Highlights

- 88 Energy has gained access to crucial seismic data for the Project Icewine East leases.

- The FB3D data is expected to aid in determining optimal future exploration and appraisal drilling locations.

- The company plans to drill a new exploration well in 2023.

- 88E has reported over 70% increase in Project Longhorn production since its acquisition.

88 Energy Limited (ASX:88E) has released crucial updates related to its Icewine East and Longhorn projects.

The company has secured access to seismic data that will help in determining suitable drilling locations for upcoming exploration and appraisal wells at the Icewine East project.

Moreover, there has been a considerable increase in production from the Project Longhorn conventional oil & gas production assets.

RELATED ARTICLE: 88 Energy (ASX:88E) confirms positive outcomes via third-party mapping of Project Icewine

Seismic data for Icewine East

88E has inked a licensing agreement with SAExploration, Inc. for the use of Franklin Bluffs 3D seismic survey data (FB3D). The initial licence fee includes as part payment US$1.0 million in fully paid new ordinary shares in 88E (the issuance of 181 million new shares at AU$0.008 per share).

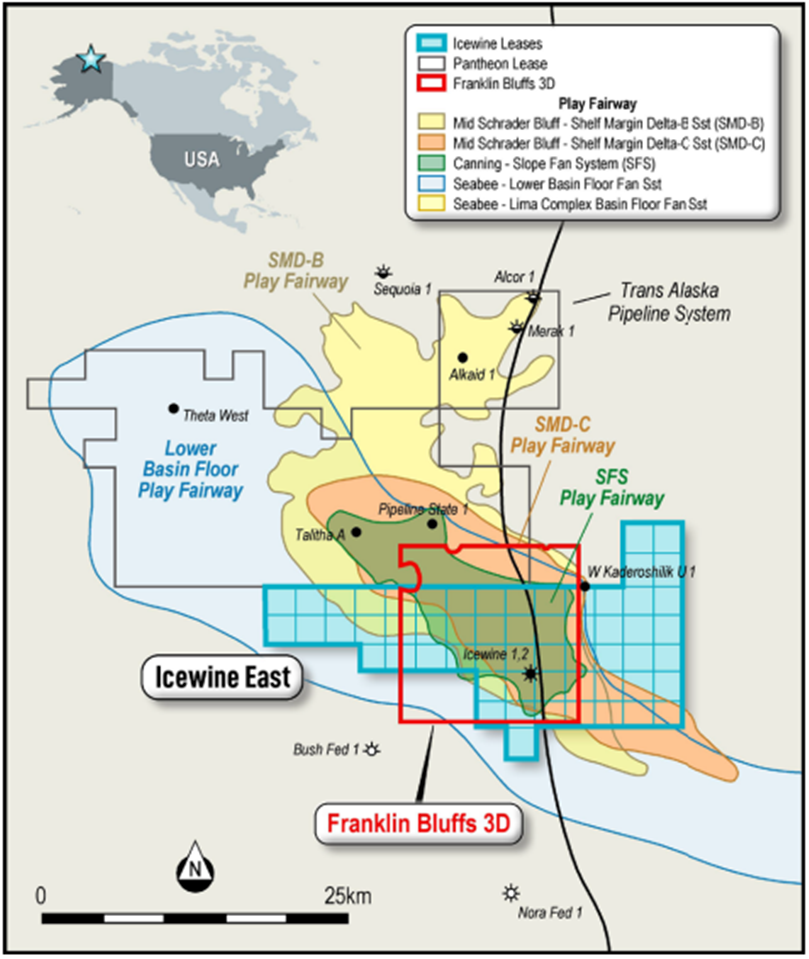

The data covers ~86 square miles and extends over the eastern section of the project where the Shelf Margin Delta (SMD), Slope Fan Set (SFS) and Basin Floor Fan (BFF) play fairways have been independently mapped.

The FB3D data will help in upcoming analysis and review, covering Amplitude-variation-with-offset analysis (AVO Analysis) and simultaneous seismic inversion, in defining suitable targets for each play and therefore finalising optimal drilling locations for upcoming exploration and appraisal wells.

Moreover, the data will be used to secure prospective farm-out partners for due diligence program.

