Highlights:

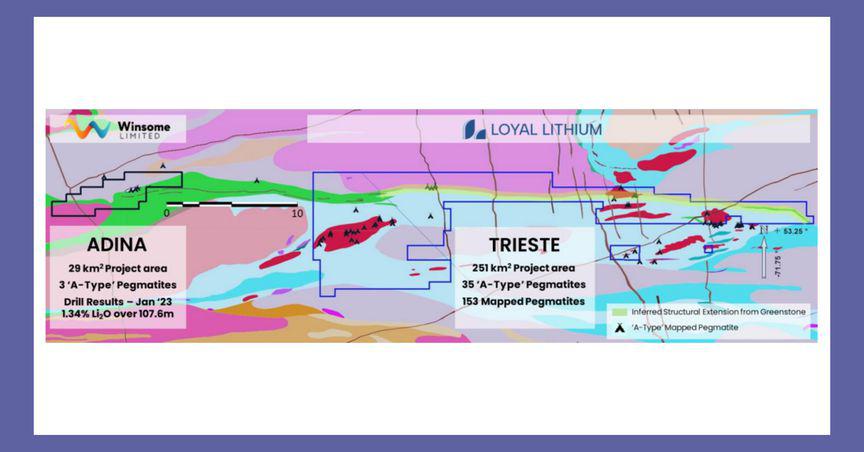

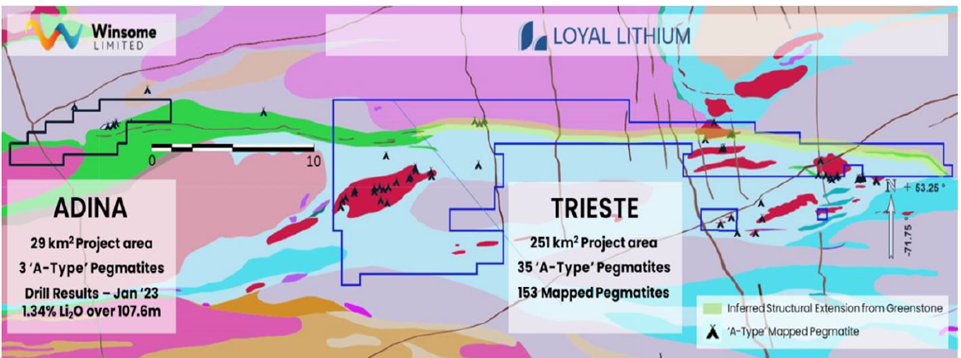

- The large-scale Trieste Lithium project neighbours the Adina Lithium project drillhole, where a significant lithium mineralisation was recently intercepted.

- Loyal Lithium has the largest landholding in the Trieste Greenstone Belt, with its Trieste Lithium project covering 251 sq. kilometres.

- Trieste project area is 8.6 times larger than Winsome Resources’ (ASX:WR1) Adina Lithium Project.

- A successful trial has confirmed the historical high-resolution satellite data correlation with known mapped pegmatites at Trieste.

- Complex derivations of satellite data are planned for refining targets for the inaugural field program in the Canadian spring 2023.

Loyal Lithium Limited (ASX:LLI) is making some eye-catching progress, with notable developments across its 100%-owned Trieste Lithium Project.

In a major development, the company has announced the completion of a successful trial confirming the correlation of high-resolution satellite data with previously known pegmatites at the project. This development is likely to aid in refining targets for the inaugural field program at the project in an efficient and cost-effective manner.

Geospatial Intelligence Ltd will conduct more complex derivations of satellite data across the Trieste project to streamline the method of refining targets for its inaugural Canadian spring field program 2023.

Trieste covers 251 km2 – 8.6 times larger than Adina lithium project

The Trieste lithium project is a large-scale asset fully owned by Loyal Lithium and is located 14km east of the Adina lithium project of Winsome Resources (ASX:WR1). Recently a significant lithium mineralisation of 1.34% over 107.6m was intercepted from the Adina drill hole.

In the highly prospective Trieste Greenstone Belt, Loyal Lithium highlights that it has the largest landholding through its Trieste project that alone covers 251km2. The company says that the project area is 8.6 times larger than the Adina Lithium Project.

The Trieste project area in the Trieste Greenstone Belt covers a 39km long contact zone with a significant historical data. The project, which has not been explored for lithium in the past, includes an anomalous historical lithium assay of 180ppm.

Image Source: Company Update

Trieste contains 35 ‘A-Type’ & 118 ‘G-Type’ pegmatites

There are 153 logged pegmatite outcrop observations at the Trieste project, out of which 35 observations have same classification as found at Adina lithium project.

‘A type’ pegmatite observations are nearly 11 times more than those found at Adina. A total of 118 ‘G type’ pegmatite observations are also present in the historical data.

It is to be noted that the company highlights both ‘A Type’ & ‘G Type’ as prospective for lithium

Trieste inaugural field program due in Canadian spring 2023

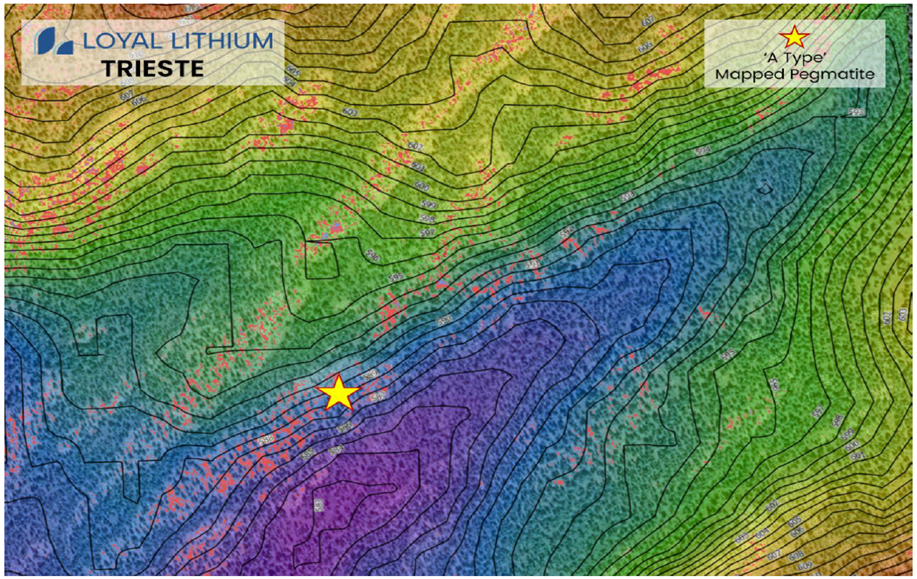

High-resolution historical satellite data was used by Geospatial Intelligence Ltd for the trial, which was focused on assessing the level of correlation between the data and historically mapped pegmatites. It is a multi-spectral small-scale trial, hence more detailed, accurate large-scale images are yet to be produced

Previously no lithium exploration was carried out at the Trieste project, but historical data has now aided in identifying 14 initial target areas for high-priority field investigation.

Image Source: Company Update

The above image displays contours and reflectance of the Trieste project. The scattered red dots represent multi-spectral band classification of outcrop. The exposed outcrop is differentiated from the other land cover with the help of contours.

The company plans to undertake priority sampling and examination along the edge of northwest facing scarp since pegmatites can intrude the escarpments creating faults.

Satellite imagery data will help in prioritising the targets with a detailed work plan created in advance for the inaugural field program in the Canadian spring 2023.

The share price of Loyal Lithium was trading over 7.6% higher to AU$0.387 midday on 13 January 2023.