Nova Minerals Limited (ASX: NVA)

On 21 June 2019, Nova Minerals Limited (ASX: NVA) announced the commencement of drilling after the successful and ongoing Induced Polarisation (IP) geophysical survey works at the Oxide prospect on the Estelle Gold Project. Reportedly, to expand the projectâs exploration footprint, the surface sampling and mapping program would commence by early July at RPM and Shoeshine prospects.

Earlier, in 2018, Nova organised a mapping campaign conducted by the Pacific Rim Geological Consulting of Fairbanks Alaska, which verified that higher gold values are associated with bismuth telluride and arsenopyrite mineral phases (mineralogy); this mineralogy is hosted by quartz veins containing narrow alteration selvages.

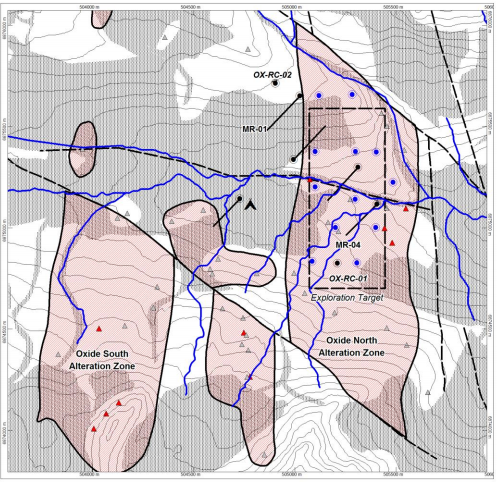

Planned Phase 1 Drill Hole (Blue Dots) (Source: Companyâs Announcement)

As per the release, given last yearâs field season, Mr Tom Bundtzen of Pacific Rim Geological Consulting Inc. identified two high-quality targets while completing a first pass geological mapping of the Oxide occurrences. Importantly, the identified targets comprise of wider envelopes that contain argillic-phyllic to propylitic hydrothermal alteration; these targets were given destinations as Oxide North and Oxide south. Furthermore, Mr Bundtzen collected chip samples, which returned the grades of up to 1.04 g/t Gold having an average grade of 0.183 g/t Gold. It was reported in March 2019, that the Oxide North and Oxide South are located 1300 to 1600 metres along the strike, and width is in the range of 550 to 600 metres while the depth is unknown at this time.

Nova Minerals asserted that the exploration âProject Pipelineâ process would be used for exploration strategy to maximise the chances of multiple major discoveries; it defines a specific deliverable for each milestone along with a criterion, which needs to be ticked to determine to the prospectâs move before a new milestone.

Outlook

Reportedly, sampling and mapping at RPM and Shoeshine would commence in July while drilling work has begun, and IP survey is ongoing on it. Nova Minerals also mentioned that the project had surpassed the previous expectations of the team, and the company would update shareholders on the progress of the project.

By the end of the trading session, on 21 June 2019, the stock of Nova Minerals closed flat at A$0.022, from the previous close. The performance of the stock in the past one year is -29.03% while its year-to-date return is positive 10%. In the past three months and one month, the return of the stock is +46.67% and +37.50%, respectively.

AIC Mines Limited (ASX: A1M)

On 21 June 2019, AIC Mines Limited (ASX: A1M) announced the results from the 100% owned 4G Hill Prospect at the Marymia Exploration Project in Western Australia. Reportedly, four shallow costeans were mined across the 4G Hill gossan, which was recognised by soil sampling and rock chip sampling. Also, rock chip sample assay results of 387 g/t gold and 230 g/t gold (high-grade) had been reported from the 4G Hill gossan.

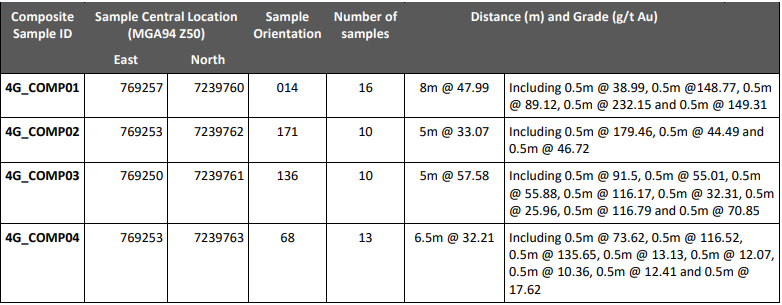

AIC Mines collected four composite samples across the exposed gossan surface, which returned the below samples in the table:

Composite Samples (Source: Companyâs Announcement)

AIC Mines also collected rock chip samples from the four costeans at 1 metre intervals; these samples also reflected high-grade gold results where the gossan intercepted a maximum result of 85.85g/t gold.

