Highlights

- XRD analysis at Andover Project confirmed spodumene as a dominant lithium mineral.

- Independent technical analysis defined five new potential target zones at Andover South Project.

- Soil sampling at Mt Sholl defined multiple lithium in soil trends along strike of GreenTech Metals’ (ASX:GRE) Osbourne JV pegmatite discovery.

- In the latest quarter, the company secured 100% of LCT and Ni-Cu-PGE mineral rights as well as entered into an MoU over Mt Sholl with First Quantum Minerals.

- RDN secured 100% LCT mineral rights over the Arrow Lithium-Gold project.

Raiden Resources Limited (ASX: RDN, DAX: YM4) reported significant progress across its Western Australian projects in the latest quarter ended 31 December 2023.

In the quarter, the company received further encouraging rock chip sampling assays for its Andover South project in the Western Australian Pilbara region. The company defined new potential target zones and confirmed spodumene as dominant lithium mineral at the project.

The period saw the company securing 100% of rights in Arrow Minerals’ (ASX:AMD) WA-based lithium Arrow project.

The company also signed an MOU with First Quantum Minerals Australia covering the Mt Sholl project rights in the Pilbara region of Western Australia.

Andover South Project - Significant results, new targets

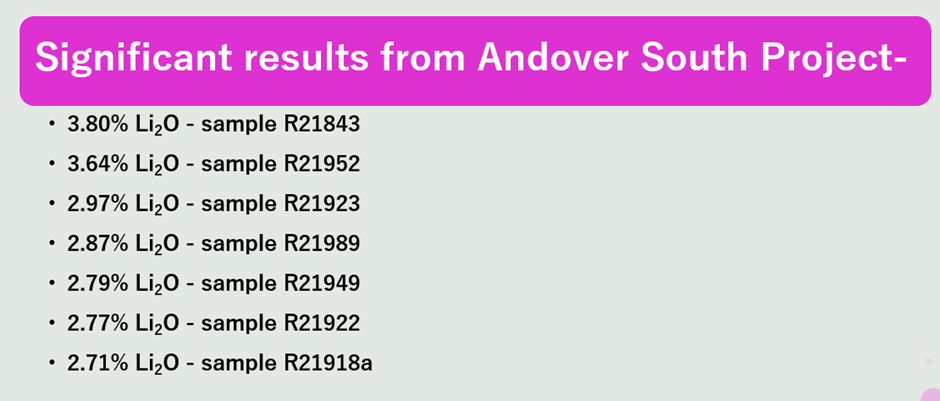

Throughout the quarter, detailed structural mapping and outcrop sampling campaign was conducted at the Andover Project while the company gathered data required to plan upcoming drill campaign.

Out of 143 rock chip samples, 34 samples, representing 24% of the total samples returned >1% Li2O. These results boost the company’s confidence in the high-grade nature of outcropping pegmatite at Andover South.

Data source: Company update

In November 2023, RDN engaged CSA Global to extend support in the re-evaluation exercise of the project. The field program comprised re-mapping of the defined pegmatites and assessment of the outcrop.

Independent technical analysis by CSA Global highlighted five new potential target zones at the Andover South Project.

Further semi-quantitative XRD analysis was undertaken by the company on whole rock chip samples which were gathered in late August 2023. Selected samples had previously returned 2.14% and 2.11% Li2O values.

The XRD analysis confirmed the previously reported results that spodumene might be the dominant lithium bearing mineral. The most significant result included 29% spodumene returned in one of the samples.

After finalising the drilling campaign, the company plans to send larger, representative samples for further analysis.

In October 2023, the company informed that it had entered into a Deed of Variation. With this development, five recently acquired tenements at Andover Lithium project were added to the existing Native Title and Heritage exploration Agreement with the Ngarluma Aboriginal Corporation.

Mt Sholl Project – MoU, New Mineral Rights

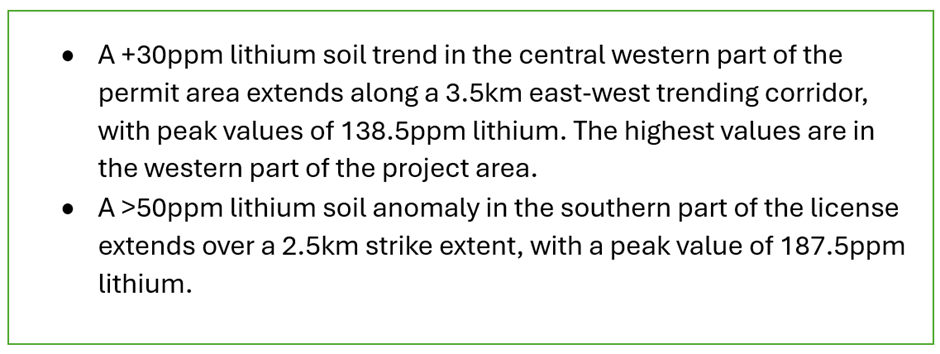

In the last quarter, a soil sampling program was executed over the northern tenement of the project, in which samples were tested for full suite of LCT elements and other elements.

The results to date have defined multiple different geochemical trends.

Data source: Company update

During the period, the company secured full LCT and Ni-Cu-PGE mineral rights at Mt Sholl. Moreover, RDN executed a memorandum of understanding over the Mt Sholl project with First Quantum Minerals Australia Ltd. To know more, read here.

In early 2024, the company plans to undertake follow-up programs.

LCT Mineral Rights at Arrow Project

RDN also secured 100% of LCT Mineral Rights at Arrow project. Reconnaissance work has defined outcropping pegmatites and visually confirmed spodumene mineralisation on the Arrow project. Read more.

RDN shares traded at AU$0.022 midday on 8 February 2024.