Highlights

- An MOU has been executed with First Quantum Minerals Australia (FQMA) over the Mt Sholl Ni-Cu-PGE project.

- FQMA would fund the project solely to earn up to 70% equity in the project.

- Raiden retains gold and Lithium-Caesium-Tantalum (LCT) rights over Mt Sholl and a 30% free-carried interest up to decision to mine.

- A binding letter agreement is expected to be executed in coming months.

Raiden Resources Limited (ASX: RDN, DAX: YM4) has entered into a non-binding memorandum of understanding (MOU) with FQMA over the Mt Sholl Ni-Cu-PGE project rights. Under the MOU, FQMA would fund the project solely up to decision to mine (DTM).

As per the terms, FQMA gets the option to earn into a 70% interest in the project through staged investments, while RDN retains a 30% free-carried interest till DTM and gold and LCT rights.

FQMA will have one year (starting from the date of execution of agreement) to undertake an agreed due diligence program for an option to enter an earn-in agreement. To earn a 70% equity in the project, the firm needs to sole fund at least AU$25 million over eight years on exploration and related studies.

RDN would get AU$10 million in staged cash payments throughout the exploration cycle.

Details of the transaction

Stage 1

Due Diligence - FQMA has committed to undertake following activities during the due-diligence period-

- Fulfil all minimum expenditure needs to maintain the licenses linked with the project.

- Undertake ground based electrical geophysical programs (EM and IP) across the identified favourable intrusive body to screen the deposit for large sulphide accumulations to ~500m depth.

- Execute reverse circulation and diamond drilling programs totalling at least 3,000m.

- Finance and support selective metallurgical studies.

- Direct at least AU$1.5 million of agreed expenditure towards in-ground studies and campaigns.

- For reimbursement of costs, the firm is required to pay AU$250k to RDN.

Stage 2

In the Stage 2 of the transaction, FQMA gets the option to acquire 51% of the project, by accomplishing these milestones-

- Finalise a joint venture agreement within three months of Stage 2.

- Fulfil all expenditure commitments related to the tenure to ensure that the project is in favourable standing.

- Maintain annual in-ground expenditure of at least AU$2.5 million.

- Invest AU$12 million in exploration within three years of commencement of Stage 2.

- Pay AU$750k in cash to RDN on execution of the JV agreement.

Stage 3

After the conclusion of Stage-2, FQMA is required to inform RDN within 90-days of completion, whether it wants to enter in Stage 3 to acquire additional 19% interest in the project, bringing the total project interest to 70%.

In Stage 3, FQMA is required to –

- Take up the role of project administrator.

- Maintain an annual in-ground expenditure of AU$3 million.

- Invest AU$25 million in exploration within four years of beginning of Stage 3.

- Establish a JORC compliant resource in one or more deposits of >300kt contained Ni equivalent.

- Pay additional AU$4 million to RDN in equal instalments. Instalments to begin with the beginning of Stage 3.

- At the end of Stage 3, final cash payment of AU$5 million will be made to RDN.

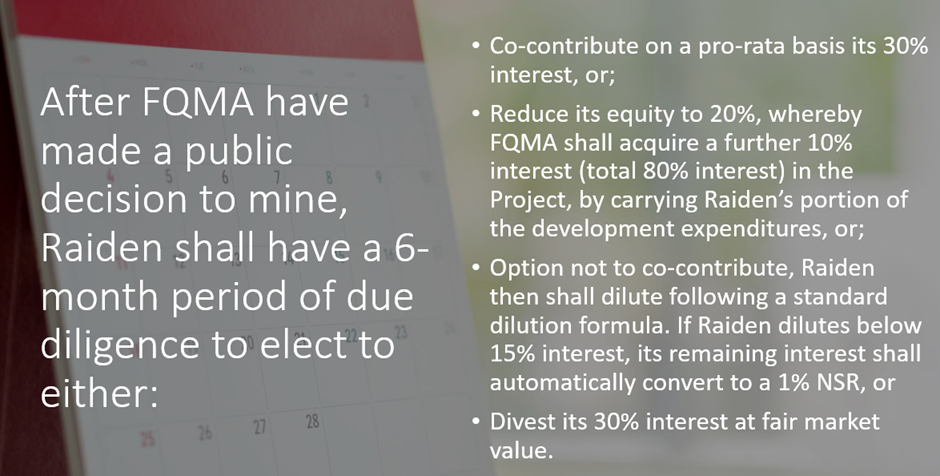

After completion of Stage 3, FQMA is required to maintain all licenses in favourable standing and conduct studies and campaigns to assist the decision to mine.

During Stage 4, at any time, FQMA can announce about the DTM publicly and sole fund programs and studies until the permits essential for commencement on construction of the mining project are received.

Data source: Company update

The ongoing metallurgical studies on Mt Sholl are planned to be advanced under the proposed partnership with FQMA.

RDN shares traded at AU$0.035 apiece at the time of writing on 13 December 2023.