Highlights

- Jindalee Resources (ASX:JRL) has enhanced its focus on lithium exploration with the advancement of drilling at its flagship McDermitt Project.

- The company intends to be a pure-play US lithium developer with McDermitt considered as one of the largest lithium deposits in the US.

- Significant supply shortage of lithium is looming as the growing popularity of electric vehicles is aggressively driving the need for lithium.

- The company seeks to demerge its Australian asset portfolio by way of a new standalone vehicle in early 2023.

Jindalee Resources Limited (ASX:JRL) has been making notable strategic moves to enhance its focus on lithium exploration.

The focus has been on advancing its McDermitt Lithium project, which suggests significant indicated and inferred mineral resources with notable upside. Boasting an area of 54.6 sq. km, McDermitt is considered as one of the largest lithium deposits in the US, with inferred and indicated mineral resources of 1.82 Bt @ 1,370ppm Li for 13.3 Mt Lithium Carbonate Equivalent at 1,000ppm Li cut-off.

The company’s strategic model is aimed at delivering shareholder value via engaging in the acquisition of prospective ground for a low upfront cost, advancing projects with early-stage exploration and target generation, and participating in transactions that deliver exposure to project and commodity.

Bright prospects in the US lithium market

Given its proximity to major lithium customers, the McDermitt project suggests the possibility of emerging as a significant contributor to the US lithium supply dynamics.

The estimated demand improvements for lithium in the battery industry have resulted in anticipations for lithium prices to further improve and/or stay at healthy levels. A significant increase in demand for lithium is expected to come from the automotive industry amid the growing shift towards electric vehicles and the looming supply shortage of lithium.

Besides this, JRL believes that the concerns in the US over the country’s reliance on critical mineral imports can possibly be a driver to steer the project towards development.

Recent work at world-class, Tier 1 McDermitt lithium deposit

In late-July 2022, JRL reported the commencement of drilling at its McDermitt project to infill and extend the Mineral Resource Estimate (MRE).

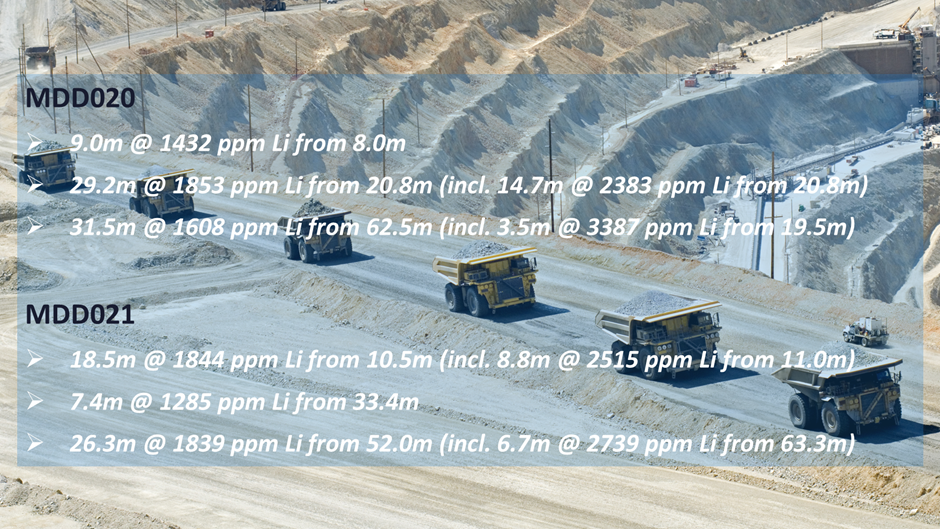

Till late August 2022, JRL had completed 10 diamond holes as part of the 28-hole drilling program. The company received strong initial assay results, with further assay results from the finalised drilling expected in early October 2022.

Initial assay results (Data Source: JRL Announcement) | Image Source: © Oranhall | Megapixl.com

JRL has initiated an RC drilling for the remaining 18 permitted holes, with the campaign expected to complete in October.

The drilling is likely to aid in establishing the level of lithium mineralisation across the project while boosting the confidence in Inferred Mineral Resource and translating to Indicated Resource category.

Endeavours to be pure-play US lithium developer

JRL believes that it is suitably financed to continue the advancement and de-risking of the McDermitt Project in 2021-2022.

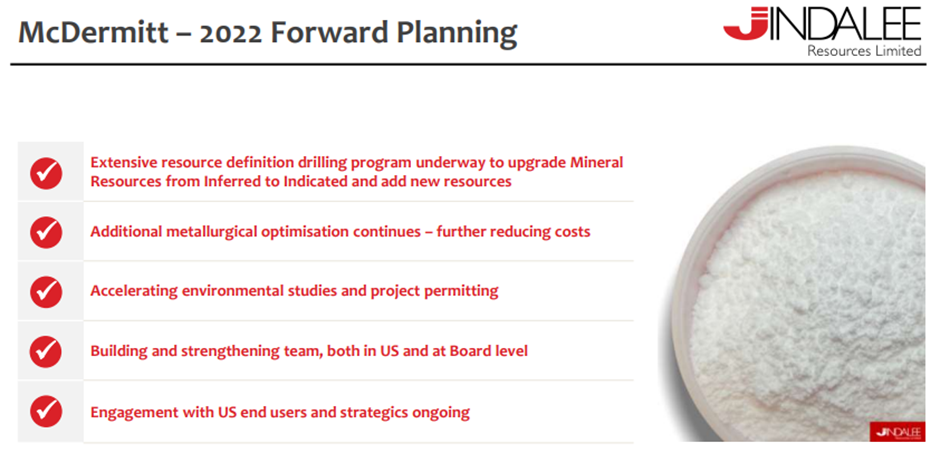

This is backed by the company’s plans for various works, ranging from further metallurgical optimisation to producing lithium carbonate for testing by potential partners and engaging with US investors as well as prospective partners.

Source: company update

In a recent strategic move, JRL announced plans to demerge its Australian asset portfolio via a standalone vehicle, Dynamic Metals. The development is aimed at repositioning Jindalee as a pure-play US lithium developer.

The demerger of the company’s portfolio of other critical commodities in Australia is planned via IPO in early 2023, with a priority entitlement to Jindalee shareholders. The Australian projects hold potential for nickel, lithium, gold, magnesite, and iron ore. The project areas have witnessed extensive historical exploration and are believed to be in highly prospective mineral fields witnessing discoveries to date.

JRL shares traded at AU$2.380 on 23 September 2022.