Source: 88E Announcement 27/06/22

RELATED ARTICLE: A snapshot of 88 Energy’s (ASX:88E) March quarter activities across 4 key projects

Exploration work planned for 2023

88E is currently engaged in finalising plans for 2023, including the drilling of an exploration well over the Icewine East acreage and a minimum of one flow test from several Brookian reservoirs mapped on the project. These reservoirs are the same reservoirs that are nearby Pantheon wells, including Alkaid-1, Talitha-A and Theta West-1, and have flowed 35⁰ to 40⁰ API oil.

Moreover, 88E is continuing with its planned farm-out of the Icewine East acreage.

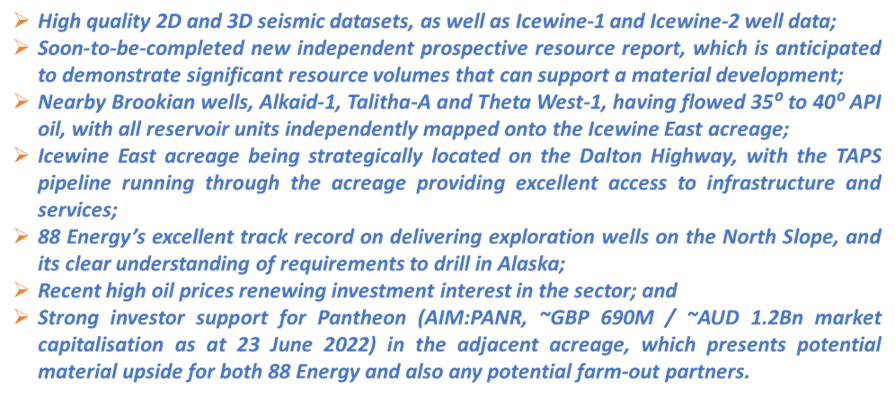

Extensive dataset and track record that significantly de-risks the Icewine East acreage

(Source: 88E Announcement 27/06/2022)

RELATED ARTICLE: 88 Energy (ASX:88E) riding high on Project Icewine update

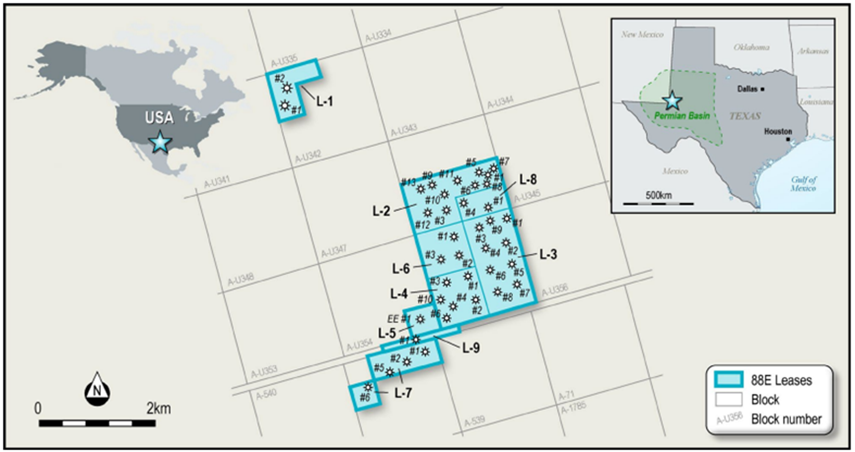

Project Longhorn sees elevated production rates

88E has reported the successful completion of the first three of seven planned capital-efficient workovers on time and on budget at the Project Longhorn. The workovers have delivered substantial growth to the total oil & gas production rates of the project.

Subsequent to the finalisation of the third workover at the end of May, the production surpassed 650 BOE per day gross at initial production rates.

Source: 88E Announcement 12/04/22

In July, 88E expects the daily production rates to settle at approximately 500 BOE per day gross, indicating approximately 70% jump in production since the acquisition in mid-February this year.

The elevated production offers further exposure to higher WTI oil and gas price environment and fast tracks payback on the asset acquisition as well as capital investment in the workovers.

Four planned workovers at Project Longhorn

The joint venture participants at the Project Longhorn have agreed to expedite the outstanding four planned workovers.

Furthermore, 88E has also agreed to partly finance its share of the expected US$3.5 million in development capital through the issue of US$3.0 million in 88E shares to Lonestar I, LLC. The funds will be used for working capital contributions of Longhorn towards the remaining CY222 capital development program.

The targeted seven capital development activities at the project are expected to be concluded earlier than planned in Q4 2022.

88E shares traded at AU$0.008 midday on 27 June 2022.