Highlights

- VRX Silica (ASX:VRX) has made notable progress across its asset portfolio, including the results of further bulk testwork programs at Arrowsmith North.

- VRX also declared a Mineral Resource Estimate for its Boyatup Silica Sand Project during the quarter based on the drill samples gathered.

- VRX has also advanced various infrastructural works across its projects.

VRX Silica Limited (ASX:VRX), the pure-play silica sand explorer and developer, has reported its activities conducted during the September 2022 quarter.

These works have been carried out at VRX’s silica sand projects located in Western Australia, including Arrowsmith North, Arrowsmith Central, Muchea, and Boyatup.

Let us have a detailed view of the company’s advancements across its project portfolio during the September quarter.

Results received for additional bulk testwork programs at Arrowsmith North

VRX is continuing a revised capital estimate on a customised 2Mtpa processing plant with a distinct patented custom process circuit.

During the September quarter, VRX received results of additional bulk testwork programs that were undertaken during the earlier two quarters. These programs delivered enough final product for the large samples needed for glassmaking furnace testing and foundry resin coating testing.

VRX has identified long-lead items and has also initiated the specification and production of tender documentation of processing equipment for the plant. This will help in a timely construction program after a decision to mine at Arrowsmith North is made.

Infrastructural developments at Arrowsmith North

On the engineering front, VRX is continuing the final design phase to shop the detailing of all departments. Moreover, the company has also updated the finalisation schedule with new lead times for major equipment.

VRX has successfully drilled a process water bore, along with the completion of monitoring boreholes for the borefield. The plant is designed to operate primarily with recycled water.

With numerous gas wellheads located in close proximity to the project area, VRX is engaged in the evaluation of the possibility and costs of developing a power supply from locally produced LNG.

VRX is also engaged in discussions for finalising its logistics plans with Mid West Ports Authority and with the rail owner, Arc Infrastructure. Besides this, VRX has access to the neighbouring Brand Highway, and approval is pending for the 100% detailed road intersection plan submitted to Main Roads.

VRX has been focused on gaining approval for the development of the Arrowsmith North project shortly after the tenements were acquired. During the June quarter of 2022. VRX submitted the Environmental Review Document (ERD) with the EPA for the project, and the company expects to receive the final EPA approval in December 2022. Following this, the six-month construction phase is slated to begin in January 2023, subject to Ministerial Consent.

In terms of key plant equipment, VRX has commenced the purchase of equipment, the banana screen, which has been stripped and assessed for refurbishment by the original manufacturer and post painting the work is complete.

