Highlights

- Incitec Pivot operates through two customer-oriented divisions

- In FY23, IPL’s revenue decreased by 4.86% to AUD 6,008.10 million

- Janchor Partners Limited has the highest stake in the company with a shareholding of ~8.91%

Incitec Pivot Limited (ASX: IPL) stands as a prominent technology provider for the resources and agricultural industries. IPL operates through two customer-oriented divisions: Dyno Nobel, which operates across the Americas, Europe, Middle East, Africa (EMEA), and Asia Pacific, and Incitec Pivot Fertilisers, a renowned integrated manufacturer and distributor of fertilisers spanning the eastern coast of Australia.

In the financial year 2023 (FY23), the company registered a 4.86% YoY fall in its revenue to AUD 6,008.10 million, 34.58% YoY decline in EBITDA to AUD 1,215.40 million and 44.76% YoY fall in group NPAT to AUD 560 million.

The fall in revenue in FY23 was because of a reduction in commodity prices from their historic highs in FY22. During the reported period, Dyno Nobel business exceeded expectations, with Dyno Nobel Asia Pacific business delivering EBIT of AUD 188 million on the back of improved customer demand for Dyno’s technology and record production at the Moranbah ammonium nitrate plant.

The company highlighted that FY23’s earnings are the second best since 2008, driven by technological and customer growth.

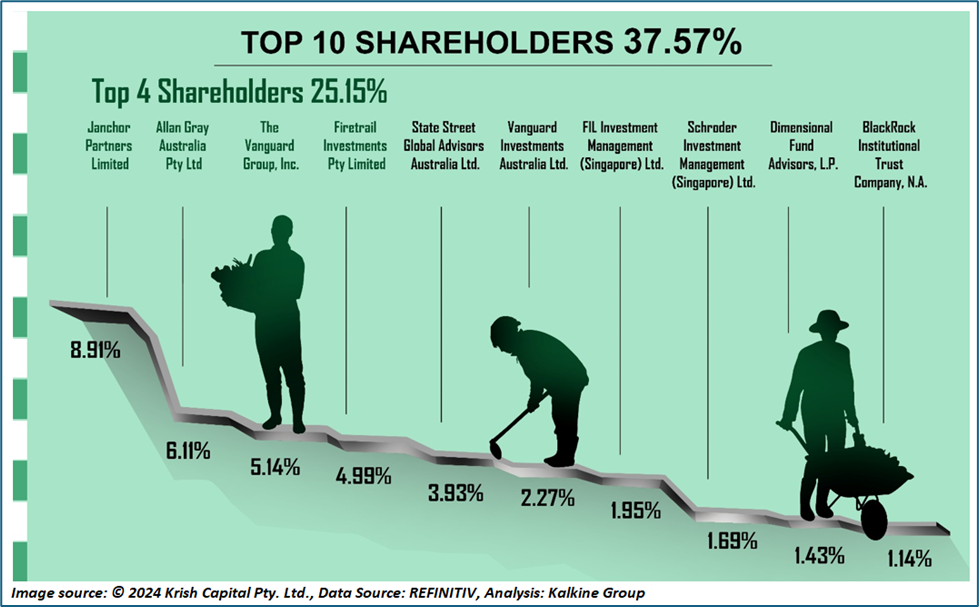

Top 10 shareholders of IPL

The top 10 shareholders of IPL have around 37.57% shareholding in the company. Janchor Partners Limited and Allan Gray Australia Pty Ltd have the highest stakes in the company with a shareholding of ~8.91% and ~6.11%, respectively.

Recent business update

On 23 April 2024, the company notified that State Street Corporation, and its associated firms together became a substantial shareholder in IPL on 19 April 2024, with a shareholding of nearly 5.23%.

Outlook

The company expects to see an improvement in the profitability driven by continued commercial discipline and focus on cost management. The company believes that its premium technology has a competitive edge in the market, which prioritises value over cost.

The company expects positive market conditions to continue in Australia for its Dyno Nobel business, comprising a firm, short-term demand outlook for iron and coal ore.

Repricing and recontacting are expected to occur through 2024 and 2025, and this is expected to benefit the Dyno Nobel business.

In FY24, full-year production is expected to be in the range of 730kt to 770kt, compared to earlier expectation of 780kt to 820kt.

Share performance of IPL

IPL shares closed 1.81% higher at AUD 2.820 apiece on 7 May 2024. In the last one year, IPL’s share price has jumped 2.41% and in the last six months, it has increased by 17.09%.

The 52-week high of IPL is AUD 2.920, recorded on 26 March 2024, while the 52-week low is AUD 2.227, recorded on 15 June 2023.

IPL Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 07 May 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.

_06_10_2025_02_08_56_744493.jpg)