Highlights

- Jindalee Resources (ASX:JRL) has significantly boosted the McDermitt Mineral Resource with a Total Indicated and Inferred Resource of 1.82 Bt @ 1370 ppm Li for 13.3 Mt LCE.

- The company has initiated infill and extensional drilling at the McDermitt project.

- JRL is gearing up to separate its Australian assets via the formation of Dynamic Metals.

- The company ended the June quarter with AU$10.8 million in cash and securities.

Jindalee Resources Limited (ASX:JRL) has witnessed back-to-back exploration success in recent times. One of the key developments has been the significant increase in the McDermitt Mineral Resource Estimate (MRE).

Moreover, the company saw the commencement of trading on the US OTC Markets, infill and extensional drilling program at McDermitt, and preparation for becoming a pure-play US Lithium Company.

What’s more, the company is in a strong financial position with AU$10.8 million in cash and securities at June-end.

Let us look at JRL’s impressive progress during the last quarter and the subsequent period.

Encouraging MRE upgrade at McDermitt Lithium Project

Subsequent to integrating the results from 12 holes drilled in December 2021, JRL shared an updated MRE in early July for its wholly owned McDermitt Project located in the US.

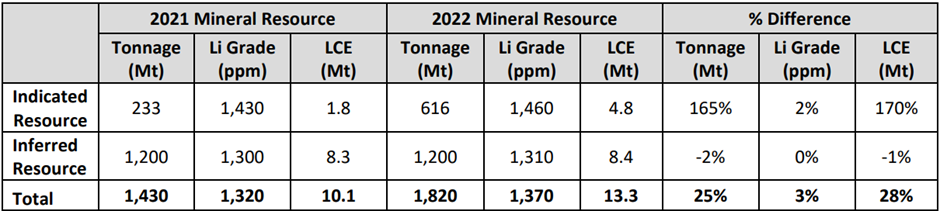

The Total Indicated and Inferred Resource for the project now stands at 1.82 Bt @ 1370 ppm Li for 13.3 Mt LCE. This MRE update indicates an overall boost (from 2021) of 25% in tonnage, 3% in grade and 28% in contained lithium.

Source: JRL Announcement 28/07/2022

JRL has a further 28 drill holes fully permitted to drill in 2022 to infill and upgrade the resource. Moreover, diamond drilling has kicked off at the McDermitt, and an RC rig is expected to arrive in September. Assay results are anticipated during the December quarter.

Currently, JRL is also continuing environmental baseline studies prior to the submission of an Exploration Plan of Operation (EPO) application. Besides this, metallurgical studies are underway at Nagrom to optimise the processing flowsheet.

Recent developments have been encouraging for JRL as they indicate favourable implications for the prospective advancement of the McDermitt deposit.

Image Source: © Franz1212 | Megapixl.com | Data Source: MGV Announcement 28/07/2022

Becoming a pure-play US Lithium Company

JRL plans to separate its Australian assets through a newly listed vehicle, Dynamic Metals Limited. Currently, preparations are underway to form Dynamic. The aim is to focus on the development of the McDermitt Lithium Project in Oregon to become a pure-play, US lithium developer.

JRL’s Board has, however, decided to delay the implementation of the separation amid the recent deterioration in market sentiments toward junior resource listings. The company looks to implement the separation through an initial public offering (IPO) of securities in Dynamic.

Widgiemooltha Project exploration makes headway

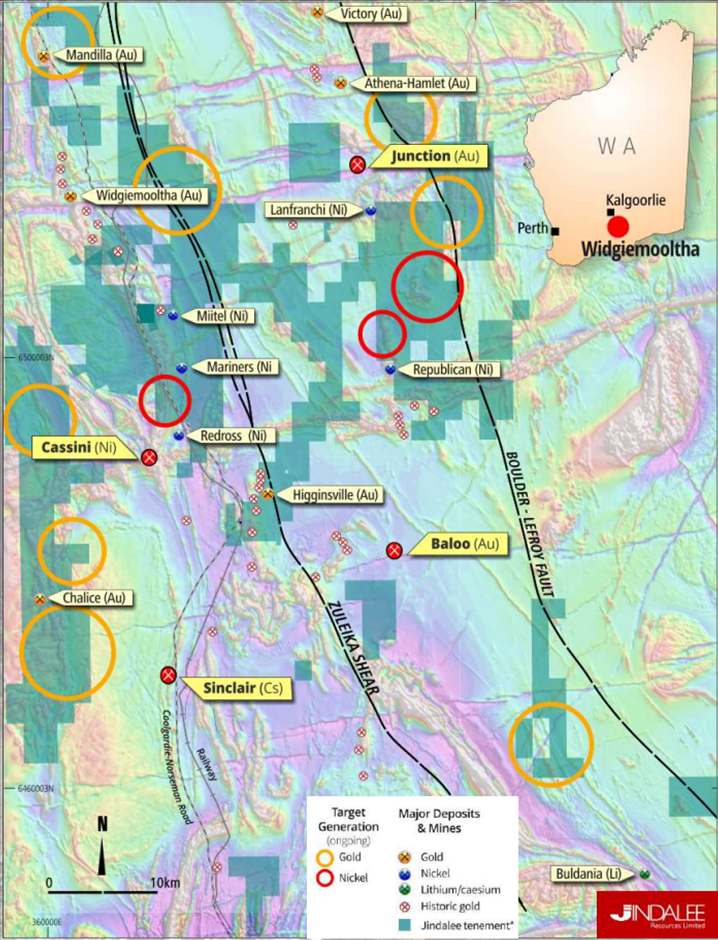

The Widgiemooltha Project is the company’s largest Australian project, with a significant land holding of 880km2 in a highly prospective mineral field.

During the quarter, JRL mostly continued non-ground disturbing activities. Moreover, key tenements were pushed forward for grant and the company’s key focus during the quarter remained on the mapping of lithium pegmatites.

Source: JRL Presentation 28/07/2022

JRL believes that the Heritage Surveys can be concluded in the September quarter in preparation for drilling towards the end of 2022.

Ongoing work at Lake Percy project and Prospect Ridge

At the 100%-owned Lake Percy project, JRL was granted the second tenement in the project area (E63/2088). Moreover, the company lodged a Program of Work (POW) for drilling, which was also approved during the quarter.

The company has initiated preparation for drilling, comprising Heritage Survey requests along with flora and fauna surveys.

At the Prospect Ridge (JRL 30% and GWR 70%), GWR shared its intention to expedite work after a site visit. In early May 2022, GWR provided the details about the initial step of these plans, which includes an RC drill program for infilling the Arthur River deposit to a drill spacing of around 50m x 50m.

The aim is to expand the size and resource classification of the deposit and secure sample material for metallurgical test work and prospective offtake partners.

JRL is committed to advancing key assets while tapping growth opportunities in Tier 1 jurisdictions.

JRL shares were trading at AU$2.510 midday on 04 August 2022.