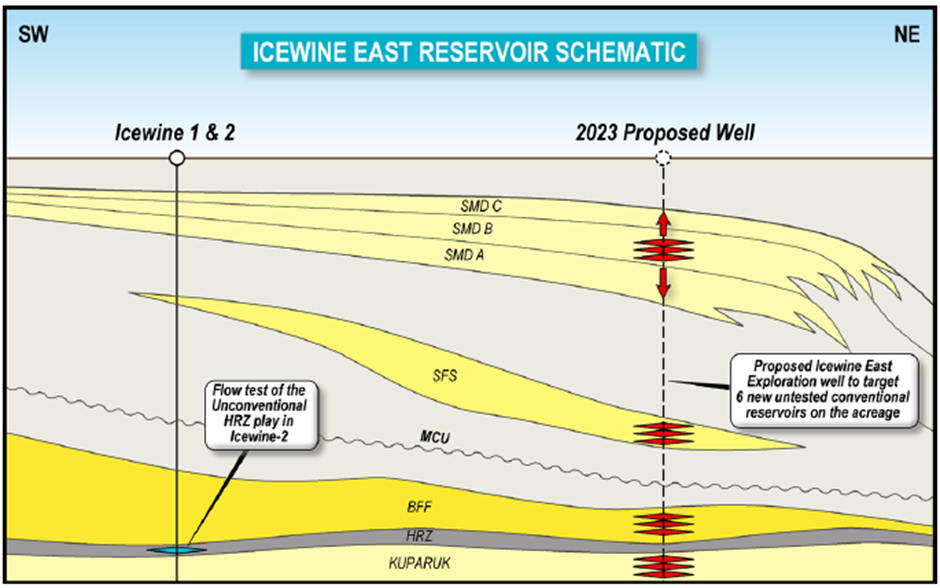

88E is currently engaged in the full interpretation of the leased Franklin Bluffs 3D data, including the AVO analysis. This will aid in identifying the ‘sweet spots’ for each play and determining the optimal future exploration and appraisal drilling well locations on the acreage.

Prospective Resources Estimate for Icewine East

88 Energy holds a 75.227% working interest in the project, which is located on the central North Slope of Alaska and covers an area of 185,320 net acres.

The resource estimate at Icewine East was concluded during Q3 of 2022.

Resource estimate at Icewine East on a 100% basis (Image source: 88E update, 10 August 2022)

88E plans to drill an exploration well on the acreage in 2023, based on the data interpretation of the leased Franklin Bluff 3D and AVO analysis.

Image source: 88E update, 10 August 2022

88E shares last traded at AU$0.011 on 9 August 2022.