Highlights

- OFX Group is a global money services provider and has presence in 50 countries

- In 1HFY24, OFX’s net operating income grew by 9.4% YoY to AUD 115.1 million

- Selector Funds Management Limited has the maximum stake in OFX with a shareholding of ~11.36%

Established in 1998, OFX Group Limited (ASX:OFX) is an ASX-listed international money service provider. The Sydney-based group offers its foreign exchange and money transfer services across 50 countries. The company mainly caters to enterprise, consumer and corporate clients.

In the first half of the financial year 2024 (1HFY24), the company saw continued growth across its B2B segments in all regions. In 1HFY24, net operating income (NOI) increased by 9.4% YoY to AUD 115.1 million and corporate revenues grew by 7.2% YoY to AUD 63.4 million. Meanwhile, underlying EBITDA decreased by 1.5% YoY to AUD 31.8 million.

During the reported period, the company also closed the acquisition of Paytron.

Recent business update

Through an ASX update dated 23 February 2024, the company informed that Connie Carnabuci acquired 1.064 shares of OFX indirectly for AUD 1,609,19. The shares are held by Connie Carnabuci Super Fund and Gardone Pty Ltd ATF Paul Fryer.

On 1 February 2024, the company notified about the appointment of Robert Bazzani as an independent non-executive director of the company’s board, with effect from 1 February 2024. He has more than 20 years’ experience at an international consulting company, KPMG.

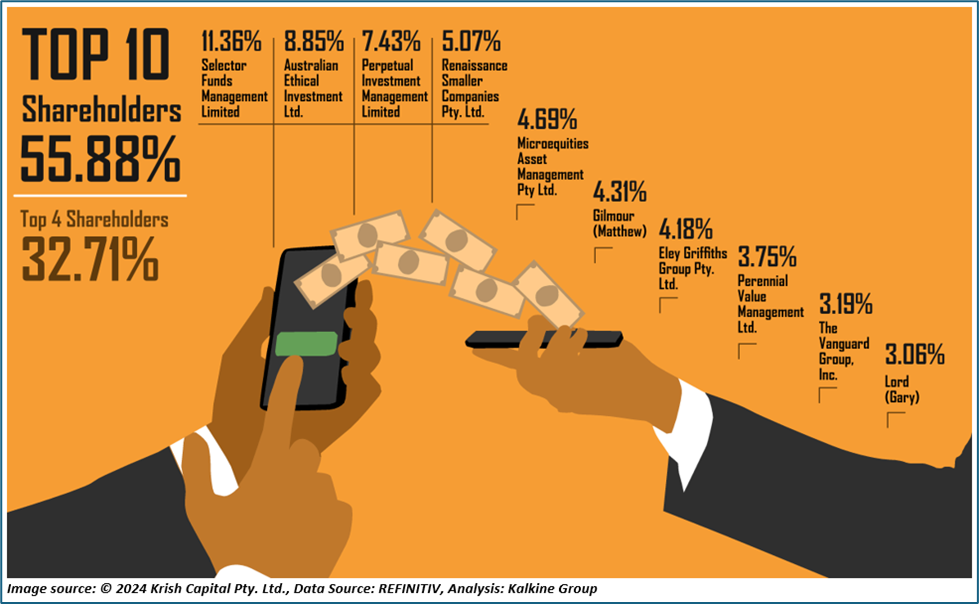

Top 10 shareholders of OFX

The top 10 shareholders of OFX have around 55.88% shareholding in the company, while the top four have around 32.71% shareholding. The highest stake is held by Selector Funds Management Limited and Australian Ethical Investment Ltd. With a shareholding of ~11.36% and ~8.85%, respectively.

Outlook

The company is optimistic about its performance in FY24, with the second half expected to perform better than the first half. In FY24, the company expects to deliver net operating income of AUD 225 – 238 million and underlying EBITDA of AUD 63-70 million, incorporating synergies from Firma and excluding Paytron’s acquisition.

Continuous corporate registration and active client growth is expected. Moreover, the company expects to see high-value use cases in the consumer segment and increased interest income and pricing.

Share performance of OFX

OFX shares closed 2.61% lower at AUD 1.49 apiece on 4 March 2024 with a market cap of AUD 380.51 million. With this, OFX’s share price dropped by 19.68% in the last 12 months and has fallen by 21.37% in the past nine months.

The 52-week high of OFX is AUD 2.20, recorded on 24 July 203, while the 52-week low is AUD 1.325, recorded on 14 November 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 4 March 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.