Highlights

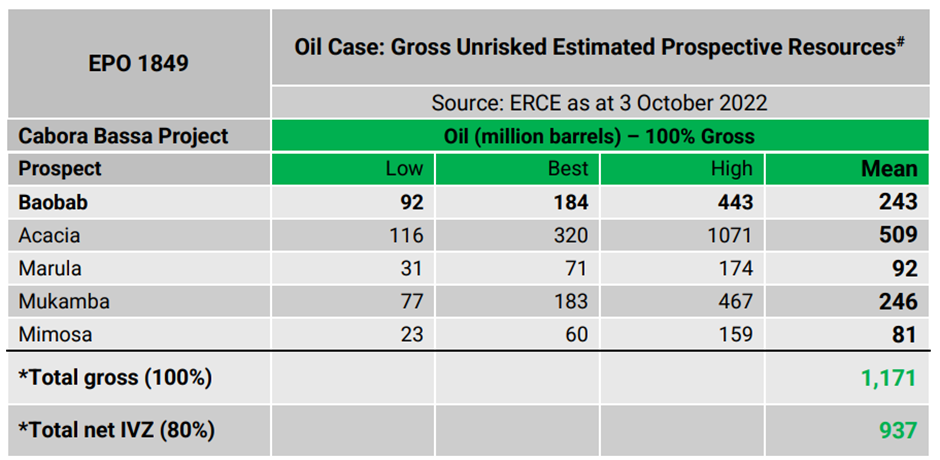

- Invictus Energy reveals an updated ERCE estimate of Independent Prospective Resource of 1.17 billion barrels of oil from five drill ready prospects in Basin Margin Area.

- Currently, the company’s net share of the Basin Margin area prospective resource would be 937 million barrels of oil and 4.4 billion boe for the total project area.

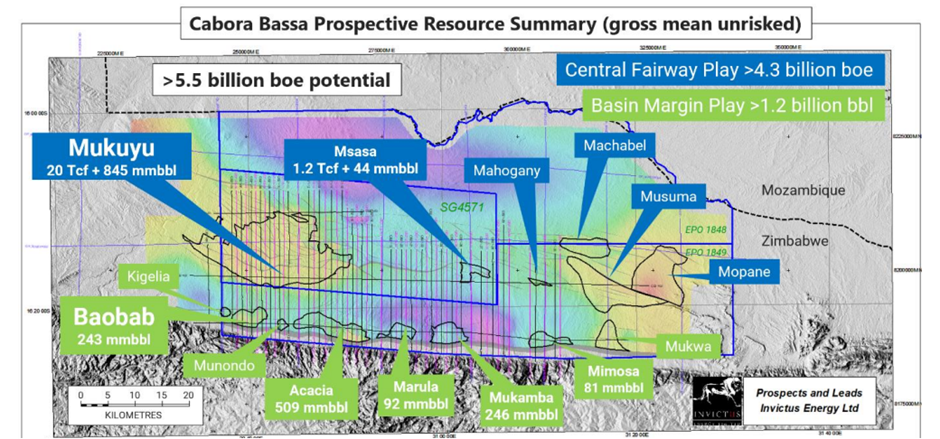

- The estimated total prospective resource base for the Cabora Bassa project portfolio now stands at a combined 5.5 billion boe.

Invictus Energy Limited (ASX:IVZ) shares were trading 6.250% higher at AU$0.212 as of 11:41 AM AEDT on ASX today (6 October 2022). The surge in IVZ share price came on back of the prospective oil resource update released by the company today.

The ASX-listed firm has received an updated Independent Technical Report from ERCE estimating substantial additional resource potential at Cabora Bassa, in the Basin Margin Area of the recently assigned Exclusive Prospecting Order 1849. As per ERCE, the gross mean recoverable conventional potential of the Basin Margin Area estimates at a combined 1.17 billion barrels of conventional oil on a gross mean unrisked basis.

The new prospective resource estimate covers Mukamba, Mimosa, the Baobab, Acacia, and Marula prospects. However, the latest ERCE estimate excludes additional leads along the basin margin and central fairway area.

Now, the estimated total prospective resource base for the Cabora Bassa project portfolio stands at a combined 5.5 billion boe (gross mean unrisked).

Note: Prospective Resource Estimate for Msasa prospect was determined by Getech. The Company confirms that there have not been any material changes to the resource estimate for the Msasa prospect since the release of the updated Prospective Resource Estimate on 1 July 2019

Summary of Basin Margin Oil Case Unrisked Prospective Resource Estimate

Prominence of updated ERCE estimate

Invictus Energy holds 80% share in the Cabora Bassa project. With the latest prospective resource update, the company’s net share of the Basin Margin area prospective resource would equate to 937 million barrels of oil (pre 10% SWFZ back in right) and 4.4 billion boe for the total project area.

The Basin Margin play is now positioned at comparable scale to the prolific East African Rift System which led to material discoveries in the “String of Pearls” plays in Kenya and Uganda.

Cabora Bassa Prospective Resource Summary & Play Map

In-depth details of the ERCE update

New data from the Cabora Bassa 2D Seismic Survey (CB21 Survey) is incorporated in the ERCE prospective resource estimate. CB21 Survey data helped the firm develop a material portfolio of high potential prospects and leads. As per IVZ, the survey has boosted the potential for numerous stacked hydrocarbon bearing zones in the newly identified Basin Margin play.

Initially, the Basin Margin play will be tested by the Baobab-1 well that demonstrates characteristics similar to the play opening discoveries in the Lokichar Basin in Kenya and Albertine Graben in Uganda.

The Prospective Resources have been estimated by ERCE using a conventional oil case as well as a gascondensate case because there remains hydrocarbon phase uncertainty with the source rock depositional type and thermal history.

How’s work progressing at Baobab-1 wellpad?

The construction work at the Baobab-1 wellpad is in progress. Upon its completion, the rig will be moved, while subsequent drilling will begin soon after the Mukuyu-1 well is completed.

Baobab-1 will be drilled as a vertical well for testing numerous stacked Cretaceous and younger targets, within four-way and three-way dip closures, against the southern basin bounding rift fault.

Baobab shows structural characteristics similar to the basin opening Ngamia discovery drilled in the Lokichar Basin in Kenya. Ngamia-1 successfully tested a stacked three-way dip closure that found pay at different horizons and led to discoveries in the “String of Pearls” along the basin margin.

Image: © 2022 Kalkine Media®