Movement in share prices is generally influenced by the demand and supply of a particular stock. If the demand for a stock is more, its prices would increase and vice versa. There are several other factors that influence the stock prices such as:

- Positive/negative news

- Fundamentals

- Business and future growth prospects

- Announcements with respect to dividends

- Change in management

Kathmandu Holdings Limited - Stock Performance:

In this article, we would discuss Kathmandu Holdings Limited (ASX:KMD), which released its performance results for FY2019 on 18 September 2019, pushing its share price by 6.46% to A$2.800 at the end of the day.

The stock of Kathmandu Holdings Limited, a retailer of clothing and equipment for travel and adventure, was trading at A$2.780 on 19 September 2019 (AEST: 01:30 PM), down 1.767% from its previous close. KMD has a market capitalisation of A$641.67 million with approximately 226.74 million outstanding shares, annual dividend yield of 5.06% and PE ratio of 11.60x. The stock has delivered a return of 37.38% and 18.41% in the last three months and six months, respectively, while its year-to-date return stands at 8.02%.

FY2019 ended 31 July 2019 emerged as another record year for KMD. The year reflected the companyâs successful rollout of multi-channel, brand led growth strategy.

FY2019 Key Highlights:

- There was an increase of 12.4% in the Summit Club members to 2.2 million as compared to FY2018.

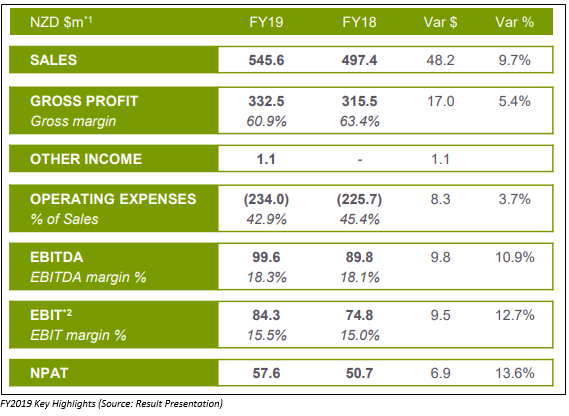

- The companyâs sales also increased during the period by 9.7% to NZ$545.6 million. Growth included a more than 0.6% increase in same store sales on constant exchange terms. In Australia, same store sales grew by over 2.7% as compared to the previous corresponding period (pcp).

- The Oboz business, after successful integration, grew strongly during the period. The FY2019 pro forma sales growth from this segment was 30% to US$44.6 million, and pro forma EBIT growth was 38.6% to US$7.9 million. The business reported continued growth in key accounts as well as core styles. Along with that, the business also diversified its customer and product mix.

- An investment of NZ$1.3 million was directed towards setting up wholesale business in North America. Early response from this investment was reported positive during the period, as the company was able to secure initial wholesale orders for 45 doors and 5 online sites.

- Online sales increased by 9.2% at constant exchange rates to NZ$48.4 million.

- The company reported a gross profit of NZ$332.5 million, a 5.4% increase on pcp.

- EBIT increased by 12.7% to NZ$84.3 million

- Net profit after tax grew by 13.6% to NZ$57.6 million.

- KMD unveiled a full year dividend of NZ$0.16 per share

Australia remains the largest market for Kathmandu Holdings Limited. Total sales in Australia in FY2019 increased by 4.5%, as a result of increased product categories. The same store sales growth of more than 2.7% represents KMDâs focus on providing its customers with a great shopping experience.

On the other hand, sales in New Zealand declined during the financial year 2019 by 3.1%. Focus of the company in this region for FY2020 would be on boosting footfall and conversion metrics in key metro markets. The company has also opened its flagship stores in main cities. Owing to these new openings, the company is hoping for better results in the future.

Balance Sheet Highlights:

Balance sheet of the company remained strong during FY2019. Net assets increased from NZ$420.52 million in FY2018 to NZ$442.06 million in FY2019. The increase in net assets was supported by a significant decrease in total liabilities during the period. Total shareholdersâ equity for FY2019 stood at NZ$442.06 million. The balance sheet also witnessed an increase in retained earnings for FY2019, giving a sense of confidence among the investors.

Cash Flow Highlights:

- Operating Activities: During the year ended 31 July 2019, KMD reported a fall in its operating cash inflows from NZ$75.60 million in FY2018 to NZ$61.67 million. There was an increase in cash receipts from customers from NZ$502.91 million in FY2018 to NZ$546.50 million in FY2019. Also, income tax and interest received grew during the reported year.

Additionally, payments made to suppliers and employees grew from NZ$406.51 million in FY2018 to NZ$455.74 million in FY2019. Payments towards income tax, as well as interest, also increased during this period.

- Investing Activities: Cash inflows through investing activities were reported from investments in other financial assets; however, cash outflows through investing activities included the purchase of property, plant and equipment, purchase of intangibles and acquisition of subsidiaries. Net cash outflows from the companyâs investing activities declined from NZ$121.62 million in FY2018 to NZ$15.70 million in FY2019.

- Financing Activities: Net cash inflow through financing activities was reported at NZ$92.61 million from loan advances. The company also paid NZ$33.88 million as dividends and repayment of loan advances worth NZ$106.61 million. Net cash outflows through financing activities stood at NZ$47.88 million at the end of the year.

By the end of FY2019, KMD had net cash and cash equivalents of NZ$6.23 million.

Outlook:

According to Mr Xavier Simonet, the Managing Director and CEO of Kathmandu Holdings Limited, the company is well positioned for delivering on future growth opportunities. The Oboz business has helped in transforming KMD from a top retailing company in Australasia to an international player in the brand-led multi-channel business. This business also helped KMD in the diversification of channels, brands, products as well as markets.

For the financial year 2020, some of the companyâs key strategic priorities are:

- Investment in innovation to provide global adventurers with unique and disruptive solutions

- For future store optimisation, focus on implementing merchandise planning and warehouse management systems

- Become capable of delivering and testing apparel for women on an accelerated timeline.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.