Progressing on its mission to locate, acquire and develop high value mineral projects, exploration company Krakatoa Resources Limited (ASX: KTA) is set to acquire a 100% interest in the Belgravia Project, which is prospective for porphyry copper-gold systems and high-grade gold skarn mineralisation.

On 26 September 2019:

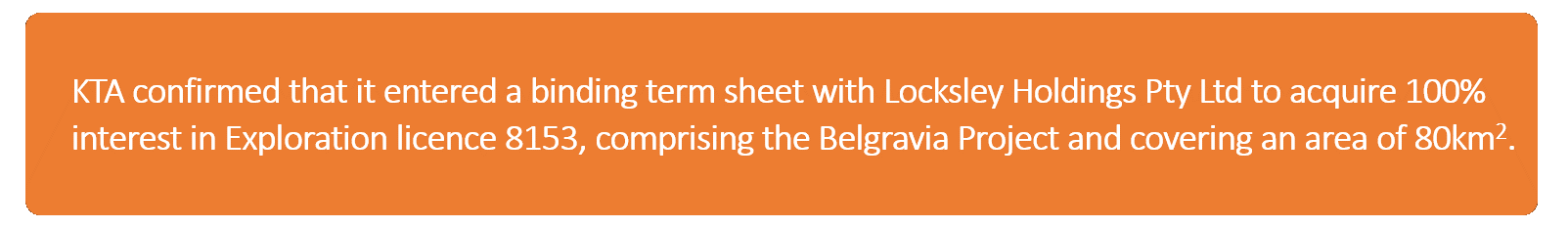

Project Location over Gravity Map (Source: Company reports)

Following the release of the announcement, KTAâs stock skyrocketed by 39.13% during the intraday trade.

KTA has been on an inorganic growth spree. Only a few months back, the company had acquired highly prospective Mt Clere Rare Earth Project in Western Australia, and is now set to acquire the Belgravia Project, which is prospective for four deposit types

- Porphyry Cu-Au,

- Associated skarn Cu-Au,

- Orogenic A and

- VMS-Au mineralisation.

With the addition of these significant projects in its portfolio, KTA is emerging as a strong mid-cap exploration company in Australia.

Belgravia Project Overview:

Belgravia Project is located in the central part of the Molong Volcanic Belt (MVB), Lachlan Fold Belt, NSW and lies 7-kilometrr east from the town of Molong and around 20-kilometre NE of the major regional centre of Orange, providing excellent road, rail, power, gas and water infrastructure. The region in which the project is located constitutes the largest porphyry province in Australia.

Within MVB, four major porphyry systems are identified:

- Cadia - Newcrestâs Cadia Valley Operations (Cadia Hill, Ridgeway and Cadia East);

- Copper Hill, which underlies the Belgravia Project;

- Cargo; and

- Boda

The Belgravia Project is highly prospective for:

- Porphyry copper-gold systems akin to the Cadia Valley porphyry cluster and Alkaneâs Northern Molong Porphyry Project

- High-grade gold skarn mineralisation similar to Junction Reefs

Belgravia contains parts of the Copper Hill Igneous Complex (CHIC), which locally hosts the Copper Hill deposit with a total resource of 87Mt @ 0.32g/t Au & 0.36% Cu comprising

- Indicated resources of 47mt @ 0.39g/t Au & 0.4% Cu and

- Inferred resources of 39mt @ 0.24g/t Au & 0.32% Cu, using a 0.2% copper cut-off grade

Belgravia Project Positioned in Tier-One Mining Jurisdiction:

The Belgravia Project is located between Newcrest Miningâs Cadia Valley Mine and Alkane Resourcesâ Northern Molong Porphyry Project. Further, it is situated adjacent to the Copper Hill porphyry Cu?Au deposit.

Cadia Valley: The Belgravia Project is located along trend, approximately 40 kilometre north of Newcrest Miningâs world-class Cadia Valley Operations (CVO), which includes Cadia East, Ridgeway and Cadia Hill.

