Highlights:

- New significant gold intersections further extending the mineralisation potential have been obtained across Musgrave Minerals Ltd’s projects, mainly the flagship, Cue Gold Project.

- Updates on Cue project (100% MGV owned) prospects:

- At White Heat-Mosaic deposit and Big Sky deposit, assay results are pending for several RC holes from extensional and infill RC drilling.

- Waratah and East Numbers targets: Follow-up RC drilling is scheduled for November.

- At Mt Magnet South Project (100% MGV owned), broad-spaced surface geochemical sampling has been conducted for select targets pending assay results.

- At the Evolution JV front, assay results are pending for multiple drill holes at Lake Austin area - diamond and AC.

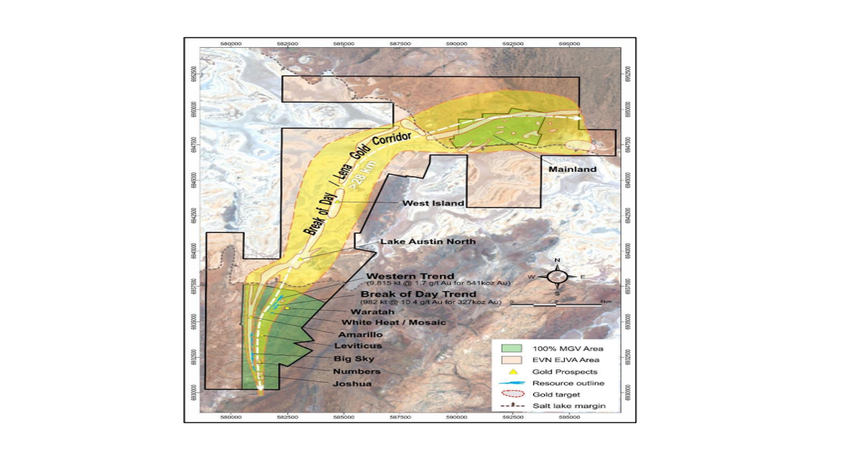

Musgrave Minerals Ltd (ASX:MGV) has released its September quarter report. During this period Musgrave’s flagship project, the Cue Gold Project saw new significant gold intersections further extending the mineralisation potential. Let’s have a quick look at the gold and base metal explorer’s performance during the September quarter.

Exploration and development updates

A. Cue Gold Project (wholly owned by MGV)

The Mineral Resource at the Cue Gold Project stands at 12.3 Mt @ 2.3g/t Au for 927koz gold.

On the resource drilling and exploration front, positive results have been obtained from the Amarillo and Waratah prospects of the project.

The high-grade component of the resource base will be important for future development, says the company.

White Heat-Mosaic Deposit

The company drilled 56 RC holes for a total of 6,299m for the near-surface gold endowment at White Heat-Mosaic (this drilling has not yet been included in the resource estimate).

Assay results have been reported only for 27 of the RC drill holes, with assays pending for the remaining 29 RC drill holes. The mineralisation continues to be open down plunge.

New RC intersections have extended the high-grade mineralisation by ~30m below previous high-grade drilling results.

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022.

Further, new splay lode returning 6m @ 14.0g/t Au from 127m (22MORC137) in a new area has been identified.

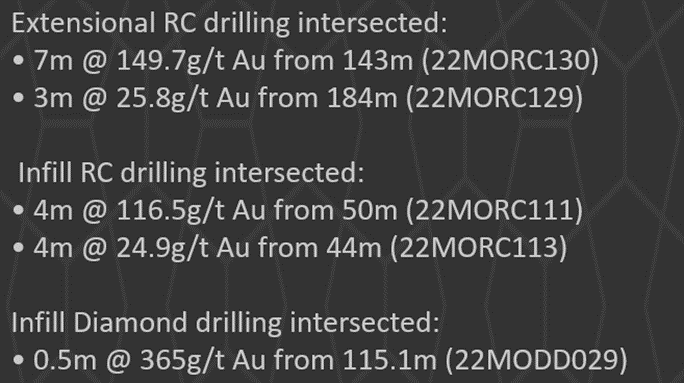

Big Sky Deposit

During the quarter, the company drilled a total of 100 RC holes (infill and extensional) totalling 7,247m in a bid to confirm and enhance the near-surface gold endowment along the Big Sky trend. Assay results have come for 51 holes while assays are pending for the remaining 49 holes.

The drill results:

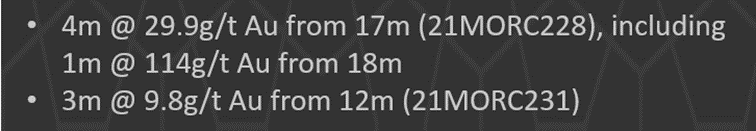

- Beyond the current Mineral Resource Estimate (MRE) boundary:

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022..

