Highlights

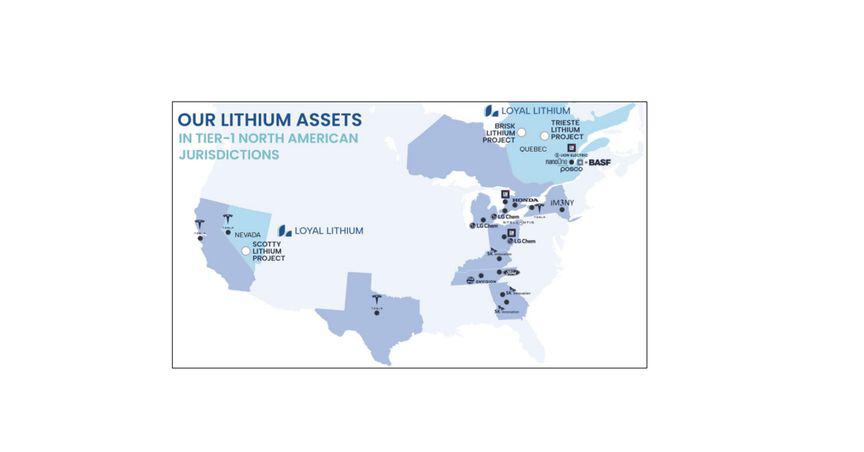

- Loyal Lithium has a highly prospective project portfolio in the James Bay Lithium District in Quebec, Canada and Nevada, US.

- The company tripled land position in the James Bay Lithium District with the acquisition of the Trieste Lithium Project.

- The December quarter saw completion of an inaugural field exploration program at the Brisk Lithium project.

- Exploration work continued to advance at the Scotty Lithium Project with inaugural drill campaign expected in Q1 2023.

- LLI has outlined exploration work plans including drilling across its projects for 2023.

December quarter saw Loyal Lithium (ASX:LLI) moving forward with full gusto to explore and develop its Tier 1 North American assets, namely the Trieste, Scotty and Brisk lithium projects.

During the quarter, the company successfully transitioned to lithium with a formal name change from Monger Gold to Loyal Lithium Limited.

The company also executed a placement, receiving firm commitments to raise AU$4.5 million (before costs). At the end of the quarter, the company held approximately AU$6.57 million in cash.

Here is an overview of the company’s projects and its developments during the latest quarter:

Loyal Lithium-The largest landholder in Trieste Greenstone Belt

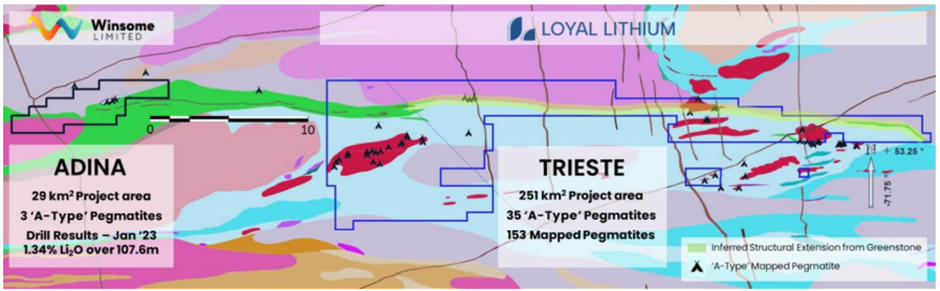

The quarter saw Loyal Lithium enlarging the area of its Trieste Lithium Project. The large-scale lithium project covers 251km2 within the Trieste Greenstone Belt. This area is 8.6 times larger than Winsome Resources’ (ASX:WR1) Adina Lithium Project, where recently a drill hole recorded a significant lithium mineralised intercept of 1.34% over 107.6m.

Trieste Lithium Project – GSQ Region Interpretation (1:100k)

Image source: company update

The Trieste project area has never undergone exploration for lithium; however, it contains an anomalous historical lithium assay site (180ppm Li).

Loyal Lithium has outlined work plan for the Trieste lithium project covering:

- Review of historical data that is publicly available and obtained via acquisition.

- Geochemical testing of pegmatites found in historical drill core at the southern end of the project.

- The company has planned satellite imagery interpretations, for which highly experienced research-grade consultants have been engaged. The results are expected in February 2023.

- LLI intends to undertake a Spring/Summer 2023 field program, subject to the output of the data review, drill core assays and satellite imagery. Work is currently planned to commence in late May 2023.

- Also, the company is considering a geophysics program.

Read here the latest company developments at Trieste.

