Highlights

- Clinuvel Pharmaceuticals is an ASX-listed global pharmaceutical firm which develops and commercializes therapies

- In 1HFY24, the company recorded around 10% YoY increase in revenue and 1.4% YoY rise in net profit after tax

- Wolgen (Philippe Jacques) has the highest stake in CUV with a shareholding of around 6.84%

Based in Melbourne, Clinuvel Pharmaceuticals Limited (ASX: CUV) is an international specialty pharmaceutical company dedicated to developing and marketing therapies for individuals with genetic, metabolic, systemic, and severe acute disorders. Moreover, the company offers healthcare solutions to the broader population. Its primary treatment is SCENESSE®, an innovative photoprotective and repigmentation medicine.

For the six months ended 31 December 2023 (1HFY24), the company saw a 9.9% YoY surge in revenues, taking it to AUD 32.26 million, a 1.4% YoY uptick in net profit after tax, reaching AUD 14.81 million, and an 11.2% YoY increase in cash and term deposits to AUD 174.45 million.

During the reported period, revenue growth was driven by the sales of SCENESSE, which saw increased adoption among patients in North America. Additionally, the period saw workforce expansion and the company invested in a new commercial office facility.

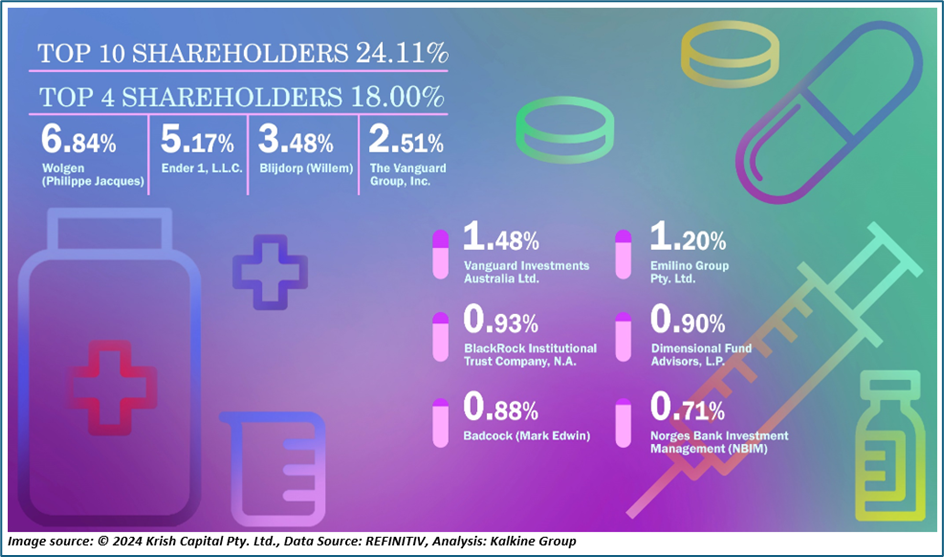

Top 10 shareholders of CUV

The top 10 shareholders of CUV have around 24.11% shareholding in the company, while the top four have 18% of the shareholding. Wolgen (Philippe Jacques) and Ender 1, L.L.C., have the maximum stake in the firm with a shareholding of around 6.84% and 5.17%, respectively.

Recent business update

Through an ASX update dated 14 May 2024, the company notified that JPMorgan Chase & Co. and its associated entities became a substantial shareholder in the firm with a voting right of 5.34%, as on 9 May 2024.

On 29 April 2024, the company shared that CLINUVEL's medication afamelanotide garnered a favourable assessment for orphan drug designation (ODD) from the European Medicines Agency (EMA) for addressing xeroderma pigmentosum (XP). This designation not only extends commercial, regulatory and financial incentives but also marks the fifth European orphan drug designation for afamelanotide.

Outlook

For the five financial years until June 2025, the company is expected to remain within the expected expenditure of AUD 175 million.

The focus is on expanding into new territories by rolling out consumer focused PhotoCosmetic products. The company eyes expansion across the Middle east, Europe and North America. Other key focus areas of CUV are undertaking acquisitions and advancing its clinical programs.

Share performance of CUV

CUV shares closed 3.46% lower at AUD 15.080 apiece on 15 May 2024. With this, CUV’s share price declined by 21.38% in the last one year and had decreased by almost 9.10% in the last six months.

The 52-week high of CUV is AUD 21.45, recorded on 28 August 2023, while the 52-week low is AUD 12.96, recorded on 11 March 2024.

CUV Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 15 May 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.