Summary

- Saunders utilises in-house expertise to provide a comprehensive range of projects that includes design, manufacture, construction, installation, and maintenance services

- Its core business focus since inception has been to provide clients with innovative and cost-effective solutions for their individual project specifications

- A record orderbook and strengthening pipeline of new opportunities underpin the future growth for Saunders, as the Company positions for growth

- Currently, while the Company continues to remain focused on preservation of cash via reduced discretionary operating and capex, revenue guidance for FY20 is in the range of $66 - $70 million with EBIT margin forecast of 1.8% - 2.3%

Enriched with an experience of 69 years, Saunders International Limited (ASX:SND) operates as a multi-disciplined engineering and construction company, providing solutions to the bulk liquid storage, industrial, energy, defence, resources, and road and rail infrastructure sectors. The Company has a national presence throughout Australia besides Saunders PNG entity and operations around the Pacific Rim.

An active contributor to the development of Australian industries, SND has managed to work closely with several original oil majors including Mobil, BP, Shell and Caltex since the 1960s. Its clientele has expanded to include a diverse combination of industries, for instance, mining sector players and water utilities.

In this backdrop, let us skim through Saunders’ positioning in the business of civil infrastructure-

Saunders’ Civil Infrastructure Business

Over many years, the Company has developed a reputation for accomplishing challenging projects through innovation design alternatives and construction methods.

In the business of civil infrastructure, the Company holds expertise in the areas of precast concrete, concrete foundation works for heavy industry, bridge construction works, foundation systems, jetty and wharf construction, and building and construction management. Saunders Civilbuild, which has an experience of over 5 decades, is focused on undertaking projects covering the construction, upgrade and maintenance of road and rail bridges, wharves and jetties for state authorities, local government, major mining, and private sector clients.

Owing to strategic long-term relationships with local government authorities, the Company’s core strategic objective/ priority in this business is to expand national civil infrastructure footprint and develop bridge maintenance business.

Saunders’ Projects in Civil Infrastructure

Before diving into the Company’s projects pertaining to civil infrastructure, it is important to note that this business was one of the top contributors to the Company’s impressive orderbook in HY20-H1. Moreover, the orderbook, which was reported at $ 97.1 million in the first half (up by a whopping 60.5% relative to 30 June 2019) is currently in excess of $ 107 million.

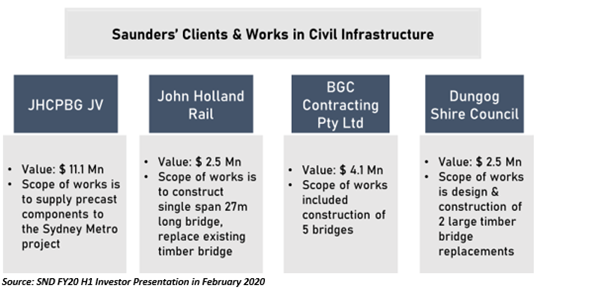

Now that we understand the significant contribution of civil infrastructure in the Company’s growth, let us look at four clients from the business-

JHCPBG JV

For JHCPBG JV, in a project valued at circa $ 11.1 million, Saunders’ scope of works includes supplying precast components to the Sydney Metro project. Particularly, the Company is involved in the supply to Chatswood, Marrickville and Barangaroo sites.

It should be noted that Sydney Metro is Australia’s largest public transport project and comprises of 31 metro stations and over 66km of new metro rail.

John Holland Rail

For John Holland Rail (JHR), in a project valued at circa $ 2.5 million, Saunders’ scope of works includes construction of a single span 27m long bridge over the North Coast rail line at Martins Creek to replace the life expired existing timber bridge. Works will also be inclusive of construction of 200m of approach roadworks either side of the bridge.

It should be noted that this project marks the second contract awarded to Saunders Civilbuild by JHR in Martins Creek.

BGC Contracting Pty Ltd

For BGC Contracting Pty Ltd, in a project valued at circa $ 4.1 million, Saunders’ scope of works includes construction of five bridges for the client on the section south of Yambacontr. As updated towards the end of February 2020, this project was in the final stages of completion, with all structures completed.

It should be noted that the BGC Woolgoola to Ballina Pacific Hwy upgrade project is the largest regional public infrastructure project of Australia.

Dungog Shire Council

For Dungog Shire Council, in a project valued at circa $ 2.5 million, Saunders’ scope of works includes design and construction of two huge timber bridge replacements for Dungog Council. Saunders is likely to deliver a turnkey solution to the council, covering design, construction, and precast supply.

Driven by commitment to safety, innovation, excellence and growth, Saunders continues to deliver high-quality engineered solutions across the complete asset lifecycle. The stock has been garnering investor traction, evident from its performance on 9 July 2020 at AEST 02:32 PM, when its stock was trading upward by 3.774 per cent to $0.550. YTD returns were noted at 63.08%.

(Note: All currency in AUD unless specified otherwise)