Highlights

- At Xanadu West, second phase reverse circulation (RC) drilling defined large zone of oxide gold mineralisation.

- Cash balance at the end of quarter stood at AU$8.3 million.

- Drilling is planned at the Beete Project after obtaining Plan of Works (POW) approval.

Platina Resources Limited (ASX: PGM) made significant progress in advancing its Xanadu Gold Project during the latest quarter ended 31 March 2024. With focus on exploration and development, the company conducted a second phase of reverse circulation (RC) drilling at the project, yielding promising results. The successful drilling campaign has further validated the project's potential for oxide gold mineralisation.

The mining and exploration company had cash balance of AU$8.3 million at the end of March quarter and tradeable equity investments of AU$0.18 million. Additionally, PGM holds 49 million shares in Major Precious Metals Corp.

Platina also noted the potential receipt of milestone payments of up to US$6 million from a subsidiary of Rio Tinto Limited, as well as the return of a US$1 million warranty guarantee associated with the sale of the scandium project.

Oxide gold mineralisation potential at Xanadu Project

At the Xanadu Project, the company concluded the second phase of RC drilling during the March quarter. The RC drilling program was conducted over 15 holes covering 2,186m. The drilling campaign in Xanadu's western tenements focused on evaluating the Amphitheatre West extension, the Claudius prospect, and regions exhibiting notable arsenic concentrations in rock chip anomalies at Pompeii.

The holes drilled at Amphitheatre West were spaced 200m apart, building upon the promising outcomes (7m at 1.05g/t and 2m at 1.16g/t) from PGM's RC drilling conducted at the site in 2022.

After the quarter end, on 4 April 2024, the company released the “extremely encouraging” intercepts reported after the drilling campaign.

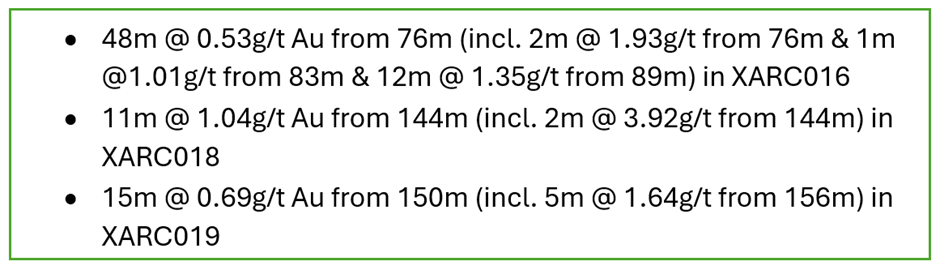

Oxide gold mineralisation was encountered in three out of the five holes drilled at the Amphitheatre West prospect, comprising:

Data source: company update

Platina's current focus is on assessing deeper airborne electromagnetic (AEM) and induced polarisation (IP) targets. As soon as a diamond drilling rig becomes available, the company plans to test up to four holes to explore the deeper sulphide potential of the system.

Progress across Beete and Brimstone projects

At the Beete Gold Project, located in Eastern Goldfields, Western Australia, the company intends to undertake an aircore drilling campaign. The cultural heritage clearance processes have been finalised, and drilling is scheduled to begin in May 2024 pending approval of the POW.

The aim of the drilling program will be to test for bed rock anomalies by utilising targets reported via geophysical interpretations and soil sample analysis.

While at the Brimstone Gold Project, additional drilling is needed to expand the size of the Garibaldi deposit and assess the potential along the strike and depth of Brandy and the southern tenements, which are awaiting cultural heritage clearances.

During the March quarter, 44 samples were chosen from the mineralised areas at the Garibaldi prospect for cyanide leach testing.

The successful second phase of RC drilling at the Xanadu Gold Project has reaffirmed the project's potential for oxide gold mineralisation. With a healthy cash balance and ongoing exploration activities, the company seems well-positioned to drive value and pursue its mineral exploration objectives.

PGM shares traded at AU$0.022 apiece on 29 April 2024.

_06_16_2025_01_53_42_112199.jpg)