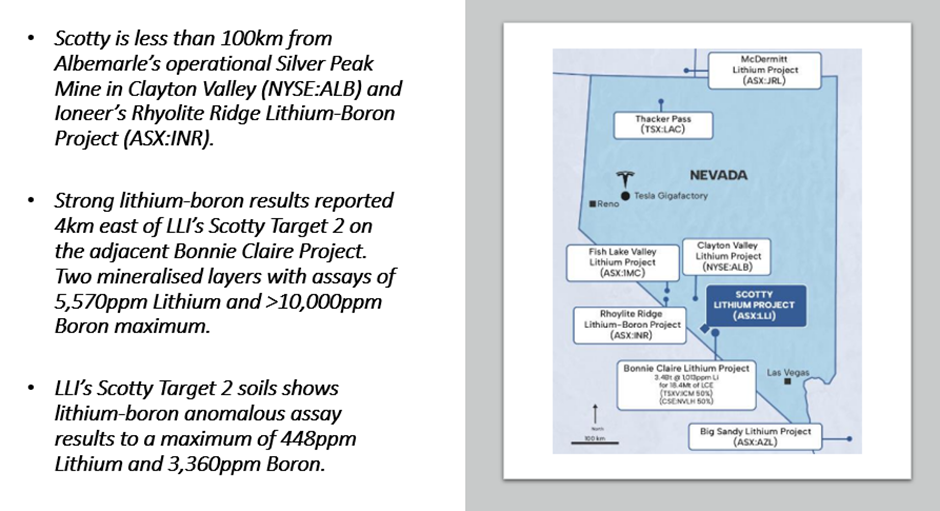

Scotty Lithium Project progressing to planned drilling operations

The Scotty Lithium Project, covering 78.1km2, has twin prospects of lithium brines and lithium sediments. It is believed to have similar geology as the nearby Iconic Minerals’ (TSXV:ICM) Bonnie Claire Project.

Data and Image source: LLI update

Loyal Lithium has engaged US-based Dahrouge Geological Consulting Inc. to manage requests for proposals, drill site preparation and drill program. As of now, the company has completed an extensive soils program recording 540ppm peak lithium, submitted drilling approval applications with the regulator, wrapped up drilling pre-approval environmental survey, and commenced MT geophysics survey.

Loyal Lithium highlights that rig availability and regulatory approval would define the start date of the drilling program, anticipated within Q1 2023.

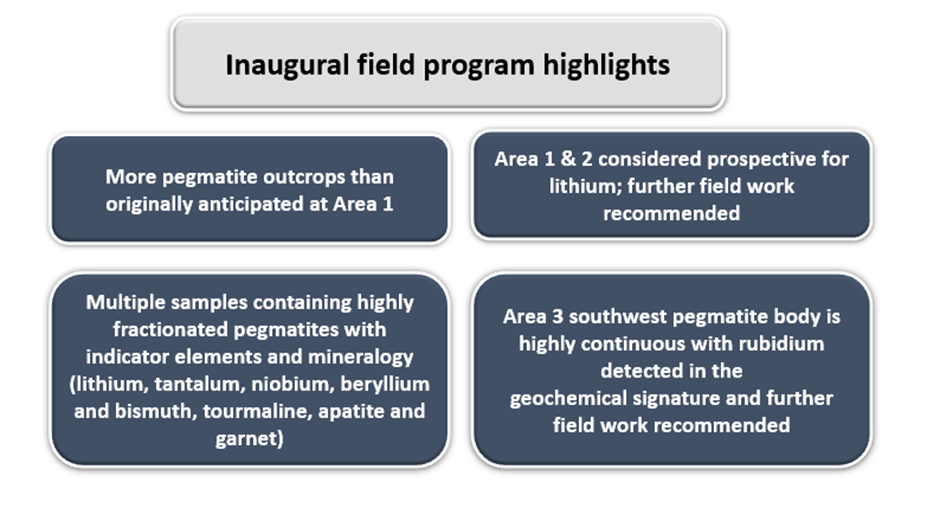

Inaugural field program at Brisk delivers anomalous assay results

Loyal Lithium has wrapped up an inaugural field program at the Brisk Lithium Project with encouraging outcomes.

Data source: company update

Backed by these findings, Loyal Lithium has outlined the following work plan:

- Complete field mapping in Areas 1, 2 & 3.

- Undertake field mapping on the southeast of Area 1 and prospective portions of Areas 2 and Area 3 not covered in the inaugural field program.

- Additional field traverses across Area 1, which the company says is the most prospective for lithium bearing pegmatites at Brisk.

Besides unveiling planned exploration across its lithium portfolio, the company highlighted the outcome of its strategic review. In line with the development, the company considers that all its Western Australian gold and base metal assets are better suited for joint venture or divestment.

LLI shares traded at AU$0.360 midday on 28 February 2023.