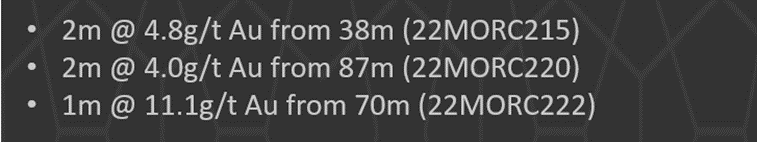

- Inside the current MRE boundary:

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022.

Regional Exploration (MGV wholly owned)

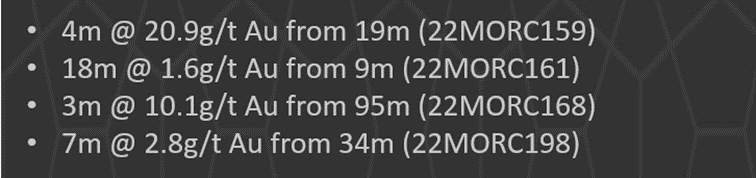

For Regional Exploration, RC drill testing of new target areas has highlighted the Waratah trend.

New significant near-surface high-grade intersections were returned from eleven RC holes at Waratah:

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022.

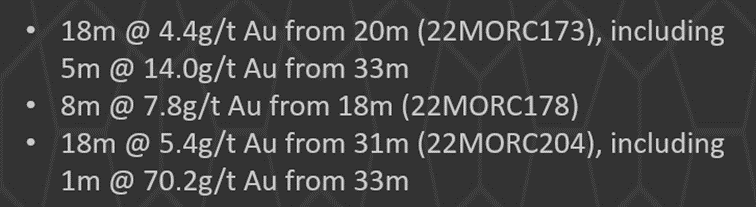

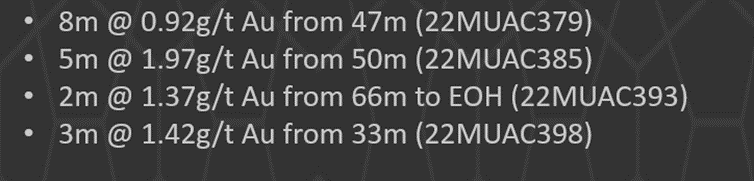

At Amarillo, RC drilling has stretched the ‘regolith’ gold mineralisation:

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022.

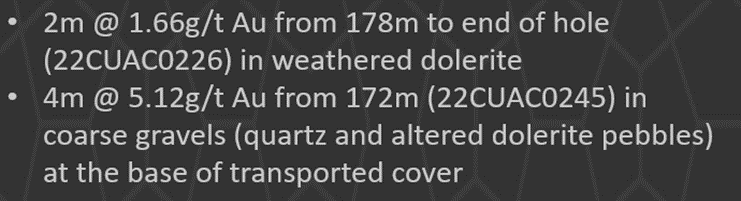

A large regional AC drill program (317 holes for a total of 10,185m) has identified a new 1.3km long gold in Archaean regolith anomaly east of the Numbers deposit. The company is planning basement RC follow-up drill testing. Anomalous gold results include:

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022.

Further, AC drilling has intersected a new gold zone 140m north of the Big Sky deposit: 9m @ 3.8g/t Au from 44m (22MUAC371). This can extend the resource at Big Sky where this mineralisation remains open to the south towards the Big Sky northern deposit.

A small regional AC drilling program was conducted at Mainland, though no significant gold anomalism has been identified.

Pre-feasibility and development: Cue Project (100% MGV)

A Stage 1 Pre-feasibility Study is scheduled to be completed in the first quarter of 2023.

The company is persistently working through the regulatory and social approval processes for starting gold mining operations at the Cue Project.

B. Lake Austin Area (Musgrave’s joint venture with Evolution)

The Lake Austin area is part of the Evolution Mining Limited (ASX:EVN) Earn-in and Exploration Joint Venture.

- Diamond drilling results - Lake Austin Area

Evolution conducted drilling on 9 diamond holes for a total of 4,699m at the West Island prospect:

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022

- AC drilling results - Lake Austin Area

Evolution conducted drilling on 117 air core drill holes for nearly a total of 14,191m:

Image source: © 2022 Kalkine Media®; data source: Company update, 27 October 2022

C. Mt Magnet South Project (wholly owned by MGV)

In March 2022, Musgrave’s subsidiary signed a sale and purchase agreement with Eastern Goldfields Exploration Pty Ltd in order to obtain a 100% interest in Mt Magnet South Project.

For some targets considered amenable to this exploration technique, broad-spaced surface geochemical sampling has been conducted pending assay results.

D. Non-core projects

Musgrave has a joint venture with Cyprium on the non-gold rights (Cyprium’s interest is 80% only for non-gold rights) over the northern Cue tenure, which includes the Hollandaire copper deposit. No significant exploration was conducted by Musgrave on these non-core tenements.

Company’s financial footing, investments

At the end of the September 2022 quarter, Musgrave had AU$7.3 million in cash.

On the investment front, the company holds shares worth AU$0.5 million in Legend Mining Limited and AU$0.1 million with Cyprium Metals Limited (ASX:CYM).

MGV shares were trading at AU$0.225 apiece on 31 October 2022 (as at AEDT 3:07PM).