Source: VRX

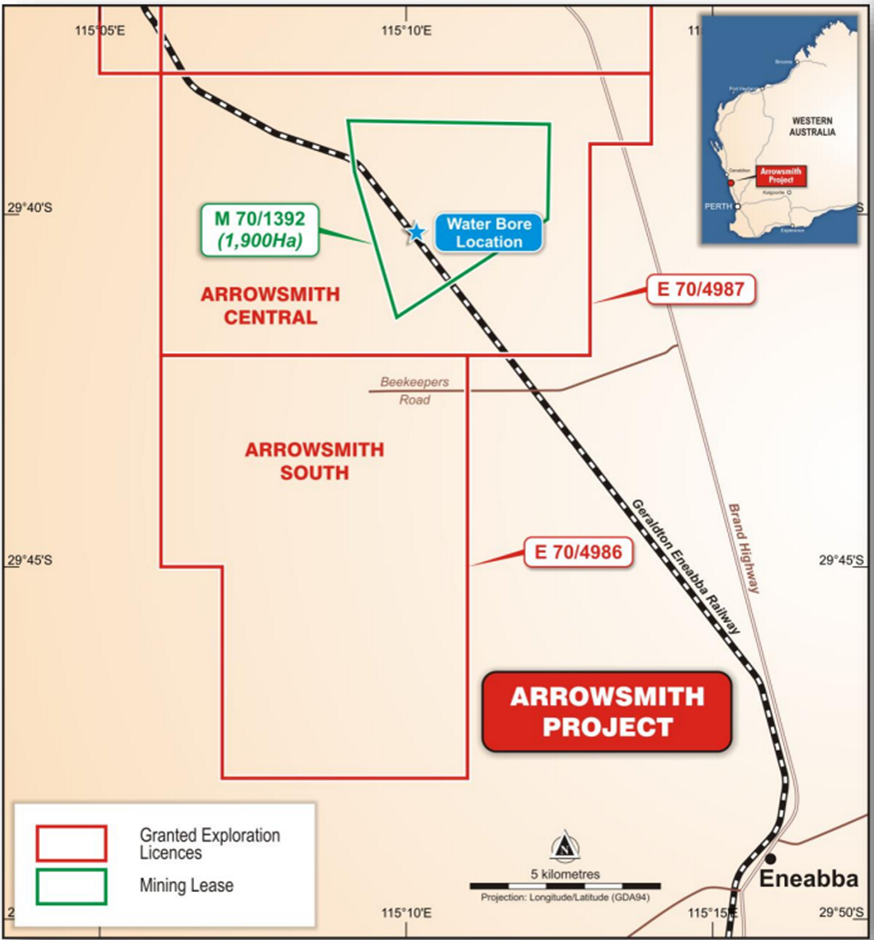

Water bores work underway at Arrowsmith Central

VRX’s second silica sand project under development is Arrowsmith Central, which has advanced to the next stage of the environmental approval process with the EPA.

Currently, VRX is waiting on the EPA response against an environmental scoping document, which was lodged by the company in June 2022. VRX remains confident that the project meets all the guidelines for assessment.

Source: VRX

In early September, VRX declared the completion of the test holes for two production water bores, with logging and test pumping underway. VRX had made an application for the allocation of 900,000 kilolitres, which has been accepted by Commonwealth Department of Agriculture, Water and the Environment (DWER).

Source: VRX

Advancements at Muchea

VRX has received numerous offtake enquiries for Muchea silica sand from the Asian markets. The company remains confident that such high-grade silica sand with a low iron content will remain in high demand.

On the environmental studies front, VRX is progressing with detailed springtime flora and vegetation studies over a selected priority area of 350Ha. VRX also plans to undertake numerous activities as part of these studies.

Source: VRX

VRX also completed 54 holes under a drill program for generating a two-tonne sample. This sample will be used in another pilot plant metallurgical test work program. Additional samples were also delivered through the program, which will be tested given the significant interest from potential offtake partners.

MRE declared for Boyatup

VRX declared a Mineral Resource Estimate (MRE) for its Boyatup Silica Sand Project during the quarter. The MRE is based on a comprehensive collation of assays, and particle size distribution on the drill samples gathered.

Source: VRX

VRX is now planning a metallurgical testwork program to ascertain the description of the potential products that can be generated from the in-situ sand resource at the project. Upon identification of these products, VRX looks to execute a marketing study to assess the focus to maximise the economic value of the project.

VRX continuing ESG reporting

Futureproof Consulting, an ESG specialist, had been assisting VRX in completing its FY22 Sustainability Report during the quarter. This report was published and included in the 2022 Annual Report released recently.

As VRX remains conscious about its social licence obligations, it intends to continuously keep track of and report on its sustainability progress.

VRX’s financial position at quarter end

During the quarter, VRX was granted General Purpose Leases G70/264, G70/265 & G70/266, and the company applied for Mining Lease M70/1418.

VRX’s exploration and evaluation expenditure for the quarter was AU$1,370,000, and the company held cash and cash equivalents of AU$7,044,000 at quarter end.

Key events post September quarter

Subsequent to the quarter end, VRX lodged a detailed application on 12 October 2022 as the company was shortlisted and invited to progress to Stage 2 of an initiative of the Western Australian State Government.

Under the initiative, selected applicants will be eligible for financial assistance via grants and other incentives, subject to a financial assistance agreement from the Investment Attraction Fund.

Besides this, VRX conducted a comprehensive heritage site identification survey over a priority area, to discover and know Aboriginal heritage values within this area. This would further help in future dialogue with the Whadjuk people about the planned mining project.

VRX expects the survey results in the December quarter.

VRX stock was noted at AU$0.135 on 04 November 2022.