Companies tend to come up with the news and announcements, in reaction to which, the price movements occur. Here, letâs look at a few small-cap stocks with significant business developments and how the stock prices of the companies have taken cues from the respective news.

Kalium Lakes Limited (ASX:KLL)

Kalium Lakes Limited (ASX: KLL) is an exploration and mining company, which was incorporated in July 2016 as part of the restructuring of Kalium Lakes Potash Pty Ltd.

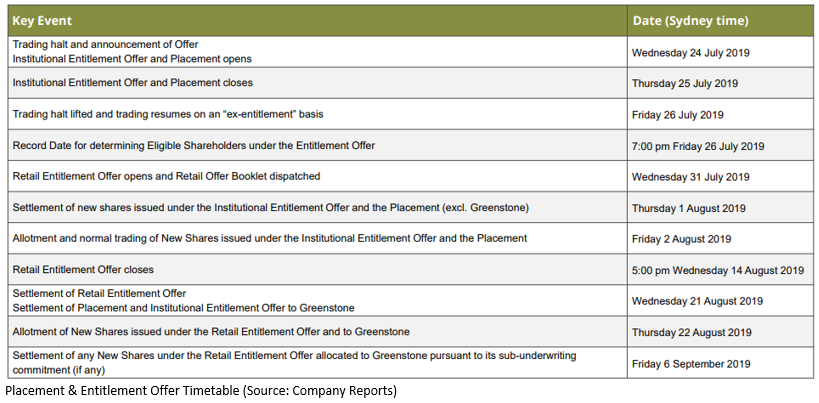

The company today, on 24th July 2019, updated investors that it will undertake an institutional placement (Placement) and an accelerated non-renounceable pro-rata entitlement offer of new fully paid ordinary shares in Kalium. The activity is aimed to raise up to ~$72 million before costs from the investors.

Offer Structure: As per the Entitlement Offer, eligible shareholders of the company will be offered to subscribe for 1 New Share for each 2.19 existing shares on 26th July 2019 (which is record date). The issue price for the offer has been set at $0.50 per New Share. The Entitlement Offer consists of an accelerated institutional and a retail portion. Through the Placement, the company will issue ~34.97 million New Shares.

The offer price of $0.50 per new share, which, at the last closing price at 23rd July 2019, represents â (a) A 26.5% discount to last closing price of $0.68; and (b) 18.3% discount to TERP of $0.612.

Deployment of Funds: The company will use the proceeds to fund the equity component of the construction of the Beyondie Sulphate of Potash Project. Part of the fund will also be used for the purpose of anticipated working capital until the first production.

Significant Shareholder Participation: The company mentioned that Greenstone Resources is a significant shareholder of KLL and holds ~19.8% of issued shares. Under the Entitlement Offer, the investor has committed to subscribe all of its entitlements. At the same time, it will also play an important role in the Placement and will achieve a relevant interest of 19.9%, which equates to the investment of ~$14.5 million, in addition to sub-underwriting $5 million of any shortfall in the Retail Entitlement Offer.

The stock of KLL last traded at the market price of $0.680, with the market capitalisation of $162.5 million on 23rd July 2019. The stock has gained ~122.95% in the last six months.

The Agency Group Australia Limited (ASX:AU1)

The Agency Group Australia Limited (ASX: AU1) is engaged in the real estate and related activities. The company has categorised its services in the segments - (a) Real Estate and Property Services, (b) Mortgage Origination Services, and (c) Other (includes financial planning, head office, etc.).

The company today, on 24th July 2019, updated the market about the receipt of the commitments from two new strategic investors to become shareholders for the purpose to raise ~$1.1 million through the Placement.

AU1 has also inked an agreement according to which debt amount of ~$5.8 million will be converted into equity, i.e. 89.1 million shares pursuant to the accomplishment of the Placement and the Entitlement Offer and receipt of prior shareholder approval. Parties engaged, in this context, will also receive 1 attaching option for every 2 shares issued as per the set terms. Consequently, debt position on the balance sheet will be reduced, primarily bank debt, from $21.2 million to $13.6 million. The company intends to refinance its remaining debt position ahead of the maturity on 30th September 2019.

