Highlights:

- The proved ore reserves at VRX’s Arrowsmith North Silica Sand Project were determined to be 9.2 Mt, while the total ore reserve value was updated to 221 Mt.

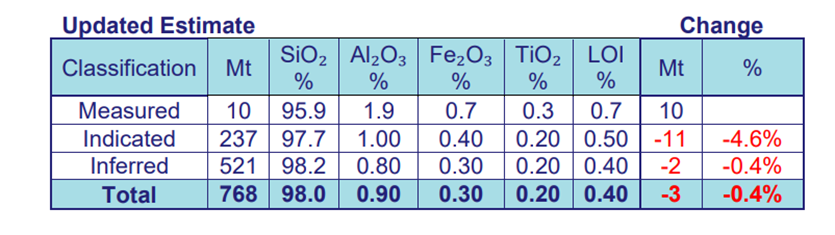

- The updated mineral resource of 768 Mt @ 98.0% SiO2 includes a measured resource of 10 Mt @ 95.9% SiO2.

- Pilot plant testwork of a bulk metallurgical composite confirmed product specifications for marketing and offtakes.

- VRX Silica Limited (ASX:VRX) shares were trading at AU$0.160, up 10.34%

Western Australia-based pure-play silica sand producer VRX Silica Limited (ASX:VRX) has updated the mineral resource estimate (MRE) and ore reserve statement (ORS) for the Arrowsmith North Silica Sand Project.

VRX has been making marked progress at the Arrowsmith North project, having completed the mining and processing pre-production activities and the analysis of saleable products.

MRE

The MRE was updated based on the drilling of an additional 130 close-spaced grade-control aircore (AC) holes.

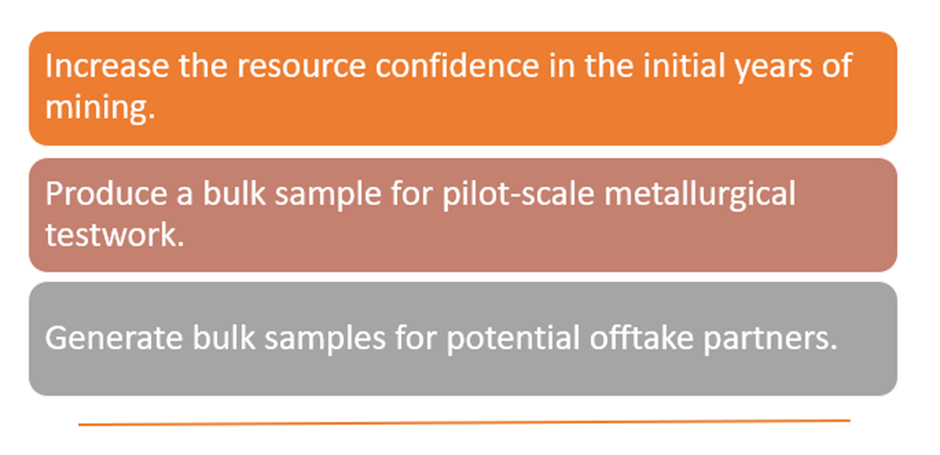

The drilling of the holes was a pre-production activity intended to:

Source: Company update

The MRE covers a spectrum of data and activities ranging from the project geology to the reasonable prospects, as discussed below.

Geological interpretation: The project is situated in the coastal regions of the Perth Basin. The company completed its geological modelling based on government soil mapping data and the data from auger and AC drill logging.

The targeted silica sands are covered by a 300 m thick humus layer and underlain by limestone.

Drilling, sampling and subsampling techniques: The drilling operation involved AC and hand auger methods with drill spacing of 400 m (east) by 1,000 m (north) along the section lines. These vertical AC holes had an average depth of 10.9 m.

From 1 m downhole intervals, 100 mm screw auger drilling samples, typically weighing 8 kg, were taken.

The AC drilling samples were taken from 1 m downhole intervals and weighed approximately 2-3 kg. The drill samples were divided into two subsamples weighing 200 g each and marked as A and B. These were then bagged and ticketed with sample numbers before being sent to the analytical laboratory.

Sample analysis: Analysis included drying and pulverizing of samples (particle size to -75 μm) for four-acid-digest multielement analysis. This was followed by inductively coupled plasma optical (atomic) emission spectrometry analysis.

Mineral resource classification: The classification is based on the guidelines issued in the JORC Code, with the mineral resource being classified as a combination of Measured, Indicated, and Inferred.

