Highlights

- Lifestyle Communities is an ASX-listed firm which develops, owns and manages affordable independent living residential land-lease communities

- In FY24, cash balance of LIC increased by 232% YoY to AUD 4.1 million

- AustralianSuper has highest stake in LIC with a shareholding of around 14.77%

Lifestyle Communities Limited (ASX:LIC) develops, owns and manages affordable independent living residential land-lease communities. The Australia-based firm has more than 21 years of operational experience and currently has 32 residential land lease communities either under management, under contract, in development or in the planning phase.

In the financial year 2024 (FY24), total revenue of LIC went up by 4.71% YoY to AUD 243.2 million and cash balance increased by a whopping 232.12% YoY to AUD 4.1 million. Annuity income of the company saw 16% annual increase in FY24 to AUD 54.7mn. However, during the reported period, operating profit after tax declined by 25.67% YoY to AUD 52.9 million, affected by a decline in new home settlements and increase in marketing and pre-sales expenses related to new projects launched in FY24.

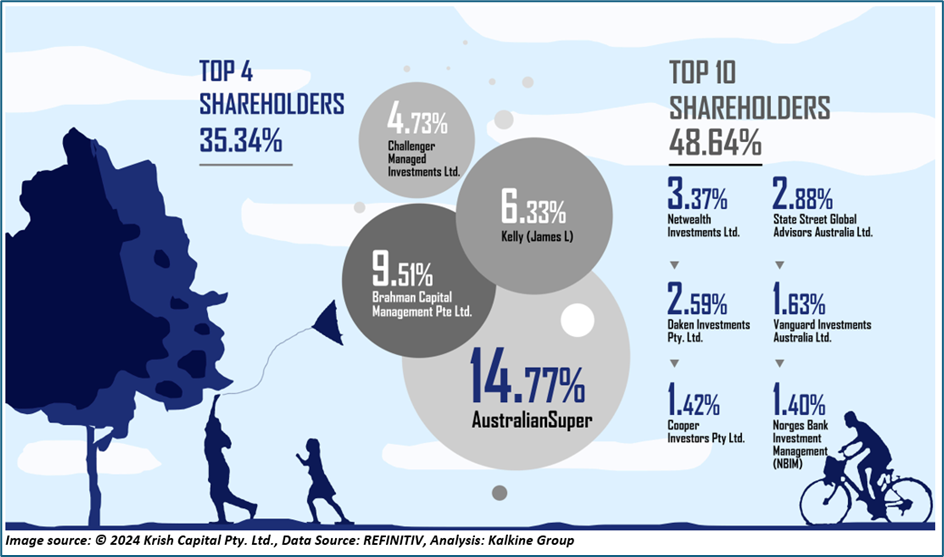

Top 10 shareholders of LIC

The top 10 shareholders of LIC have around 48.64% shareholding in the firm. AustralianSuper and Brahman Capital Management Pte. Ltd. hold the largest stake in the firm with a shareholding of 14.77% and 9.51%, respectively.

Recent business update

Through an ASX update dated 21 August 2024, the company notified that Citigroup Global Markets Australia Pty Limited and related entities ceased to be a substantial holder in the company as on 19 August 2024.

Outlook

In FY25, LIC’s focus will be on strengthening the balance sheet, decelerating the land acquisition campaign, implementing targeted strategies to sell through inventory, managing costs and resizing teams, adjusting the build program to match market conditions and restoring trust affected by recent media reporting.

The company informed that as of 12 August 2024, 348 new home sale deposits have been secured, out of which 228 homes are expected to be finalized and available for settlement in FY25 and 120 homes are expected to be completed in FY26.

Headwinds are predicted due to recent media coverage regarding its exit fee practices and ongoing weakness in the residential property market

Share performance of LIC

LIC shares closed 0.12% lower at AUD 8.28 apiece on 26 August 2024. LIC’s share price dropped by nearly 48.54% in the last one year and in the past three months, it has declined by 34.96%.

52-week high of LIC is AUD 19.07, recorded on 15 December 2023, and 52-week low is AUD 7.93, recorded on 21 August 2024.

LIC Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 26 August 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.