It is reported that the exposed 4G Hill gossan is highly ferruginous and shattered quartz vein up to 0.5m thick, formed with a flexure in an iron ore coarse gritty sandstone unit. Host rocks are Sedimentary Iron Formations (SIF), which are part of Copper Hills Schist Belt located along with the northern margin of the Archean Marymia Inlier. Nova believes that the source of gold is not understood yet, and there has been limited gold exploration including, SIF units, which can be traced for over 30 kilometres.

AIC Mines asserted results are promising and clearly warrant follow up. Currently, a detailed interpretation of the airborne magnetic survey is underway to determine the possible structural controls on the location of mineralisation; the interpretation would be utilised while planning the RC drilling program.

AIC Mines Limited operates its 100% owned Marymia Project, which is located 1,200 km NE of Perth in Yilgarn Craton, the project is a prospect for gold and copper mineralisation, along with strategic location within trucking from the Plutonic gold mine and the Degrussa copper mine. The company conducted regional mapping, regional geophysical and geochemical surveys to discover new mineral resources.

On 21 June 2019, the stock of AIC Mines last traded at A$0.380, up by 16.923% from the previous close. The performance of the stock in the past one year is +33.46 with a year-to-date return of +13.69%. The returns in the past one month and three months are -4.41% and -7.14%, respectively.

Empire Energy Group Limited (ASX: EEG)

On 20 June 2019, Empire Energy Group Limited (ASX: EEG) requested ASX to place the securities of the company on a trading halt due to a pending announcement. Today (on 21 June 2019) Empire Energy released an announcement regarding the sale of its Kansas Assets for US$19.1 million.

Reportedly, Empire Energy has entered into a Purchase and Sale Agreement (PSA) with Mai Oil Operations Inc. (Mai Oil) for the sale of Kansas Assets. Mainly, the sale proceeds would be utilised to reduce the debt of the company to maximum gross debt balance of US$8 million, rest proportion would be utilised for working capital and to promote investment in the Northern Territory shale assets. Empire Energy is expecting to complete the sale process in Q3 2019.

According to the release, the sale would allow Empire to achieve a cash flow positive production from the New York State and Pennsylvania (Appalachia) gas assets, and improvement of the Marcellus Shale and Utica Shale rights in New York State. Also, a competitive tender process with interested parties in Australia and the USA, and the appraisal of expression of interest from multiple parties was completed prior to the execution of PSA.

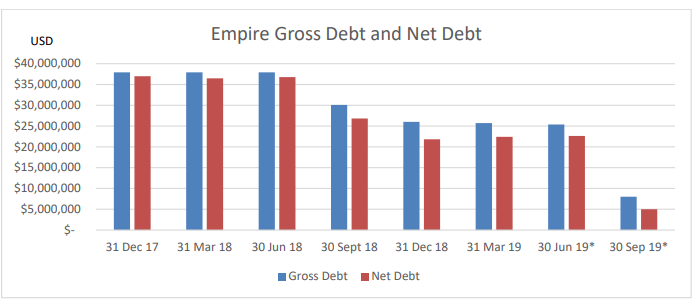

Debt Reduction (Source: Companyâs Announcement)

Cashflow Strategy

It is reported that the Empire Energy has reduced the outstanding net debt from US$36.8 million at 30 June 2018 to US$22.6 million, currently through its recapitalisation and debt reduction program. The company asserted that net debt would be reduced to ~US$5 million after the completion of the Kansas sale. As per the release, the cash balance of the company has increased from US$1.1 million (as on 30 June 2018) to ~US$2.8 million (by 30 June 2019). Also, the proceeds from the sale would improve the cash balance to underpin the development plans in Northern Territory.

Appalachia Assets

Reportedly, post the sale of the Kansas assets, Empire Energy would retain the cash flow positive Appalachia gas production assets along with all its interest in the Marcellus and Utica Shale acreage, which is crucial for the New York State gas production. Furthermore, the positive cash flow from Appalachia gas production assets would service the pending debt, while Empire Energy holds the Marcellus Shale and Utica Shale acreage at little to no cost.

Key Terms

Founded in 1949, Mai Oil Operations, Inc. is a privately held oil producer. Mai Oil is primarily focused on the acquisition, exploration and development of oil and gas assets. The company is a family owned business with an industry experience of over six decades.

On 21 June 2019, the stock of Empire Energy last traded at A$0.210, up by 5% from the previous close. The performance of the stock in the past year is -39.39%; however, its year-to-date return is +53.85%. In the past one month and three months, the stocks return are at +11.11%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.