Highlights

- Raiden has secured 100% of Lithium-Caesium-Tantalum (LCT) and Ni-Cu-PGE mineral rights across the Mt Sholl project.

- For the transaction, Raiden would pay AU$1.5 million in cash and issue consideration shares worth AU$2 million.

- Drilling near Mt Sholl project has hit pegmatite mineralisation, suggesting LCT mineralisation potential in the region.

Raiden Resources Limited (ASX: RDN, DAX: YM4) has acquired a 20% interest in 12 tenements from Welcome Exploration Ltd that comprise the Mt Sholl project. With this development, the company has 100% of Lithium-Caesium-Tantalum (LCT) and Ni-Cu-PGE mineral rights over the project.

The company believes in the lithium-beaning pegmatite mineralisation potential at Mt Sholl.

Under the agreement, for securing 20% of tenement holdings from Welcome, RDN would make a cash consideration of AU$1.5 million and issue AU$2 million worth of shares at AU$0.05 issue price.

In addition, AU$5 million of milestone payment is included in the agreement. It is payable when RDN makes a decision to mine on any tenement with respect to any mineral (excluding gold).

Prospectivity of Mt Sholl

Recently, GreenTech Metals Ltd (ASX:GRE) announced lithium in soil anomalies and pegmatite drill intercepts. Backed by this development, Raiden conducted a soil sampling campaign over the most prospective zones, considered by the company. The results defined multiple multi-km lithium in soil tends and anomalies. The defined anomalies appear to be associated to the recent discoveries on the eastern part of the project.

In early 2024, the company intends to conduct follow up groundwork on these anomalies, expected to deliver additional targets for follow up drilling.

MRE and JORC Exploration Target for Mt Sholl

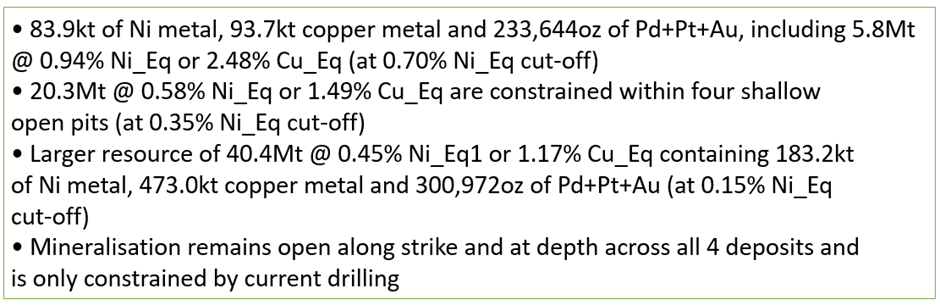

Maiden JORC Mineral resource estimate (MRE) of the Mt Sholl stands at 23.4Mt at 0.60% Ni_Eq or 1.54% Cu_Eq containing -

Data source: company update

The JORC Exploration target is 80 – 150Mt at a grade range of 0.45% - 0.75% Ni_Eq or 1.15% - 1.95% Cu_Eq.

More about the agreement

The shares to be issued as part of the consideration will be under voluntary escrow for six months from the date of completion of the proposed agreement. Before the completion, a voluntary restriction deed is planned to be signed by the vendor to implement the escrow agreement.

As per the agreement, the vendor would maintain a 20% stake in the gold rights in Mt Sholl, free carried to a final investment decision.

RDN shares traded at AU$0.031 apiece on 13 December 2023.