Kirkland Lake Gold Ltd (ASX: KLA) is an ASX listed gold mining company based in Australia. The company is having operations in two countries; Australia and Canada. On 10th May 2019, the company announced its Q1 2019 results. Currently, the company is targeting 950,000 â 1,000,000 ounces of gold (guidance earlier increased from 740,000 - 800,000 ounces to 920,000 - 1,000,000 ounces on a consolidated basis).

Financial and Operating Performance

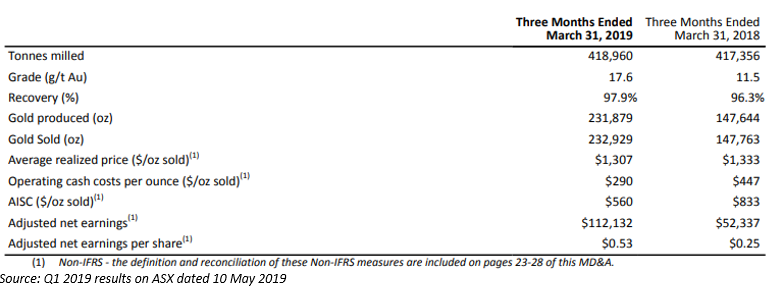

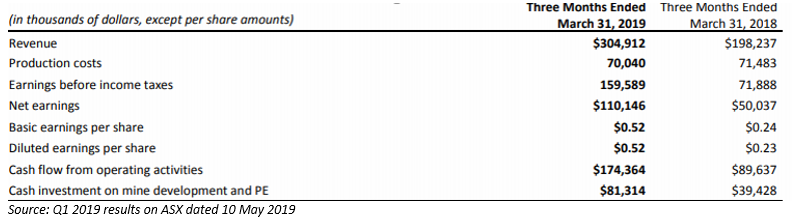

The company posted revenue of $304.91 million for Q1 2019, an increase of 54% from Q1 2018 revenue of $198.24 million on record gold sales of 232,929 ounces with an average realized price of $1,307/oz.

The company posted outstanding results: $201.6 million EBITDA (+101%pcp), strong growth in mineral reserves of Fosterville (up 60%) and Macassa (up 11%) and Q2 dividend payment of $0.04 in US funds (up by 34%).

The company posted outstanding results: $201.6 million EBITDA (+101%pcp), strong growth in mineral reserves of Fosterville (up 60%) and Macassa (up 11%) and Q2 dividend payment of $0.04 in US funds (up by 34%).

The net earnings of the company were reported at $110.14 million after adjusting for total taxes of $49.44 million. This is an increase of around 120% from Q1 2018 net earnings of $50.03 million. The adjusted net earnings of $112.1 million also increased by 114% from Q1 2018. Due to the increase in net earnings, the basic earnings per share (eps) had also increased for the reporting period from 0.24 cents per share (cps) to 0.52 cps.

On the balance sheet front, the company reported an increase in the total assets from $1.71 billion in Q4 2018 to $1.89 billion in Q1 2019; Inventories increased from $40.09 million to $45.11 million. The total liabilities also grew from $447.05 million in Q4 2018 to $501.67 million in Q1 2019 which included an increase in share-based liabilities from $4.28 million to $6.71 million, income tax payable from $34.43 million to $54.67 million in the same period.

The company witnessed the cash inflow of 174.36 million from operating activities, and the pcp inflow was reported 89.63 million. The company used net cash of $86.02 million with pcp cash outflow of $38.69 million. Financing activities led to a net cash outflow of $8.32 million (outflow of $6.25 million pcp). The cash increased by 25% or $83.9 million.

Managementâs Declaration

On the same day, (10th May 2019) Anthony Makuch (CEO) and David Soares (CFO) lodged a document stating full certification of the financial report and interim MD&A, making a detailed declaration that financial report and interim MD&A are reviewed by them. There have been no misrepresentations in the reports as per their knowledge.

Annual and special meeting of shareholders

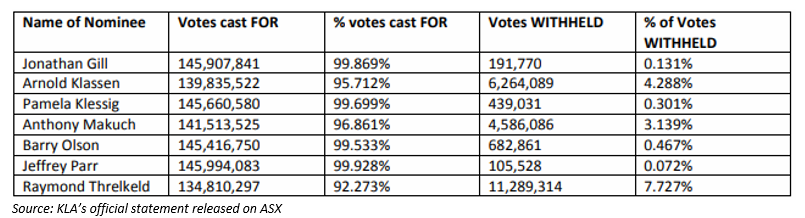

The company also announced the result of its annual and special shareholders meeting which was held on 7th May 2019.

All the proposed resolutions to the shareholders were duly passed with a vast majority. A total of seven nominees listed above were elected as directors of the company until the annual and special shareholders meeting.

All the proposed resolutions to the shareholders were duly passed with a vast majority. A total of seven nominees listed above were elected as directors of the company until the annual and special shareholders meeting.

Stock Performance

The company has a market capitalisation of A$10.14 billion. The 52-week high and low of the stock is A$52.49 and A$23.5 respectively. The stock is currently trading at A$48.00 (As at 1:17 PM AEST,13 May 2019). In the last one year, the stock has delivered a return of 90.69%, and the YTD return stands at 25.56%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.