Cadia East has a total resource of:

34Moz Au and 7.6Mt Cu comprising entirely indicated resources of 2,900mt @ 0.36g/t Au & 0.25% Cu2.

Alkane Resources: The Belgravia Project sits along trend, approximately 70 kilometre south of Alkane Resources Limitedâs recent porphyry discovery. Alkane recently discovered substantial porphyry gold-copper mineralisation at the Boda prospect within Northern Molong Porphyry Project, which increases the prospectivity of the Molong Volcanic Belt (MVB), where the Belgravia Project is located.

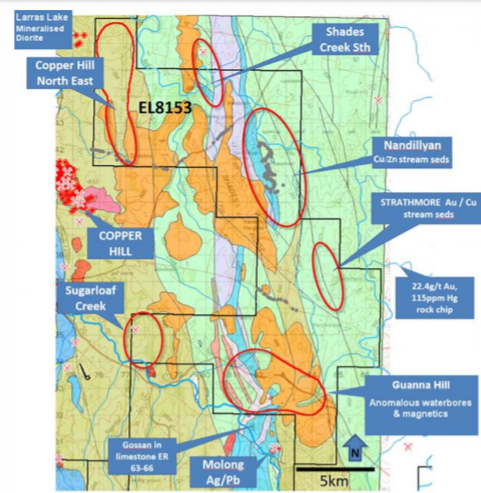

Copper Hill (The oldest mined Cu deposit in NSW): The project is located near the Copper Hill gold-copper deposit, which contains a total resource of 87Mt @ 0.32g/t Au and 0.36% Cu comprising indicated resources of 47mt @ 0.39g/t Au and 0.4% Cu and inferred resources of 39mt @ 0.24g/t Au and 0.32% Cu, using a 0.2% copper cut-off grade.

Copper Hill Location (Source: Companyâs Report)

Copper Hill Location (Source: Companyâs Report)