The Placement comprises the issue of approximately 9.2 million new fully paid ordinary shares to Magnolia Capital and 7.7 million shares to Honan Insurance Group to raise approximately $1.1 million. Subject to the receipt of prior shareholder approval at the general meeting to be convened shortly, the subscribers under the Placement will also receive 1 attaching option for every 2 shares subscribed for and issued on the terms set out below. The Placement shares will be issued at a price of $0.065 per share.

Entitlement Offer: AU1 will offer 4 for 7 Entitlement Offer, which will comprise ~69 million new fully paid ordinary shares. The subscriber will also be entitled for 1 free attaching option for every 2 shares subscribed for and issued as per the set terms to raise ~$4.5 million. The company has received firm commitments to underwrite any shortfall to the Entitlement Offer.

Indicative Capital Structure: With the completion of the Placement, Entitlement Offer, Debt Conversion and other shares to be issued, the capital structure will be as follows:

Indicative Capital Structure (Source: Company Reports)

At the current market price of $0.081, the market capitalisation stands at $7.89 million. The stock is trading close to its 52-week low of $0.069. With the news of capital raising, the stock was up 6.579% on 24th July 2019.

Black Rock Mining Limited (ASX:BKT)

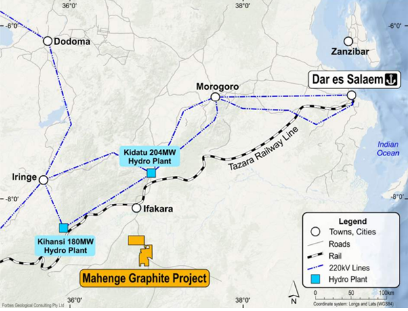

An Australian-based company, Black Rock Mining Limited (ASX: BKT) has a key focus on the development of graphite tenure in the Mahenge province of Tanzania.

The company, on 24th July 2019, updated the market that it has completed a definitive feasibility study (DFS) on the Mahenge Project in October 2018 and is moving towards securing project financing and progressing into construction and operations with the first production targeted in 2020 to 2021. The exact timing of the first production will be an outcome of the progress on securing finance.

Mahenge Graphite Project (Source: Company Website)

The company will undertake the enhanced DFS (eDFS) on account of strong demand seen from customers and also includes the provision for a fourth production module of 85k tonnes per annum, increasing the total steady state production to 340 â 350k tonnes per annum. The development schedule will be pursuant to the financing and confirmation of the 16% Tanzanian government free carried interest. The schedule will be in four production modules, each coming online annually after the first module, rather than every two years in the original DFS.

The company also mentioned that the financial metrics have improved with the unlevered NPV attributable value after tax and free carried interest increasing by 30% to US$1.16 billion or $1.65 billion from US$895 million. Long run C1 OpEx stands at US$397/t (AISC $481/t), with IRR of 44.8%.

The company is targeting steady state annual production to increase from 250k to 340k tonnes.

At the current market price of $0.084, the market capitalisation stands at $45.67 million. The stock has gained ~100% on YTD. Reacting to this news, the stock price has zoomed 7.692% on 24th July 2019.

Vital Metals Limited (ASX:VML)

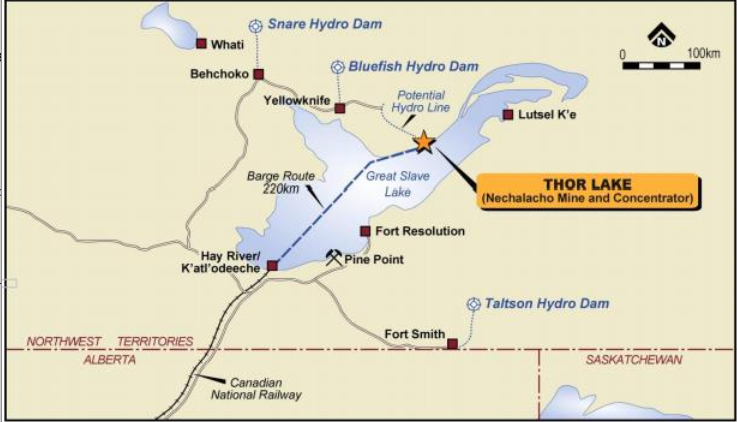

Vital Metals Limited (ASX: VML) is engaged in the mineral exploration and holds a portfolio of gold, technology metals and base metals with projects located in West Africa and Germany.

