Highlights

- Tabcorp experienced a revenue decline of 3.9% in FY24 to AUD 2,338.9 million due to weak wagering market conditions.

- The company reported a statutory net loss after tax of AUD 1,359.7 million.

- Declining inflation, with CPI at 2.7% in August 2024, down from 3.5% in July, may ease cost pressures and improve margins.

- State Street Corporation increased its stake in Tabcorp to 5.08%, becoming a substantial shareholder.

- The new Victorian Wagering and Betting Licence, effective August 2024, is expected to boost revenue in FY25.

Tabcorp Holdings Limited (ASX:TAH) is an ASX-listed consumer company which offers gambling and entertainment services, including wagering and media. In the financial year 2024 (FY24), the company witnessed adecline in its revenue to AUD 2,338.9 million, down 3.9% YoY (AUD 2,434.4 million in FY23), driven by weak wagering market conditions.

The company’s EBIT also reflected this downturn as it dropped to AUD 97.4 million from AUD 150.5 million in FY23. Despite this, underlying gaming services EBITDA jumped 14.3% YoY in FY24. The period recorded statutory net loss after tax of AUD 1,359.7 million due to non-cash impairment charges of AUD 1,376.4 million.

In terms of macroeconomics factors, Tabcorp is likely to benefit from declining inflation as it will lead to drop in cost pressure and improvement in profit margins. According to the data released by the Australian Bureau of Statistics (ABS) on 25 September 2024, monthly consumer price index (CPI) of Australia for the 12-months through August 2024, increased by 2.7%, down from a 3.5% increase in July. Notably, CPI reading for August 2024 was the lowest since August 2021.

State Street Corporation’s confidence in TAH

A leading investment management company has increased its stake in Tabcorp. On 30 September 2024, through an ASX-filing, the company notified that State Street Corporation, and its associated entities became substantial shareholder in TAH on 26 September with 116,059,488 shares, representing 5.08% of the total issued capital in TAH.

Outlook

In the near term, the company expects to continue to witness soft market conditions observed in the second half of FY24.

The company informed that Australian wagering market is historically resilient, and the management is optimistic about its long-term growth potential.

The new Victorian wagering and betting licence, which began in August 2024, is anticipated to contribute to the company’s revenue in FY25.

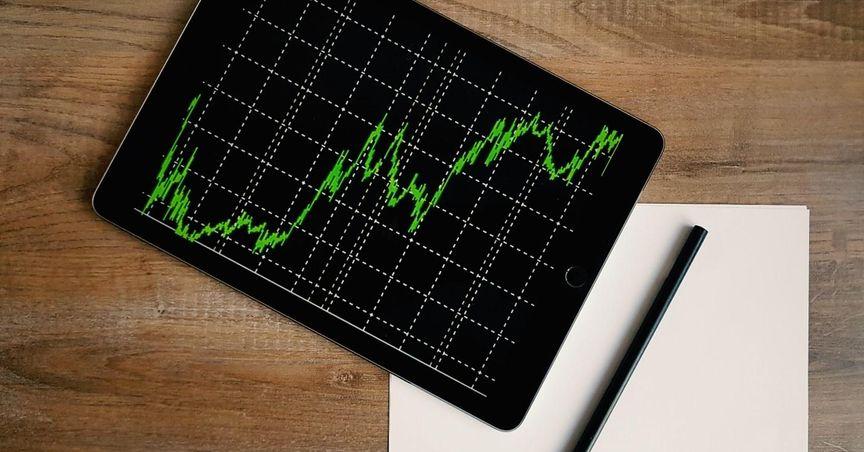

Share performance of TAH

TAH shares closed 6.32% higher at AUD 0.505 apiece on 30 September 2024. In the last one year, TAH’s share price has dropped by almost 46.28%, while in the past three months, it has declined by almost 28.37%.

52-week high of TAH is AUD 1.00, recorded on 27 September 2023, and 52-week low is AUD 0.37, recorded on 9 September 2024.

TAH Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 30 September 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.