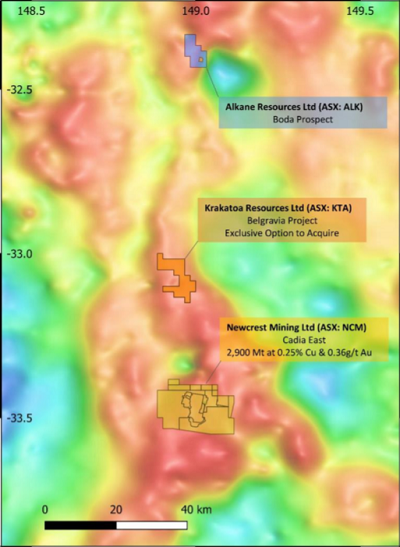

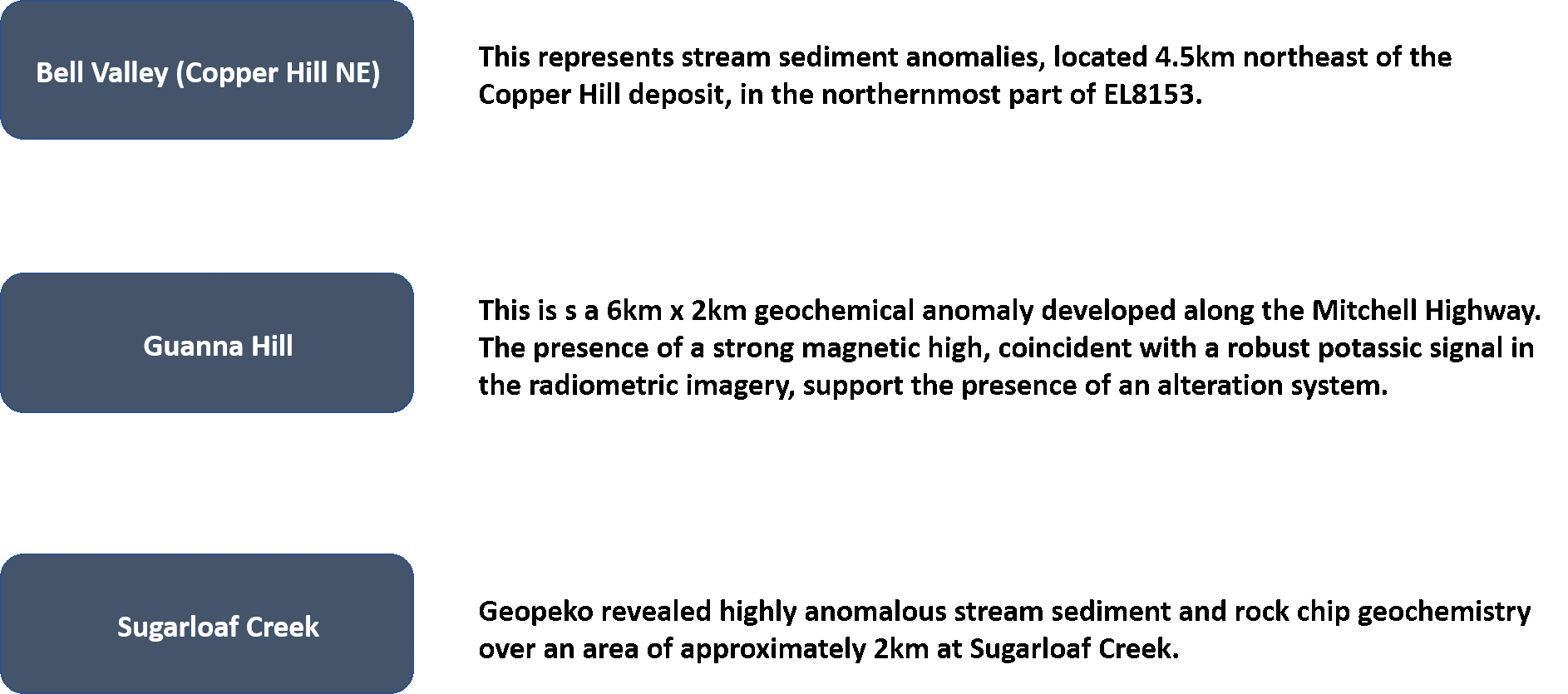

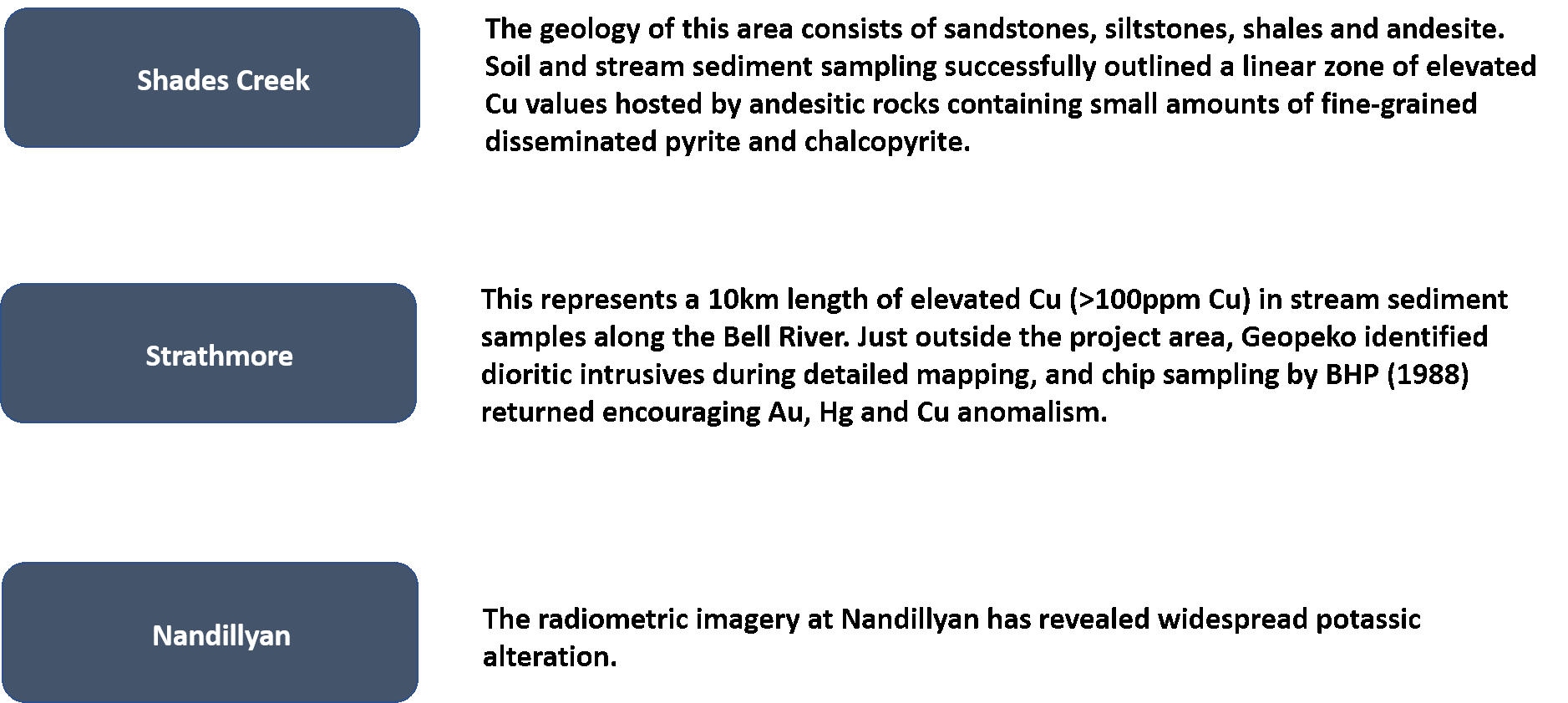

Six Initial Cu?Au Targets:

Vendor, Locksley Holdings Pty Ltd, has generated six initial Cu?Au targets for immediate consideration by the company:

The company will utilise its 21-day due diligence period to review and validate these targets.

Exploration Targets (Source: Company Reports)

The Binding Terms Sheet

The binding terms sheet with Locksley Holdings grants the company a 21-day option period to undertake due diligence on the Belgravia Project for a consideration of $10,000, which has already been paid.

After the due diligence process and exercise of the option, 100% of the Belgravia Project can be acquired through the following consideration:

- 10,000,000 ordinary shares

- $300,000 cash

- 1% net smelter royalty

The issue of the 10,000,000 ordinary shares requires shareholder approval.

On completion of the transaction, 10,000,000 quoted options exercisable at $0.05 on or before 31 July 2021 will be issued to the facilitator of the transaction, King Corporate Pty Ltd.

Exploration Consultant:

KTA has appointed highly experienced Mr. Stephen Woodham as NSW exploration consultant. Stephen has more than 30 years of experience in mining and exploration and has an extensive track record in logistics, tenement acquisition, land access, mining investment, and commercial and cross-cultural negotiation. In his extensive experience, Stephen has bagged projects that have lead to in substantial gold discoveries in New South Wales.

Way Forward:

To fund its due diligence on the Belgravia Project and meet its working capital requirements, KTA has secured firm commitments to raise $330,000 through the issue of 15,000,000 ordinary shares at a price of 2.2c per share. The shares will be issued under existing LR7.1 capacity.

After completing the due diligence process, a swift progression to drilling will be planned and the exploration will focus on discovery of large tonnage, moderate grade Cu-Au porphyry and high-grade Au ± Cu skarn deposit styles.

Stock Performance:

On the date of the news announcement i.e. 26 September 2019, KTA stock closed the dayâs trade at $0.030 up more than 30%.

The stock is continuing its upward momentum and is trading at $0.031, up 3.4% (as on 27 September 2019, AEST: 12:40 PM) as compared to its previous closing price. KTAâs market cap stands at $4.05 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.