Source: Company update

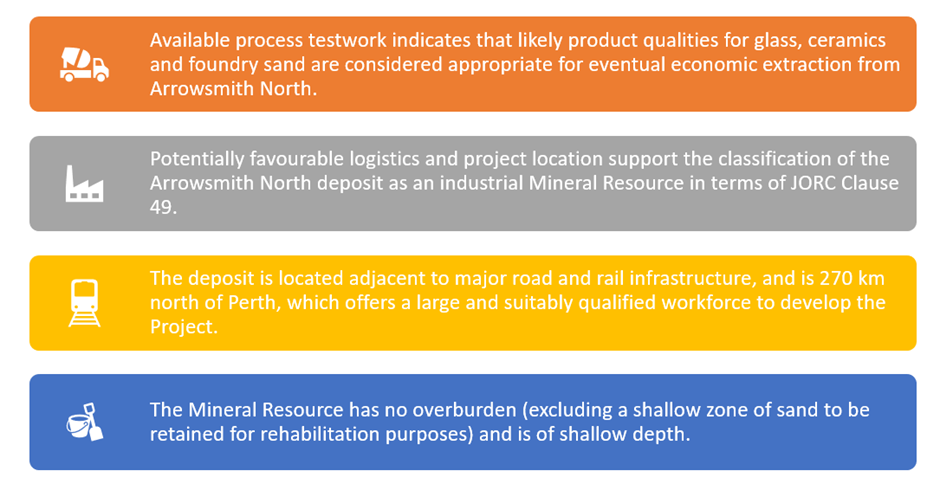

Reasonable prospects hurdle: As per VRX’s update, the Competent Person believes that there are reasonable prospects for economic extraction based on the following attributes:

Source: © 2022 Kalkine Media®, data source: company update

Pilot plant testwork: The company is conducting a pilot testwork program covering fundamental process unit operations as per the present process design: elutriation (mimicking the constant density tank), attritioning, and a HydroFloat® pilot.

The testwork is being conducted on three parcels of material (totaling ~3 t) representing the project's resource average.

Ore reserve estimate update

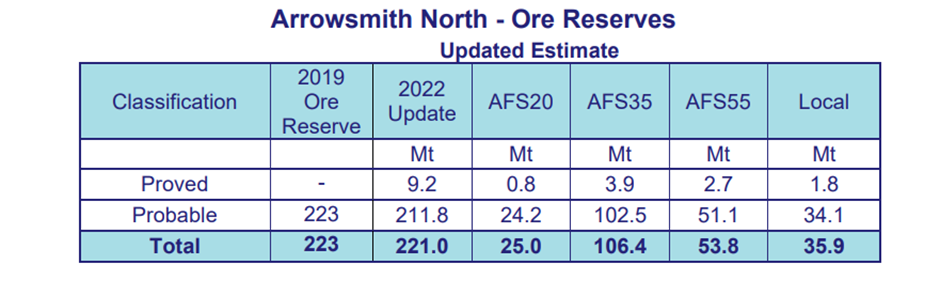

The company engaged Cube Consulting to provide an updated ore Reserve estimate for Arrowsmith North. Based on this, the 2019 probable ore reserve of 223 Mt has been updated to proven ore reserves of 9.2 Mt and probable ore reserves of 211.8 Mt, as shown below.

Source: Company update

The updated ore reserve estimate follows the guidelines in the JORC Code.

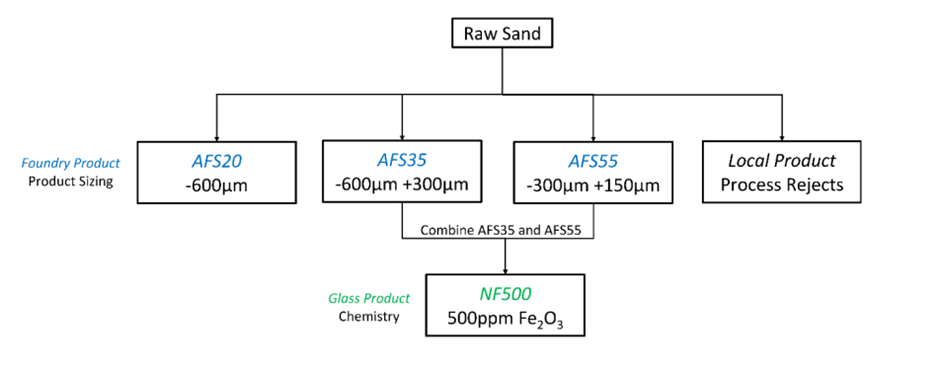

Mining parameters and scheduling: The company has planned to mine the entire resource and process it into four distinct product categories, as shown below:

Source: Company update

The Tails, Local Product, as shown below, are the result of sizing processes for the -150 μm size and from the hydrofloat for the coarser sizings.

Source: Company update

Management comment

Source: © 2022 Kalkine Media®, data source: company update

Way ahead for VRX

The company has concluded all the mining and processing pre-production works. Additionally, the production of the final products’ bulk material and the planned processing plant’s detailed engineering design are on the verge of completion.

Furthermore, the company is in the final stages of gaining regulatory approval to commence construction in 2023.

Click here to know about the company’s FY22 highlights.

VRX Silica Limited (ASX:VRX) shares were trading at AU$0.160, up 10.34% on 11 November 2022.