Highlights

- Jindalee Resources (ASX:JRL) is going full steam at its world-class, Tier 1 lithium deposit in McDermitt.

- McDermitt, located in close proximity to major lithium customers, is expected to materially change US lithium supply dynamics.

- The company is undertaking drilling at McDermitt to infill and extend Mineral Resource.

- JRL plans to demerge its Australian assets in early 2023 as Dynamic Metals via IPO.

Jindalee Resources Limited (ASX:JRL) is progressing its McDermitt Lithium project, a world-class, Tier 1 lithium deposit in the United States. The project hosts a substantial indicated and inferred mineral resource with significant upside. As of July 2022, the Mineral Resource Estimate (MRE) stands at 1.82 Bt @ 1,370 ppm lithium for 13.3 Mt LCE (Lithium Carbonate Equivalent) at 1,000ppm Li cut-off.

The company has a track record of creating value, backed by factors such as world-class assets, experienced management with a history of success, tight capital structure, and low cash burn rate.

Recently, JRL unveiled its strategy to reposition the company as a pureplay US lithium developer. The company now looks to demerge its Australian portfolio of other crucial commodities via a new entity, Dynamic Metals, in early 2023.

The company is fully focused on its McDermitt project, which indicates the potential to significantly contribute to the US lithium supply dynamics, given the proximity to major lithium customers.

Source: © 2022 Kalkine Media®, Data: RL updates

Jindalee sharpens focus on McDermitt amid strong tailwinds

The recent developments in the US that highlight concerns over the country’s dependence on foreign critical mineral sources indicate a major opportunity for JRL. The company believes that this can potentially offer favourable implications for the development of the project.

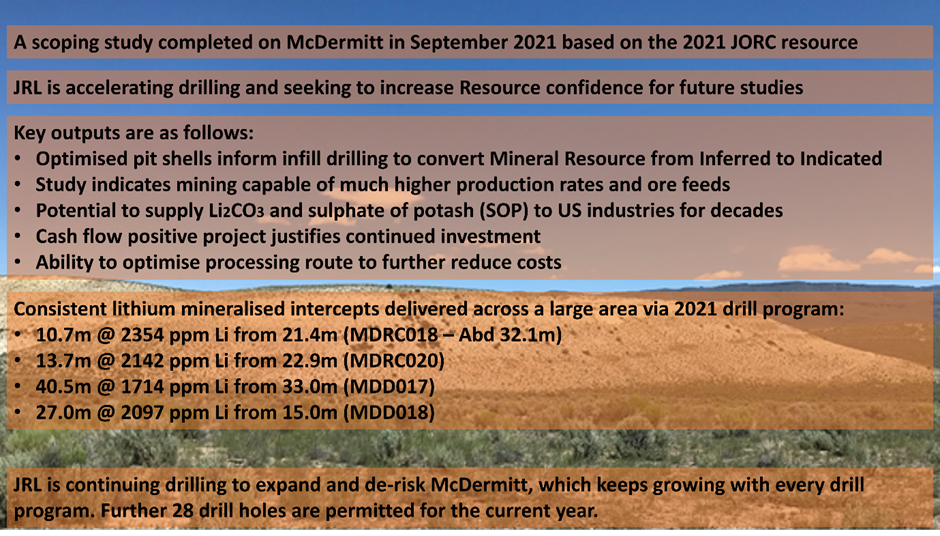

The company’s recent progress across the project includes the following:

Source: © 2022 Kalkine Media®, data source: JRL reports

JRL is going full steam with an extensive resource definition drilling program to upgrade Mineral Resources, and further metallurgical optimisation is progressing. The company is also expediting environmental studies and project permitting work while strengthening its team in the US as well as at the Board level.

JRL is also actively engaged with US end users and is progressing strategics.

Sustainability measures and hot lithium market

In light of the social responsibility commitments in the US, JRL is undertaking various measures to minimise its impact on the environment and the community. The company recognises its responsibility to the environment and the local community and has a dedicated team of experienced environmental consultants.

Lithium prices are expected to improve further, given the forecast demand in the battery industry, specifically in the automotive industry. Moreover, the looming supply shortage of lithium amid growing popularity of electric vehicles suggests strong demand for lithium in the future.

Demerger of Australian assets and forward plan

The Australian assets of JRL are classified into four categories, including the following:

- Widgiemooltha Project

- Lake Percy Project

- Generative Projects (establishing new land positions)

- Joint Ventures (comprises earn-ins and retained interests)

The Widgiemooltha Project is a substantial landholding placed in a highly prospective mineral field where discoveries are being made to date, even though the area has witnessed extensive historical exploration.

The Lake Percy Project covering 180km2 of fully granted tenure north of Lake Johnston region holds nickel, lithium and gold potential

JRL shares traded at AU$2.720 on 23 August 2022.