Highlights

- The Bankable Feasibility Study (BFS) for the Arrowsmith North Silica Sand Project has been updated following detailed engineering.

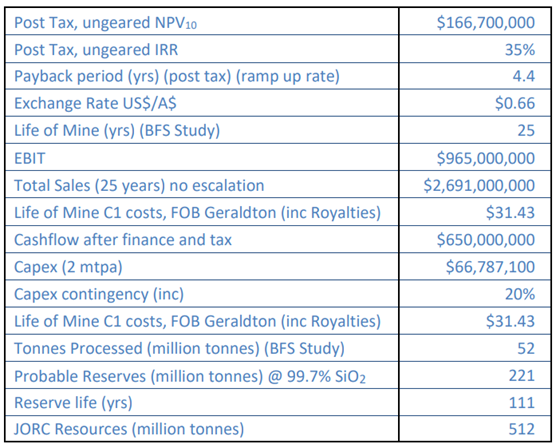

- Robust financial metrics have been reported through the updated BFS.

- Ungeared NPV10 of AU$167 million has been reported based on 25 years of mining from a resource exceeding 100 years.

- The environmental approvals process is expected to be concluded soon.

VRX Silica Limited (ASX: VRX) has announced robust financial metrics from the updated Bankable Feasibility Study (BFS) at its Arrowsmith North Silica Sand Project, Western Australia. The update follows detailed engineering with all capital and operating components recently re-tendered. The initial BFS was prepared in August 2019.

Robust financial metrics revealed through the updated BFS

The updated study suggested ungeared NPV10 of AU$167 million based on 25 years of mining of a +100 year resource. Proved and Probable Ore Reserve stands at 221Mt @ 99.5% SiO2.

Although capital expenditure has increased compared to the 2019 BFS, it remains modest with a payback of nearly 4.4 years. The increase is attributed to:

- A change in the process circuit expected to deliver superior products but initially incurring higher costs.

- A jump in steel, construction and concrete labour costs for the processing plant. Notably, rices of fabricated steel have doubled since 2019.

- Additional costs related to supporting infrastructure, flotation reagent storage and power reticulation.

- Extra costs for road construction, as well as the design and approval of the Brand Highway intersection.

- Acquisition of offset land to align with State Offsets Policy guidelines.

Key financial metrics (Image source: Company update)

In November 2023, the company finalised the mineral resource estimate. Production from upgraded reserves following a new MRE has been included in the updated BFS.

Meanwhile, the company reports that the environmental approvals process is nearing completion and VDT trials are set to commence.

VRX shares traded at AU$0.102 apiece on 6 March 2024.