On 25th June 2019, the company had set its foot into a binding term sheet to acquired a private Australian registered company, which identifies, acquires and brings the production of rare earths projects, Cheetah Resources Pty Ltd.

Today, on 24th July 2019, the company provided an update on the Cheetah Resources acquisition and mentioned that VML is progressive towards the due diligence process, and has successfully completed the technical due diligence on the Thor Lake and Wigu Hill projects. VML has agreed with Cheetah to extend the period of due diligence to August 14, 2019, on account of the volume of material related to the licensing and permitting already in place for the Thor Lake Project. The company also mentioned that it is planning to move quickly and assess options to use mechanical sorting to generate, without the use of process water or chemicals, a high-grade concentrate. The company remains focused to produce a concentrate for sale to existing refiners, which will reduce the massive capital costs and long time requirement for the construction, typically associated with building an REO refinery. The company will update the market as and when the due diligence is completed.

Location of the Thor Lake Project (Source: Company Reports)

At current market price of $0.011, the market capitalisation of the stock stands at $19.17 million on 24th July 2019.

Hot Chili Limited (ASX:HCH)

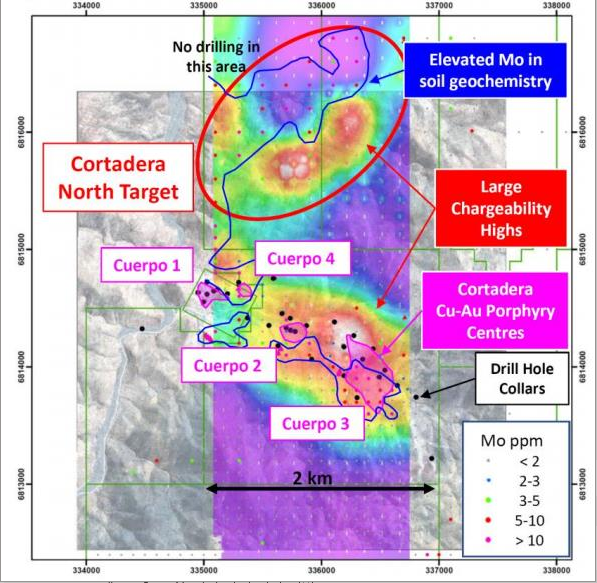

Hot Chili Limited (ASX: HCH) is engaged in the exploration of minerals. The company, on 24th July 2019, announced that a further review of past information accumulated for the Cortadera copper-gold porphyry discovery in Chile has provided an uplift to the projectsâ growth potential.

These historical details have come up with a large target lying immediately north of Cortadera, which was discovered by the earlier exploration, but never drill tested.

The target was named as Cortadera North, which measures ~2 km in strike length and 1 km in width, as per the suggestion by geophysics and surface soil geochemistry.

HCH found out four key areas of growth for Cortadera: (a) Extension of the existing porphyry centres (Cuerpo 1, 2 and 3) and definition of any significant high grade zones as confirmed at Cuerpo 3 (b) Cuerpo 4, addition of a fourth porphyry to the deposit (c) Potential for all four Cuerpos to join at depth along a 2 km strike length (d) Cortadera North target, potential for a second 2km long porphyry target zone.

IP Chargeability Depth Slice (200 m) & Surface Molybdenum (Source: Company Reports)

The company recently announced the drill results at Cortadera, wherein it mentioned that the first assay results witnessed a rise in the width to 750m from 622m.

At the current market price of $0.036, the stock has a market capitalisation of $44.67 million on 24th July 2019. The stock has gained ~282% on YTD.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.