Highlights

- Assay results for the Muchea high-grade silica flour met the specifications required by potential customers.

- The company launched an entitlement issue to raise approximately AU$3.14 million.

- The updated BFS at Arrowsmith North validated robust economic metrics and the potential to supply up to four silica sand products for the Asian market.

- The potential mine life of Arrowsmith North exceeds 100 years.

VRX Silica Limited (ASX: VRX) showcased significant progress in its endeavours in the recent quarterly update for the period ended 31 March 2024. The focus was primarily on the promising outcomes from the Muchea high-grade silica flour testwork and updated BFS at Arrowsmith North.

Post the end of the quarter, the company launched a renounceable pro-rata entitlement issue on the basis of one share for every 13 shares held at an issue price of AU$0.07 apiece with the intent to raise around AU$3.14 million. The funds raised through the offer would be used to advance the Muchea project, Arrowsmith North project, environmental follow-up and VDT trials.

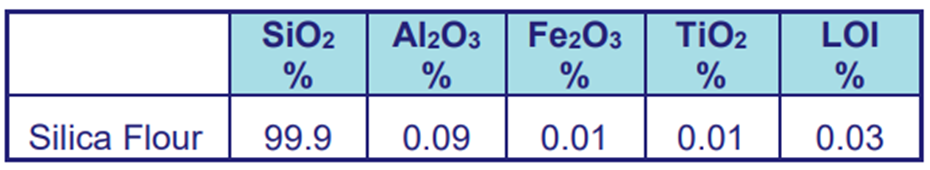

Promising Muchea high-grade silica flour testwork results

During the December quarter, the company airfreighted a 1,000kg sample of selected Muchea silica sand to a specialised testwork laboratory located in Germany. The purpose was to conduct comminution testing aimed at assessing the yield and quality of silica flour achievable from the raw material obtained from the Muchea Project.

The testwork followed a typical flow sheet of ball mill grinding followed by air classification and sizing to deliver the specific particle size required by LCD glass manufacturers. The specification stated by VRX is based on the requirements of large LCD screen producers in Asia.

The testing yielded two critical outcomes: the necessary bond work index (BWI) to decrease the particle size of the Muchea sand feed to meet the product specification, along with the desired product yield. The BWI of 23.7kw/t and product yield of 44.1% has been ascertained.

The BWI enables the company to determine a basic layout and list of equipment for a pilot plant, which once operational would be fine-tuned to provide the required specification and an expectation of an increase in product yield. For designing and construction of the pilot plant, VRX will employ a local engineering company.

The preliminary results of the testwork met its expectations, confirming that Muchea silica sand is suitable for producing high-grade silica flour for the fast-growing LCD glass market.

After the end of the quarter, the company released assays for the high-grade silica flour produced from Muchea. Read more.

Table: Assay results

Image source: Company update

VRX is actively investigating different downstream processing prospects to generate higher-value products, thereby augmenting the worth of VRX's exceptional high-quality Muchea Silica Sand Project.

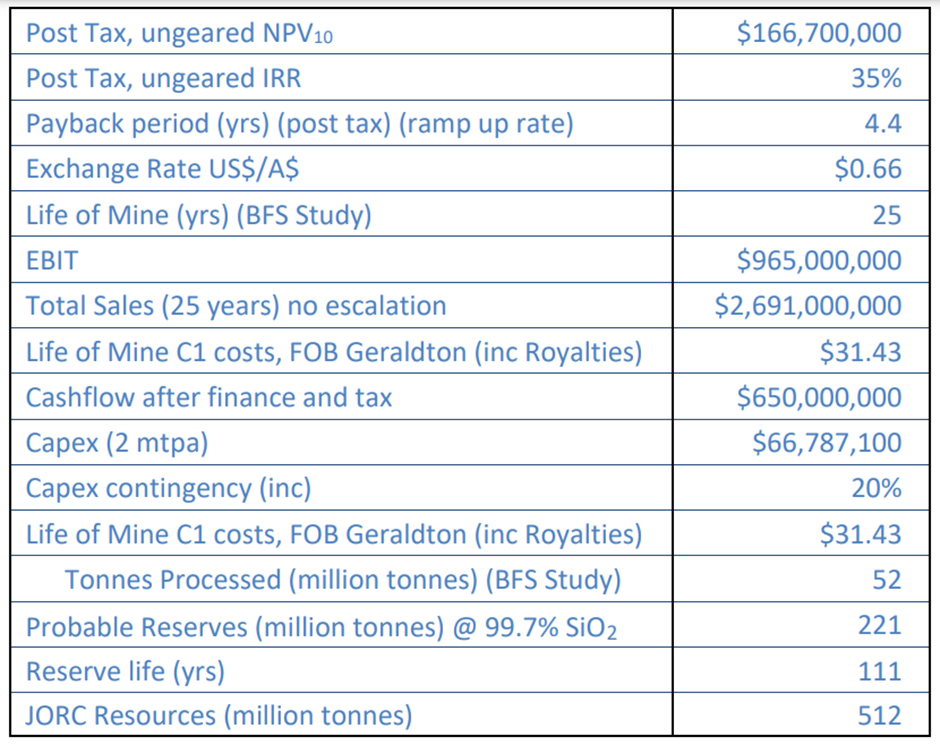

Updated Arrowsmith North BFS suggests robust economic metrics

During the latest quarter, the company shared the details of the updated BFS at Arrowsmith North. The initial BFS from August 2019 it has undergone an update after detailed engineering, with all operating and capital elements recently re-tendered.

The updated study validates the robust economic metrics of the Arrowsmith North, and its potential to supply up to four silica sand products for a growing Asian market.

The capital expenditure update includes the final engineered equipment and supporting infrastructure, along with the acquisition of offset land necessary to complete the approvals process. The operating cost update is derived from budgeted estimates provided by reputable contractors and integrates VRX's distinctive vegetation direct transfer (VDT) rehabilitation approach. The updated BFS includes production from upgraded reserves following a new mineral resource estimate finalised in November 2022.

The potential mine life of the Arrowsmith North is in excess of 100 years. Here’s the key outcomes from the updated BFS:

Image source: Company update

VRX shares traded at AU$0.07 apiece on 26 April 2024 with a market cap of AU$40.83 million.