Highlights

- Jindalee Resources (ASX:JRL) is committed to repositioning itself as a pure-play US lithium developer.

- The company is continuing planning for the separation of Australian assets to form a newly listed vehicle.

- The existing shareholders of JRL are likely to receive a priority entitlement to shares in the proposed new vehicle.

- The Board has approved AU$3.8 million for exploration activities across Australian assets.

Jindalee Resources Limited (ASX:JRL) has provided a significant update concerning plans to separate its Australian assets to form a newly listed stand-alone vehicle. The new vehicle is to be known as Dynamic Metals Limited.

The move is in line with the company’s objective to reposition Jindalee as a pure-play, US lithium developer. This will allow the company to focus its efforts on cranking up its exploration and development activities at its world-class lithium asset in the US. The McDermitt project is one of the largest lithium deposits in the United States.

Separation of Australian assets via IPO

Given the recent softening of market sentiment towards junior resource listings, the JRL Board plans to delay the execution of the separation until conditions become favourable to a stand-alone listing of Dynamic. The execution is expected in the second half of the 2023 financial year.

JRL believes that the separation will most probably be undertaken through an initial public offering (IPO) of securities in Dynamic, taking into consideration the market conditions and regulatory feedback regarding the structure of the transaction.

The existing shareholders of JRL are expected to receive a pro-rata priority entitlement to shares in Dynamic Metals.

Source: © Raywoo | Megapixl.com

Moreover, JRL looks to continuously engage with the Australian Tax Office in relation to demerger relief in case the company moves forward with an in-specie distribution of its stake in Dynamic to JRL shareholders.

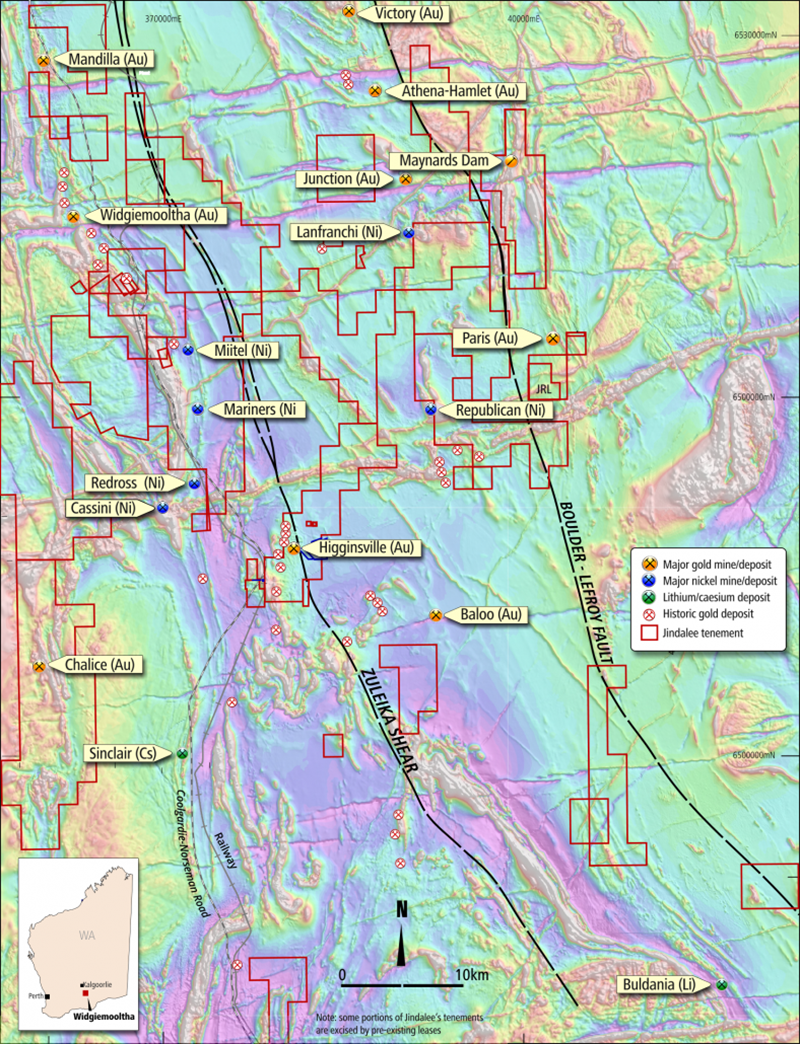

Inside highly prospective project portfolio of Dynamic

Dynamic’s portfolio will entail JRL’s two highly prospective projects for nickel, gold and lithium. Besides extensive landholding in the Widgiemooltha district and the Lake Percy Project, the portfolio will also include the company’s interest in the Prospect Ridge joint venture in Tasmania.

Widgiemooltha Project tenements (Source: JRL)

Moreover, the JRL Board has approved a 24-month exploration programme entailing an investment of AU$3.8 million for Dynamic.

The company looks to offer more information on the proposed programme of exploration works for Dynamic in the near term.

JRL shares traded at AU$2.60 on 13 July 2022.